Hsbc log in with secure key

If you need any help with accessing online or mobile banking, please check out our help tool below before going any further. Activating your Secure Key. Physical Secure Key - You'll need to have received your physical Secure Key this could take 10 working days from the time you've requested.

It is roughly half the size of a credit card and looks a bit like a calculator. It uses advanced technology to give you a unique passcode every time you log on. Throughout history, people have always found ingenious ways to protect what's important to them. It's the same online. The Secure Key is a two-factor authentication device that will help protect you from online banking fraud.

Hsbc log in with secure key

Online banking is quick, convenient and secure. Log on to access your accounts whenever you want, wherever you are. Carry out a wide range of tasks whenever it's most convenient for you. Confirmation of Payee is a name-checking service offered to protect you from scams and reduce the number of payments sent by mistake. Here's a short video giving you some more information about digital banking. If you're locked out of mobile or online banking, you can reset your log on details using our Digital banking help tool. Did you know, you can also get statements on your mobile banking app. Find out more about mobile and online statements. To view a specific transaction, use 'Search' - you'll find it above your transaction list. This can only be used for your most recent transactions.

If you don't have it, you can request a new one onscreen Enter the serial number on the back of your security device Follow the onscreen instructions to create a PIN and generate your first security code You have 60 days to activate your Secure Key. It is between 8 and 30 characters long, can include letters and numbers and isn't case sensitive.

New fraud counter-measures effective 22 August Verification needed for new online and mobile banking registration. There's a hour cooling-off period for Mobile Secure Key set-up. For more tips, visit our security centre. Say goodbye to forgetting to take your Security Device out or worrying about its battery life!

If you use mobile or online banking, a Physical or Digital Secure Key gives you added protection against the threat of fraud. The Secure Key generates a temporary code, meaning only you can access your accounts online. Fraud alert: Never give out your security codes to anyone. Criminals pretend to be people you trust like a company you pay bills to, HSBC or even the police. To find out more, visit our Fraud Guide. If you can't use the Digital Secure Key, and you'd like to discuss other Secure Key options, call us on 00 61 61 or contact us via Live Chat not available on mobile. Check your date and time settings on your mobile device. Make sure you have the option to set the date and time automatically turned on.

Hsbc log in with secure key

It is roughly half the size of a credit card and looks a bit like a calculator. It uses advanced technology to give you a unique passcode every time you log on. Throughout history, people have always found ingenious ways to protect what's important to them.

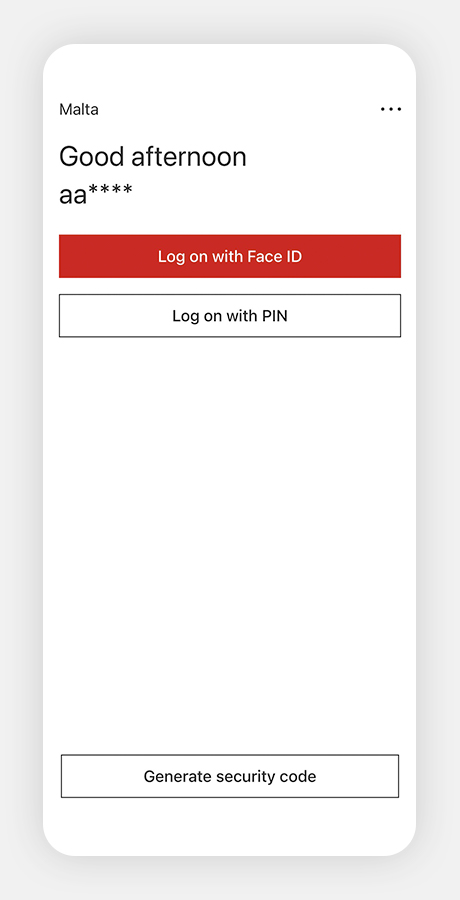

Felicia vox

Telephone banking. Back to top. You'll see a full list of devices that you've set up. Select an option to verify it's you - either by entering your password in full, not just 3 characters and a one-time code sent by text message, or via a code generated on your physical Secure Key. It's as simple as that. It is between 8 and 30 characters long, can include letters and numbers and isn't case sensitive. Visit our Help page to find out how. You'll now be able to log on using your Digital Secure Key. Note: Once you have set up your digital secure key pin, you can set up access to the app on up to 3 different devices. Please allow up to 10 working days to receive the physical Secure Key in the post. To do this start to log-on and enter your user ID. If you're using the app, go to the Profile section and select 'Security and generate security code'. Check you're paying the right person.

If you forget your Personal Internet Banking password, you can create a new one online. The answer to your security question was created when you first registered for Personal Internet Banking.

If you can't access either of the options above, you can call the number on the back of your card or visit a branch to update your details there. Can I use someone else's Secure Key? Why you should choose the Mobile Secure Key for your banking needs. If you've chosen to receive a new physical Secure Key, you'll need to wait to receive it and then follow these steps: Log on to online banking. Don't worry - there's are still approximately 2 months of power remaining. Please enter another PIN. Activating your card. You'll have 30 days to activate your new Secure Key. This message will remain on the screen of the Secure Key until the lock out has expired, then the Key will automatically power off. This can only be used for your most recent transactions. Throughout history, people have always found ingenious ways to protect what's important to them.

So happens. We can communicate on this theme.