Joint account revolut

Each Joint account holder can order a Standard card for your Joint account. Free but a delivery fee applies. The delivery charge may vary depending on where joint account revolut are sending the card. When you use your Joint account, joint account revolut, the fees and limits for your individual Personal account set out in the Personal fees page for your plan apply to any services where a specific fee or limit is not stated on this page.

This version of our terms will apply from 22 August If you would like to see the previous version of these terms, please click here. Each Joint Account holder can order a standard card for your Joint Account. Replacement Joint Account Cards. Delivery Charge for Joint Account Card. When you use your Joint Account, the fees and limits for your individual retail account apply to any services where a specific fee or limit is not stated on this page. For example:.

Joint account revolut

To ensure that the information in our articles is complete and accurate while keeping our assessments unbiased and ratings data-driven, we use the following methodology:. Each person contributing to a product review spends at least a week using that product, getting "hands-on" with all the features it offers and documenting their overall experience, unexpected benefits and any critique they might have. Our team composes of fintech professionals, working in neobanks, digital asset exchanges and payment-tech companies. With an average of 7 years in this field and more than 30 fintechs all over the world in our combined career history, we have a solid frame of reference. We strive to get at least 3 team members to review each product to eliminate personal bias and introduce a more critical approach. The final ratings are an average of all individual assessments, and the review is only published after a peer review. Review by Ian McKenzie. Contact author. Sharing a bank account is a great way to avoid endless bank transfers back and forth and petty arguments over expenses. It is no surprise that Revolut , one of the largest neobanks in the world, offers customers an ability to bank together by co-owning an account. And although Revolut joint accounts are a popular solution for managing shared finances , there are certain intricacies associated with them that may not be readily apparent. Read on and find out everything you need to know about sharing a Revolut bank account in our in-depth review!

Get the Revolut app.

.

A Revolut account helps you manage all your money in one place. You can keep as many as 36 currencies in-app, send and receive transfers to multiple countries and currencies , and easily spend around the world with your Revolut debit card. But when it comes down to it, you may want to know the key differences between Revolut and a bank account. Being an e-money institution allows us to provide you with an everyday account that you can use to manage your money in a range of ways, but Revolut is not a bank. The Revolut Group holds many licences and authorisations globally, giving us the power to provide you financial services including e-money account holding, stock trading, virtual currencies, insurance, and more. In , we rolled out local IBANs — or international bank account numbers — in Spain, France, and Ireland, with many more planned, so customers can use Revolut as their main accounts for core everyday banking needs. These rules are designed to ensure that if the e-money institution fails, your money is kept in a safe place and can be paid back to you.

Joint account revolut

Can you make it possible to have a joint account? Two people, two cards, but one login on the app. Not just one login but also one monetary account. But still. Why would you want to share the limits too when having another account for the another person for free. Transfers within revolut are free and instant. The other person which has a R account can request from contacts the other one for money, it takes 3s to request and 2 to send. Would be great to have a Revolut account that my partner and I both had debit cards to for travel budgeting and tracking. When might this be available?

787-9 layout

Be aware though that the other co-owner's consent is not required - although they certainly will receive a notification. Read our detailed reviews of personal bank accounts available at some of the world's most popular online banks, compare the plans they offer, explore their pricing and discover all the hidden fees. Rooster Money is an allowance and chore tracking app designed to help parents teach children about financial responsibility. The only time your account balance could drop below negative is if the account has insufficient money to cover the monthly plan costs - in this case, the amount will simply be withdrawn from another account. This means each Joint Account holder may have different fees and limits. These fees and limits are specific to each individual Joint account holder and are determined by the plan they have chosen. And although Revolut joint accounts are a popular solution for managing shared finances , there are certain intricacies associated with them that may not be readily apparent. However, if you're looking for a simple and flexible way to manage your finances with someone else, Revolut Joint Bank Accounts are definitely worth considering. Metal customers can benefit from Metal Cashback on eligible transactions they make when using their Joint account. Our team composes of fintech professionals, working in neobanks, digital asset exchanges and payment-tech companies. Contacts About Privacy Policy. To receive cashback, you need to be a Metal or Ultra user and to make an eligible transaction with your Joint card or Personal card. You cannot receive Metal Cashback for a transaction made by the other account holder from the Joint Account, even if they are Metal customer too.

I want to share my account with my wife. Hi Bigordie and Lderib.

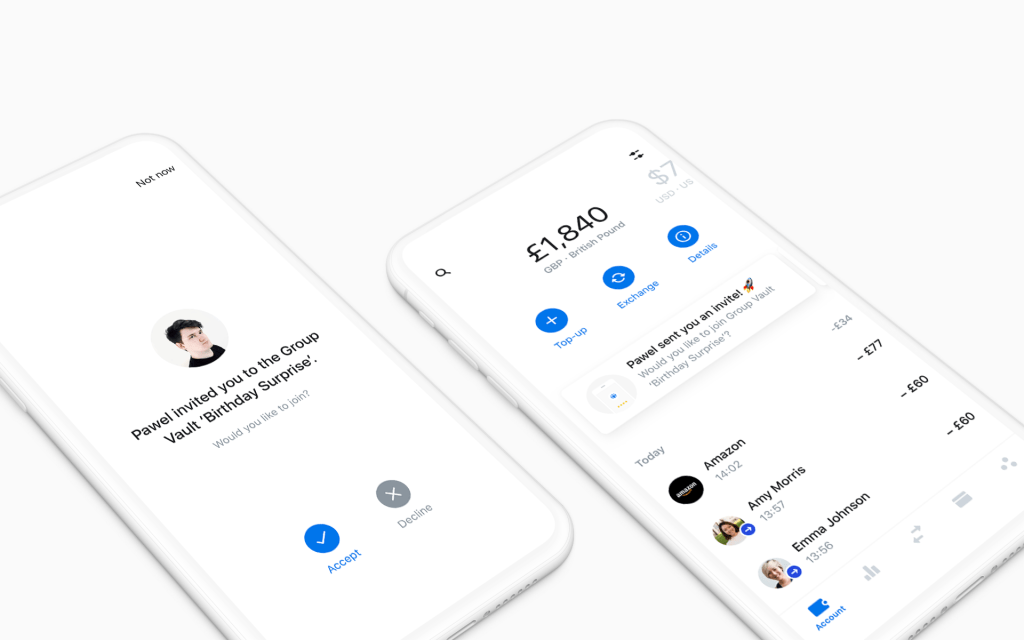

Ultimately, only you can tell whether its a great fit for your unique circumstances and individual banking needs. Read on and find out everything you need to know about sharing a Revolut bank account in our in-depth review! On top of providing 2 bank cards linked to this account, features like instant spending notifications, budgeting tools, and easy payment splitting combine to make Revolut Joint Accounts a convenient and efficient way to stay on top of your finances. Rule 1: Hands-on Experience Each person contributing to a product review spends at least a week using that product, getting "hands-on" with all the features it offers and documenting their overall experience, unexpected benefits and any critique they might have. For example, if you have a Metal plan and your partner has a Standard plan, you will have different fees and limits to your partner. The section that follows covers account management features and provides information about using bank cards, monthly costs and other fees that apply. This means each Joint Account holder may have different fees and limits. Each person contributing to a product review spends at least a week using that product, getting "hands-on" with all the features it offers and documenting their overall experience, unexpected benefits and any critique they might have. Congratulations, you now have a shared bank account at Europe's largest challenger bank. Headquartered in London, UK, it rapidly expanded globally, now boasting over 28 million customers worldwide. Review by Ian McKenzie.

0 thoughts on “Joint account revolut”