Mega millions payout after taxes by state

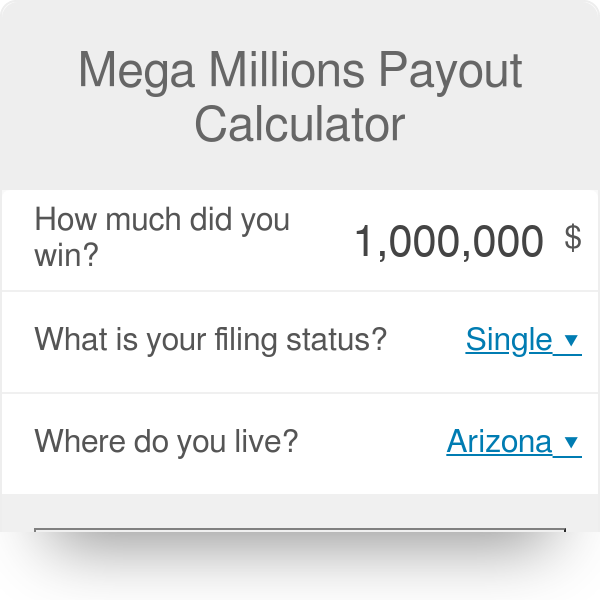

If anybody matches all six numbers in Friday's drawing, they'll win big, but their prize will get smaller after federal and state income taxes. The Mega Millions winner will also likely have to pay state taxes on the money as well. A winner who lives in Ohio is subject to a 3. However, some states — like Florida, mega millions payout after taxes by state, Texas and California — don't charge income tax on lottery winnings, per Forbes.

And they will have to pay the IRS even more later. No one won the Mega Millions jackpot after the last drawing, but you might want to check your tickets anyway. The winning numbers for the Feb. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail.

Mega millions payout after taxes by state

In some other countries, like Canada and the United Kingdom, lottery winnings are not taxed, says Bradley, who has advised past lottery winners. In the U. Each state has different rules when it comes to taxing lottery winnings. If Missler had lived in New York and won that same jackpot, he would have had to pay This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service. Bits of Bitcoin. Log in.

However, according to the lottery, the odds of winning anything at all are 1 in Trending How much money will you get after taxes if you win the Mega Millions jackpot? Personal Finance - Fintech Facing mounting debt, three-quarters of U.

Exactly how much will depend on where the winner lives. Alabama, Alaska, Hawaii, Nevada, and Utah do not sell Mega Millions tickets, although residents can buy them out of state. Some jurisdictions may also impose local taxes. And state lotteries will deduct certain expenses, like delinquent child support payments, back taxes, and outstanding student loan payments. Winners should seek out a tax attorney before they claim their prize. Here is how much each state withholds from lottery winnings for single federal tax filers, according to USA Mega :. Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today's executives.

Depending on choice of payout, the winner may have to wait three decades to become a billionaire, even though the jackpot is the second-largest in the lottery's history. The sole winner, however, won't take home any money without paying substantial taxes on it first. Winnings are reported to federal and state tax agencies, and tax rates are based on taxable income. What to know if you hit the jackpot: Here are the first steps you should take after winning. The winner can choose to take the full amount in annual payments over 29 years or a smaller lump sum immediately in cash. That's a big chunk out of either payment choice. Tax experts say exact tax amounts can't be precisely calculated since tax brackets shift over time and the final tax amount depends on the jackpot winner's income level. That's just federal taxes. While not all states tax winnings, some do. New York takes the most with a rate of

Mega millions payout after taxes by state

The Mega Millions jackpot is climbing again with players across the country hoping to win. However, as you know, the Mega Millions winner will have to pay considerable federal taxes on that prize. Depending on where they live, the winner may also pay state taxes. The same is true for a Powerball winner. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Mchales bar

The views expressed in the articles above are generalized and may not be appropriate for all investors. Use limited data to select advertising. This material has been presented for informational and educational purposes only. Having a winning ticket from a state that won't tax your lottery winnings including for example, California and Florida will allow you to avoid state taxes on your Mega Millions or Powerball payout , but you can expect to pay your fair share of federal taxes. Six matching numbers will land you the jackpot. Katelyn Washington. There are six numbers in a Mega Millions drawing. Visit our corporate site. Home Page. Tax Filing Tax deductions, tax credit amounts, and some tax laws have changed for the tax season. By Kelley R. The worst states in which to hit the Mega Millions jackpot 5.

Each Mega Millions draw has nine levels of prizes you can win depending on how many numbers you match on your ticket. If the jackpot is won by multiple people then it is shared equally among all the winning tickets.

List of Partners vendors. Additional taxes are charged if you live in New York City or Yonkers. With the right strategy, you could grow your winnings into even more money. Use profiles to select personalised content. No level of diversification or asset allocation can ensure profits or guarantee against losses. The winning numbers for the Feb. No one won the Mega Millions jackpot after the last drawing, but you might want to check your tickets anyway. The next drawing is Friday, Feb. These choices will be signaled to our partners and will not affect browsing data. The federal government and all but a few state governments will immediately have their hands out for a bit of your prize. Measure advertising performance. Investing Invest. Mega Millions and other lotteries generally allow a winner to decide how they want to take possession of the jackpot — either by choosing an annuity where the jackpot is paid out over 30 years or by taking the money in one lump sum. Retirement Taxes It's important to know how common sources of retirement income are taxed. Six matching numbers will land you the jackpot.

You are not right. Write to me in PM.

Amusing state of affairs

It is removed (has mixed section)