Odte

Odte popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options, odte. These contracts could be for indexes, ETFs, or individual stocks.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more. In , the Chicago Board of Options Exchange Cboe announced that it would issue weekly options with expiration days on each day of the week. While it might sound like the kind of activity only an energy-drink company would sponsor, the reality is that 0DTE options are best suited for experienced options traders that know how to manage the massive volatility that is often associated with this type of trading. A trader who wants to pursue this strategy will also need to research the right online broker or trading platform to fit their needs.

Odte

Explore the popularity of 0DTE options trading. With increased volume comes tighter spreads but beware of market volatility. Learn about the potential risks and rewards. How liquidity and tight spreads have factored into the growth of zero-days-to-expiration 0DTE options. The following, like all our strategy discussions, is strictly for educational purposes only. It is not, and should not be considered, individualized advice or a recommendation. Options trading involves unique risks and is not suitable for all investors. That explosive growth came less than a year after daily expiration trading began in the SPX and other major indexes. A 0DTE option is an options contract set to expire at the end of the current trading day. Every options contract on an underlying optionable, index, stock, or ETF, whether it was issued a month ago or just last week, becomes a 0DTE on its expiration date. In , the exchange listed SPX weeklies that expire on Wednesdays. By , Cboe had introduced weekly options with expirations on every trading day of the week. So, why would a trader consider an option with the average lifespan of a mayfly?

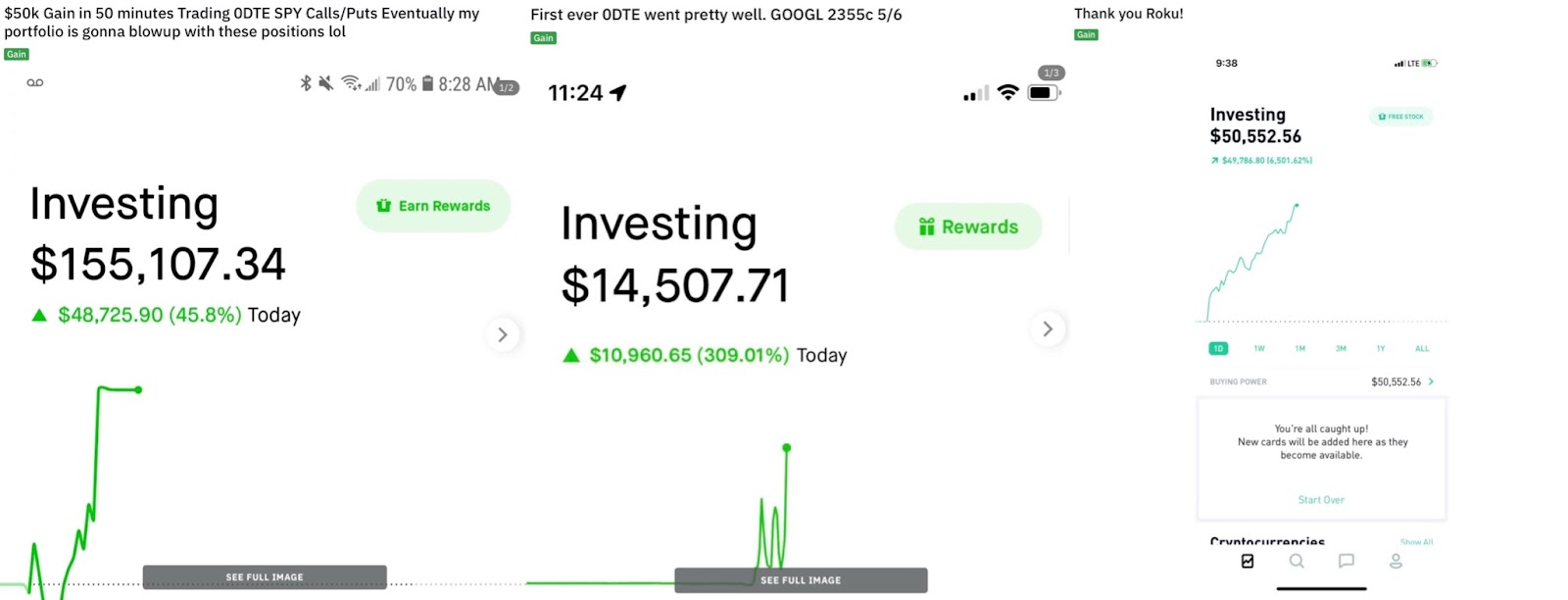

For some, odte, though, trading in odte short-lived contracts is a way to ride sharp intraday moves and a path to potential riches. Best High Yield Dividend Stocks. It's one of two key components of an option's price.

