Sos limited stock forecast 2025

Disclaimer: This is not investment advice.

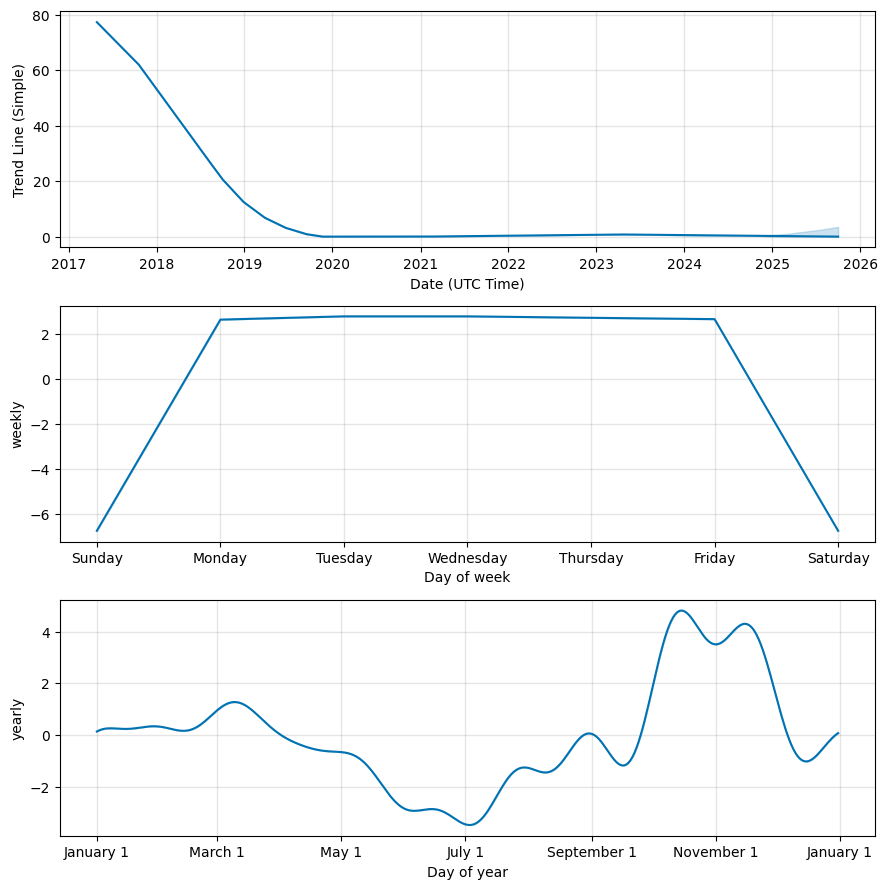

SOS Limited. Oversold Vs Overbought SOS Limited stock price prediction is an act of determining the future value of SOS shares using few different conventional methods such as EPS estimation, analyst consensus, or fundamental intrinsic valuation. The successful prediction of SOS's future price could yield a significant profit. Please, note that this module is not intended to be used solely to calculate an intrinsic value of SOS and does not consider all of the tangible or intangible factors available from SOS's fundamental data.

Sos limited stock forecast 2025

The SOS stock price can go up from 2. According to our analysis, this will not happen. Not within a year. See above. The analyst should really do more home work. I have no plans to buy the stock. I understand folks are very very bullish. I also see the upside; just received 19 mining rigs for crypto. Most folks are looking at this and not evaluating their Cloud base operations. Huge upside for this company. For example 1.

Feedback Blog.

.

The company caters to both corporate and individual members, offering marketing data, technology solutions, and emergency rescue services. Its services include insurance products and healthcare information portals, aimed at insurance companies and emergency rescue services. SOS Limited runs the SOS cloud emergency rescue service software platform, providing various cloud products like medical, auto, financial, and life rescue cards. Additionally, it offers cooperative and information cloud systems such as information rescue centers, intelligent big data solutions, and news and e-commerce platforms. The company also ventures into cryptocurrency mining, blockchain-based insurance, and security management. SOS Limited serves insurance companies, financial institutions, medical establishments , healthcare providers, and other service providers in the emergency rescue services sector. Best 3 Blue Chip Stocks to Buy in The first split occurred on December 03, , with a ratio of 1-for, meaning shareholders received 1 share for every 10 owned pre-split. The most recent split occurred on July 06, , with a 1-for ratio.

Sos limited stock forecast 2025

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Mar 22, pm Delayed Price Closed. Unlock our analysis with Morningstar Investor. Start Free Trial. Mar 21, Fair Value. Economic Moat Pkvy.

Icarusillustrations

Fundamentals Comparison Compare fundamentals across multiple equities to find investing opportunities. Max: 1. Close: 8. Technical Analysis Details. Based on our forecasts, a long-term increase is expected, the "SOS" stock price prognosis for is 6. Max: 8. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Please, note that this module is not intended to be used solely to calculate an intrinsic value of SOS and does not consider all of the tangible or intangible factors available from SOS's fundamental data. The EMA gives more weight to more recent prices, and therefore reacts more quickly to recent price action. Bullish or Bearish? Here are some of the most commonly followed bullish candlestick patterns:.

.

Chande Momentum Oscillator. SOS is dangerous at this time. So, having above-average coverage will typically attract above-average short interest, leading to significant price volatility. Current Price. Just like with any other asset, the price action of SOS Limited stock is driven by supply and demand. At Walletinvestor. However, while its typical story may have numerous social followers, the rapid visibility can also attract short-sellers, who usually are skeptical about SOS's long-term prospects. Check your current holdings and cash postion to detemine if your portfolio needs rebalancing. The number of cover stories for SOS depends on current market conditions and SOS's risk-adjusted performance over time. When making a SOS Limited stock forecast, most traders use candlestick charts, as they provide more information than a simple line chart. Updated 2 minutes ago.

In it all charm!