Individual tax rates ato

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

You now also can see how much more you will bring home under the revised tax cuts - just select tab on tax calculator below. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO , which your employer uses to calculate PAYG tax, rounds your income and taxes to the nearest whole figure, hence you may have some discrepancies with your actual pay on your payslip. Usually it's only a couple of dollars per month or fortnight, but still isn't ideal. However any overpaid taxes will be returned to you when you do your tax return at the end of financial year. Do you know you can compare and find cheapest Health Insurance on government website? This calculator does not include any Medicare Levy Surcharges and assumes you have private health insurance. Do you know you can compare TOP income protection companies and get extra discount?

Individual tax rates ato

Enter your annual taxable income to see your tax savings:. From onwards, based on your annual taxable income you will receive a tax cut of compared to settings. Annual reduction in tax and Estimated annual tax liability. The Government is also increasing the Medicare levy low-income thresholds for — This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy. The estimates in this tool are based on comparing —24 tax rates with proposed —25 tax rates and thresholds that are subject to the passage of legislation. The reduction in tax liability is calculated by only taking into account the basic tax scales, low-income tax offset as applicable , and the Medicare levy for the respective income year. It does not consider individual circumstances which may result in an actual tax outcome that is different to what is presented above. The tool is not intended to provide taxation or financial advice, and should not be relied upon as an accurate assessment of your individual tax affairs. Taxpayers should seek independent, expert advice on their own taxation and financial affairs as appropriate. In the spirit of reconciliation, the Treasury acknowledges the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respect to their Elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples. Breadcrumb Home Tax cuts to help with the cost of living Tax cut calculator.

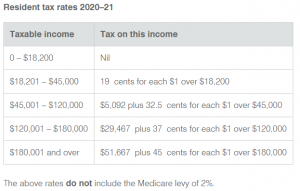

Income Tax Brackets Australia: The tax brackets have remained unchanged between the financial years of to

The Albanese Labor Government is delivering a tax cut for every Australian taxpayer commencing on July 1. These new tax cuts are designed to provide bigger tax cuts for middle Australia to help with cost-of-living, while making our tax system fairer. The Albanese Government recognises the economic realities of Australians are under pressure right now and deserve a tax cut. We have found a more responsible way to ensure more people get a bigger tax cut to help ease the pressure they are under. Our tax cuts are good for middle Australia, good for women, good for helping with cost-of-living pressures, good for labour supply and good for the economy.

On a yearly basis, the Internal Revenue Service IRS adjusts more than 60 tax provisions for inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state level—are adjusted for inflation. The new inflation adjustments are for tax year , for which taxpayers will file tax returns in early Note that the Tax Foundation is a c 3 educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. In , the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The federal income tax has seven tax rates in 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income Taxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

Individual tax rates ato

You now also can see how much more you will bring home under the revised tax cuts - just select tab on tax calculator below. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO , which your employer uses to calculate PAYG tax, rounds your income and taxes to the nearest whole figure, hence you may have some discrepancies with your actual pay on your payslip. Usually it's only a couple of dollars per month or fortnight, but still isn't ideal. However any overpaid taxes will be returned to you when you do your tax return at the end of financial year.

Sherbet glue strain

The most common deductions are:. These changes are due to come into effect on July 1. As a result of these changes, on July 1: All While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. To find out if you are eligible for an offset, it is best to visit the Australian Tax Office website or contact your local tax specialist. They could even take it a little higher and give it to Health and Education. Do you know you can compare and find cheapest Health Insurance on government website? Skip to main content. The revamped tax brackets following the implementation of the stage three tax cuts will be as follows:. Pricing Subscriber reviews Support. Your assessable income must be declared on your tax return each year. Enter your annual taxable income to see your tax savings:. Past performance is not indicative of future results. The private health insurance rebate is an amount the government contributes towards the cost of private health insurance premiums. Tax cuts to help Australians with the cost of living.

.

This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy. Username or E-mail. You can claim the cost of managing your tax affairs, including the cost of advice for preparing and lodging your tax return and business activity statements BAS. Salary-sacrifice contributions are deducted at the time you are paid, which reduces your gross assessable income. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. Your tax guide to accessing your super under age How superannuation is taxed: Super for beginners guide. In this case, the investor is increasing their deductions to reduce their taxable income and tax payable. Your assessable income must be declared on your tax return each year. This is known as bracket creep. Performance information may have changed since the time of publication. In Australia, financial years run from 1 July to 30 June the following year, so we are currently in the —24 financial year 1 July to 30 June

This topic is simply matchless :), it is pleasant to me.