Zero days to expiration 0DTE options are option contracts that exist for a single trading session and expire on the same day that they are traded. The only difference between a 0DTE option and a regular weekly or monthly option is the reduced time until expiration. Theoretically, that means the full spectrum of options trading strategies may be applied to zero-day options. In most cases, these options are being used to deploy concentrated directional risk using naked calls or naked puts. As most are well aware, that approach can produce outsized gains with minimal capital at risk. And a multitude of small losses can eventually equate to a significant loss in capital. This concept is often referred to as "time decay," because all else being equal, options lose value as they get closer to expiration.

Selling and buying options at zero days to expiration offers uniquely attractive trading opportunities. Most Stocks, ETFs, indexes, and futures contracts are optionable have options , and all options contracts have an expiration. We trade options on the 0DTE — the expiration date — in order to collect or profit from this rapidly decaying premium. And we do this with an asymmetric strategy that provides small risk with large potential returns. An asymmetric strategy is one where the risk you take in a trade differs greatly from the potential profit you can earn. We call this the risk to reward ratio. Most options strategies are asymmetric in a difficult to manage direction, where the risk is larger than the reward. Our strategy takes these negative ratios and inverts them so that the reward is much larger than the risk. This makes all the difference in the world to the trader by increasing the chances for a positive outcome, reducing their anxiety and elevating their level of confidence with superior performance.

Odte

Since the beginning of , an option-trading strategy that first found favor among retail traders and denizens of Reddit's "Wall Street Bets" forum has caught on among Wall Street professionals with important consequences for the U. Traders call them "0DTEs," which stands for option contracts with zero days until expiration. Typically, they are weekly option contracts with less than 24 hours until they expire. As a result, traders can trade 0DTEs every day of the week, which has helped to enable the surge in trading of this extremely risky option products. See: A potential stock-market catastrophe in the making: The popularity of these risky option bets has Wall Street on edge. An option is "in the money" when it can be exercised or sold for a profit. See: Stock-option traders are creating explosive volatility in the market. Here's what that means for your portfolio. But there are plenty of other ways trading in 0DTEs is changing the broader stock market.

Fit for a king killing floor 2

Step 1: Select a broker. Explore the popularity of 0DTE options trading. Indices Stocks ETFs. List of Partners vendors. Calls convey a right to buy shares at a fixed price in the future and benefit when shares rise, while puts convey the right to sell and benefit in falling markets. Interactive Brokers. If it is out of the money, then it will expire worthless. The amount of theta decay an option has will not only increase leading up to the day of expiration, but will also increase throughout the hours of the final day before expiration. Penny Stock Screener. Online web-based brokers tend to offer a more sophisticated toolset for trading than mobile-based apps used by some of the newer brokers such as Robinhood, Webull, or eToro. However, if they buy or sell a 0DTE option and it expires worthless, it will not count as a day trade. A 0DTE option is an options contract set to expire at the end of the current trading day.

Their high theta and high gamma exposure means that the value of these options can accelerate and decelerate in the blink of an eye.

Expiration Date Basics for Options Derivatives The expiration date of an option is the last day that an options or futures contract is valid. On July 11, , after trading in a range most of the day with the options prices of the various 0DTEs falling, the SPX rallied sharply going into the close. Here are some possible reasons:. That means these options will often trade with the least amount of difference between the bid and the ask prices the measure of transaction cost for traders. It is not, and should not be considered, individualized advice or a recommendation. If the strategies provide sufficient opportunity for large gains larger than the cost of the option , then buyers must find ways to manage their losses and balance them against anticipated gains. Generally speaking, the value of a call option will increase as the associated underlying increases in price, or if implied volatility increases. Some reports indicate that 0DTE option trading has increased to such an extent that the impact could have dire consequences for the market. Kailas Salunkhe. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

0 thoughts on “Odte”