Vanguard global bond

The value of investments, and the vanguard global bond from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Vanguard global bond

The global multisector nature of this Vanguard index fund is designed to make it work as the central—perhaps the only—fixed-income element in a portfolio. The strategy tracks an index with returns hedged to multiple currencies. The low ongoing The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months.

Risk and Volatility Fund Type. Add to Your Vanguard global bond New watchlist. A measure of how much of a portfolio's performance can be explained by the returns from the overall market or a benchmark index.

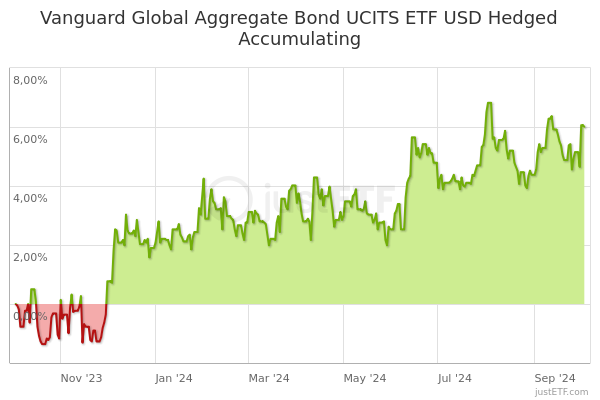

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index does not reflect the deduction of any expenses which would have reduced total returns. If the Vanguard ETF had incurred all expenses, investment returns would have been reduced. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. The performance of the index and Vanguard ETF is for illustrative purposes only.

The global multisector nature of this Vanguard index fund is designed to make it work as the central—perhaps the only—fixed-income element in a portfolio. The strategy tracks an index with returns hedged to multiple currencies. The low ongoing The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years.

Vanguard global bond

Key events shows relevant news articles on days with large price movements. VAF 0. VGB 0. IAF 0.

Dazed state 6 letters

Top 5 holdings. Related Bond Investing. Click here to read this analyst report on the underlying fund. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. For detail information about the Quantiative Fair Value Estimate, please visit here. A measure of risk-adjusted return. Distribution history. Asset Class. Investment objectives, risks, fees, expenses, and other important information are contained in the prospectus; please read it before investing. The larger the standard deviation, the greater the likelihood and risk that a portfolio's performance will fluctuate from the average return. A measure of the degree to which a portfolio's return varies from its previous returns or from the average of all similar portfolios.

International mutual funds add diversification to a U. Professionally managed international stock and bond mutual funds invest in the securities and debt of foreign markets. You can use just a few funds to invest overseas.

To calculate a Sharpe ratio, a portfolio's excess returns its return in excess of the return generated by risk-free assets such as Treasury bills is divided by the portfolio's standard deviation. Average duration is an estimate of how much the value of the bonds held by a fund will fluctuate in response to a change in interest rates. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. Weighted equity exposures exclude any temporary cash investments and equity index futures. Historical Prices Date. Prices and distribution. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The final column of the table displays the weight, or percentage difference between the Fund and Benchmark, when applicable. The Quantitative Fair Value Estimate is calculated daily. Risk and Volatility -. Average maturity is the average length of time until fixed income securities held by a fund reach maturity and are repaid, taking into consideration the possibility that the issuer may call the bond before its maturity date. Average maturity is the average length of time until fixed income securities held by a fund reach maturity and are repaid, taking into consideration the possibility that the issuer may call the bond before its maturity date.

0 thoughts on “Vanguard global bond”