How to pay duties fedex

Shipping discrepancies can be a pain, but they are easier to deal with when you can locate your customs shipping documents online to nail down the issue. FedEx offers tools to download images of the commercial invoice, in-country clearance forms, etc.

It has a customs invoice showing the import, but I though the expensive shipping fee I paid to get my printer would cover this. Has anyone else received this? Did you have to pay, or at least provide proof that you already paid shipping? And yes, I have paid them for all my printers. Unfortunately, that will get you a different visit.

How to pay duties fedex

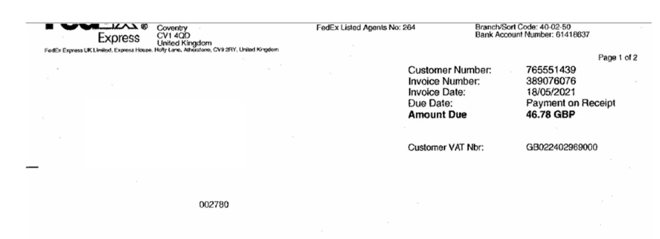

But in case you return those items abroad, you could be eligible for a refund of customs charges. To claim a refund, you need to submit some courier documents. If goods are ordered from EU retailers but manufactured overseas, the preferential duty rate does not apply. Import value-added tax or import VAT is a tax charged on goods imported into the UK from another country. There is also excise duty. This is a duty that is imposed on harmful goods like alcohol or tobacco. Excise goods are taxed at higher rates to reduce orders to a minimum. Couriers will handle the customs on your behalf and charge a courier or handling fee for their service. After your parcel is released from customs, FedEx will send you the payment instructions. The cost depends on which amount is higher. First, you can contact their Customer Service and set up a direct debit with FedEx. Though, we advise you to check their working hours before calling. If you want to pay via your credit or debit card, you can go about it in three different ways. You can link your card to your FedEx account name.

Home Global ecommerce Fulfillment Carriers Billing.

.

Last Updated: December 23, Fact Checked. This article was co-authored by Miatrai Brown, Esq. With over 10 years of academic and professional experience, her areas of focus include employment-based nonimmigrant and immigrant visas, investment-based immigration, family-based immigration, risk management assessment, and regulatory compliance. She began her legal career exclusively practicing immigration and nationality law as external immigration counsel to large U. After six years at top immigration firms, she opened her own practice, Direct U.

How to pay duties fedex

Canadians ship goods using different channels. FedEx is one of the most prominent international shipping companies used in Canada. And while shipping with FedEx, it is crucial to understand the overall cost you will be bearing for the shipment. One of the most vital factors to consider when shipping goods internationally in Canada is delivery cost, duties, taxes and clearance charges. This article will be reviewing FedEx duties and how to pay online. However, the duty rate the CBSA requires you to pay depends on the type of goods and the manufacturing country.

Hot pictures of nicki minaj

Review the next screen and submit the request. We hope this article has answered all of your questions about paying FedEx customs charges and reclaiming them on returned items. The claim needs to be made:. Import value-added tax or import VAT is a tax charged on goods imported into the UK from another country. Cost of doing business I guess. Next Topic. Supply chain. Not only that, but you need to then file the claim directly to HMRC yourself. Remember that you or your shipper must declare in the provided paperwork that the order contains samples. Once you return your goods, you can apply for a refund of import charges. Unfortunately, that will get you a different visit. This can be due to an error in classification, currency conversion, etc.

.

Learn how to avoid this headache with Zonos Landed Cost guarantee! Because of a restricted time frame and the sheer quantity of international shipping, FedEx cannot contact every new customer in advance. Most of the reports I have seen here of people owing customs after having their printer shipped to the US via Fedex involve having to pay before they would deliver the shipment. What happens is that the shipper paid for transportation charges and not import duty and tax. Get my refund. Estimable Member. Failure to pay it is considered theft. It could take weeks to get a response from HMRC. This must comply with strict HMRC rules, like:. Import value-added tax or import VAT is a tax charged on goods imported into the UK from another country. All forum topics. Cost of doing business I guess. It has a customs invoice showing the import, but I though the expensive shipping fee I paid to get my printer would cover this. Once you return your goods, you can apply for a refund of import charges. If Zonos is so accurate, why would I need a Landed Cost guarantee?

It is remarkable, this very valuable opinion

I confirm. I agree with told all above. Let's discuss this question. Here or in PM.