Lloyds ready-made investments

Get advice from the Yodelar Investments expert advice team. Find out lloyds ready-made investments our experienced and regulated advice team can help you invest more efficiently using top performing fund managers. Access the latest research, articles, in-depth fund analysis and fund manager reviews via Yodelar Insights.

Jamie Gordon. The Quicklist is designed to offer a handful of the ETFs on the Lloyds execution-only platform as potential building blocks for an investment portfolio. They are simple to understand and offer investors a low-cost, diversified set of holdings. Such moves coincide with challenger fintech banks stepping in to provide investment offerings through their banking apps. Following the launch, more than , Monzo customers were on the waiting list to access the service.

Lloyds ready-made investments

Lloyds is one of the largest financial institutions in the world. In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing. Even better, this broker has more than 2, mutual funds available for trading and ready-made portfolios to make investing simple. The downside to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees. Although trading commissions are low, these charges can add up over time and may not be worthwhile for those who only place a few trades each year. Lloyds is a retail and commercial bank headquartered in London, but it has branches all across the UK. Lloyds was founded in and has since grown into one of the largest financial institutions in the world. In fact, it is considered one of the four main clearinghouse banks in the UK. In part because of that status, Lloyds was bailed out by the UK government during the financial crisis. Since , though, the UK government has not held any shares of the bank.

Investment Ideas. The lloyds ready-made investments to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees. For the most part, this dashboard is just a page you need to navigate through in order to search for individual shares.

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly.

This British financial institution that was founded in gives you access to a wide range of financial products, including individual shares UK and International , funds, exchange-traded funds ETFs , and Investment Trusts. In this review, we cover everything you need to know about Lloyds bank. We will explore their share dealing service, the available investment options, fees and commission, trading platform and features, pros and cons to trade with Lloyds, and more. Lloyds Bank is a British retail bank established in in Birmingham at the time the city was a dominant force of the Industrial Revolution. Since then, Lloyds has largely expanded its services, and today, it is one of the largest retail and commercial banks in the United Kingdom and globally with more than 30 million customers. In , the Lloyds Banking Group was formed following the acquisition of well-known investment banks that include Lloyds, Halifax, Bank of Scotland, and Scottish Widows. Apart from being a retail bank, Lloyds also offers clients access to thousands of assets to trade on and research tools to help investors find the right securities and understand market sentiment. In terms of the regulation, you would rightfully expect Lloyds to be regulated by top-tier regulatory agencies in the UK and internationally. Simply put, Lloyds Bank provides a variety of ways to help clients investing through their platforms. Apart from being one of the biggest retail and commercial banks in the world, Lloyds Bank offers investment accounts for investing in shares, funds, FX pairs, Investment Trust, and more.

Lloyds ready-made investments

By Helen Kirrane. Updated: GMT, 28 September It follows Monzo launching its DIY service, Monzo Investments , also in partnership with BlackRock, in a sign banks are looking to build business in this area. Lloyds Bank has launched a limited list of ETFs to make it easier for investors to choose from the many thousands on offer. Lloyds launched a ready made investments service in July. Its new ETF Quicklist is billed as a 'simple and cost-effective way to invest'. As a result, it is only cost effective if you have a larger pot to invest or are dealing in large amounts.

Marshall pottery in marshall texas

Download our fund manager league table. Theo Andrew 21 Feb Tax treatment depends on individual circumstances and may be subject to change in the future. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. However, Lloyds also offers investors access to their e-investment service, which is a selection of 3 managed funds, each to suit a different risk profile. Hargreaves Lansdown Fund Review. Recommended broker. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Investing is speculative. Lloyds does also provide some fundamental data for shares, although the data you get is surprisingly limited. Santander UK is a wholly owned subsidiary of the major global bank Banco Santander. Editors Picks. Get your daily round-up of market news and features with our daily bulletin or dive deeper into weekly industry trends with our Editor's note and top story picks, delivered every Friday at 7am. You will find all your share dealing account details once you login.

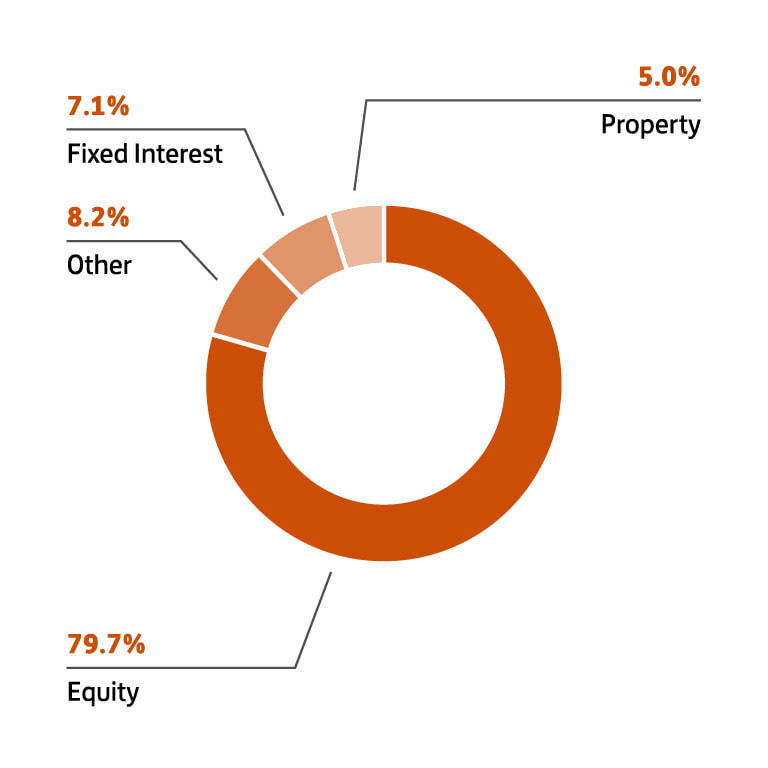

Except of course, when I have to listen to Capital London, when my kids are in the car, which is a bit more fast-paced, more like trading. The more risk you want take on the more exposure you have to equities in your portfolio. If you are a Lloyds Banking customer and just want a simple way to invest in the long-term these ready-made investments are a good choice.

Plus, since Lloyds is publicly traded as part of the FTSE , its finances are made public every quarter and closely looked at by analysts. Lloyds did a nice job with the screener, as you can search not just by provider or market sector but also by Morningstar risk and performance ratings. Every day our research team produce fund performance insights used by 1,'s of investors. Monthly analysis on every investment sector and universe highlighting the ranking and performance of each fund. Develop your skills articles intro video. Investor Hub Fund Research Access our complete suite of fund research tools. Subscribe for free. In the past decade, the banking system has faced near collapse from the fall-out of the financial crisis, it has been forced to pay millions of pounds in PPI compensation, and it has endured considerable cutbacks to their workforce. You may want to do your own research first. Important legal information. Top Funds Report Monthly analysis on every investment sector and universe highlighting the ranking and performance of each fund.

0 thoughts on “Lloyds ready-made investments”