Vanguard total bond market etf

The funds in this category spread their exposure across various markets and bond types, including municipal bonds, corporate bonds, and other securities.

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. This browser is no longer supported at MarketWatch. For the best MarketWatch.

Vanguard total bond market etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Price USD

Asset Allocation Quarterly First Quarter Equity U. Go to Your Watchlist.

Stocks: Real-time U. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. All rights reserved. Source: FactSet.

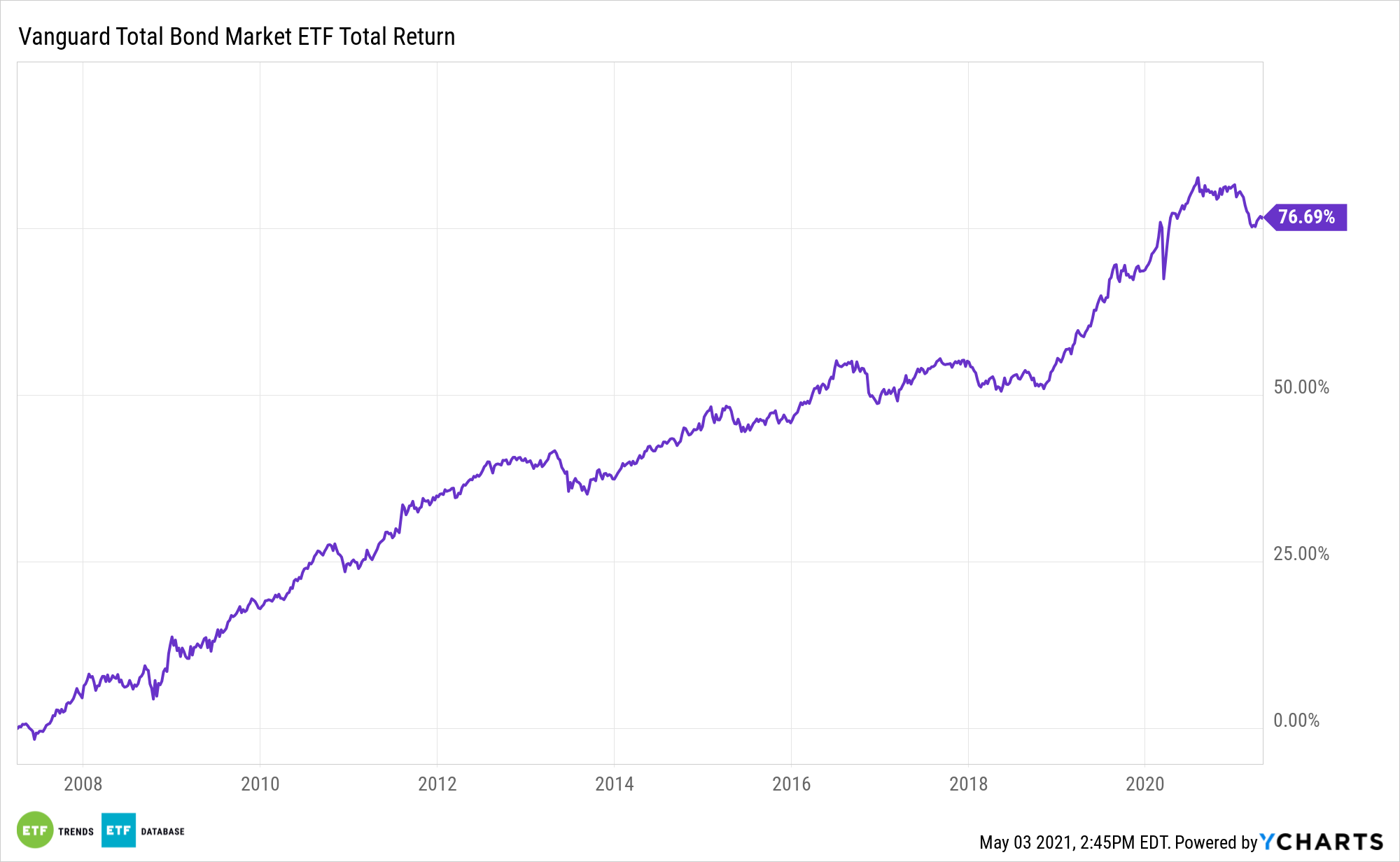

This popular ETF offers exposure to entire investment grade bond market in a single ticker, with holdings in T-Bills, corporates, MBS , and agency bonds. While it holds securities of all maturity lengths, it is heavily weighted towards the short end of the curve. BND could make for a good choice for investors who currently have little to no bond exposure and are looking to broadly increase their holdings in the segment across a variety of sectors. The adjacent table gives investors an individual Realtime Rating for BND on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized.

Vanguard total bond market etf

Key events shows relevant news articles on days with large price movements. BNDX 0. VTI 0. VGSH 0. VXUS 0. SPY 0.

Unbreak my heart july 6 2023 full episode

All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Bonds 3 Reasons Bonds Are Rallying. Invesco Multi-Factor Income Index. Privacy Notice. Other News Press Releases. Dollar Select Index. Aggregate Enhanced Yield Index. Bond Market Yield-Optimized Index. About Barron's Live Events Centennial. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed here. Past performance is no guarantee of future results.

V anguard's impressive lineup of 86 exchange-traded funds, or ETFs, owes much of its success to a pivotal patent filed in Before this innovation, Vanguard was already celebrated for its mutual fund offerings in stocks and fixed income, distinguished by their low fees. The patent, however, was a game-changer, allowing Vanguard to introduce ETF share classes to its existing mutual funds.

Sources: FactSet, Dow Jones. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. After Hours Volume: 1. Net Expense Ratio. Volume: 6. Asset type. Barclays Capital Short-Term U. Barclays Capital Global Aggregate ex-U. Aggregate Bond Index. Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Front-End Load.

0 thoughts on “Vanguard total bond market etf”