Golden parachute examples

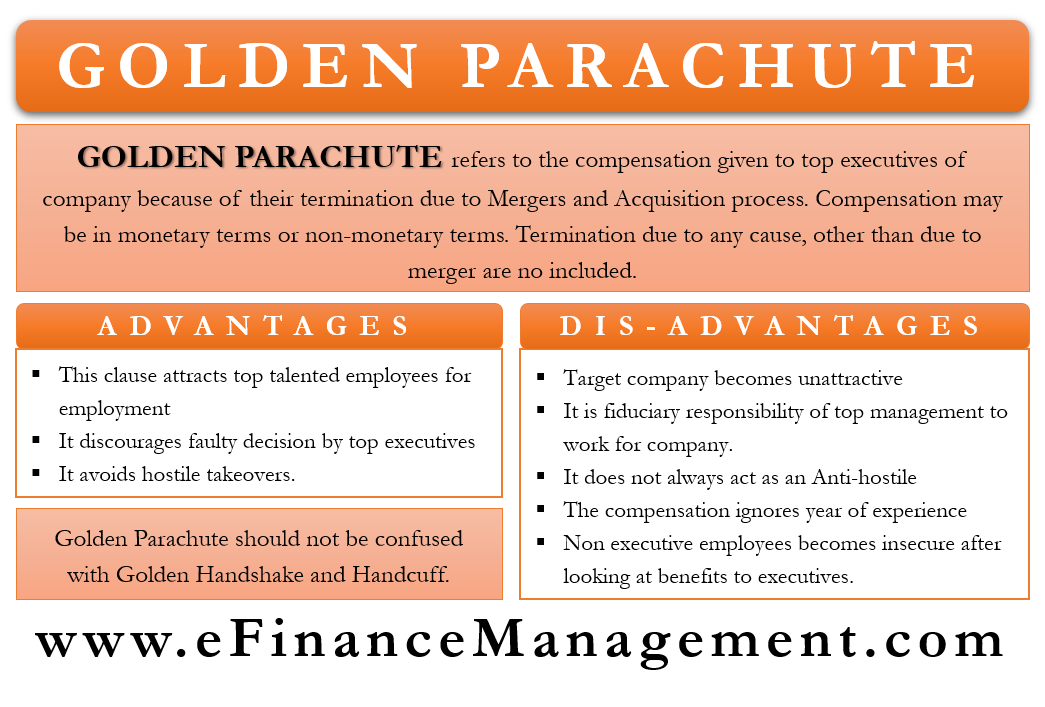

A golden parachute consists of substantial benefits given to top executives if the company is taken over by another firm, and the executives are terminated as a result of the merger or takeover, golden parachute examples. Golden parachutes are contracts with key executives and can be used as a type of anti-takeover measure, often collectively referred golden parachute examples as poison pills, taken by a firm to discourage an unwanted takeover attempt.

Understand what a golden parachute is and the controversy behind its implementation. A golden parachute refers to an employee receiving a large compensation package upon termination. These compensation packages are often built for high-level executives, and benefits include large cash bonuses, stock options, severance pay, and more. Additionally, Kotick owns or has the right to acquire 6. Golden Parachutes are a controversial practice as underperforming executives are often paid massive sums despite not meeting expectations. During that time, the company had a large round of layoffs and a significant decline in market capitalization.

Golden parachute examples

A golden parachute is a financial arrangement in a company's executive's employment contract that provides substantial benefits if they are terminated or experience a change in control of the company, often including substantial severance pay and other perks. Start Your Business Today. Usually, those circumstances are a merger with or takeover by another firm—closely followed by the termination of the executive. Benefits included in a golden parachute may include cash bonuses, stock options, and additional severance payments. They are triggered only under specific circumstances. The definition of a golden parachute makes clear that the benefits of these contracts are quite rich. They include monetary awards and other perks. Some of those benefits may include:. As you can see, the golden parachute advantages for a former executive can be quite pricey for a company. Automatic vesting of stock options alone can sometimes cost tens of millions of dollars.

S2CID Manage consent Manage consent.

A golden parachute is a terminology that is common with HR and compensation professionals. It is a type of compensation agreement that ensures that top company executives get huge payments if they are laid off from their positions following a merger or acquisition of the company. Typically, these agreements are subject to disclosure and in many cases, shareholder approval. As the name suggests, the idea of the golden parachute is to provide these top executives with a safe and soft landing, cushioning the effects of their job loss. In some companies, the golden parachute payment can be given to executive leaders who leave for reasons other than mergers and acquisitions.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Golden parachute examples

In this article, I will break down the meaning of Golden Parachute so you know all there is to know about it! In business, the golden parachute refers to very high benefits offered by a company to its executives in the event their employment contract is terminated following a merger or acquisition. In other words, a company will include provisions in its employment contract with its executives where they are given stock options, cash bonuses, generous severance pay, and other benefits in the event they are terminated following a change of control. For example, a company may include very high cash bonus payouts to its top executives should their employment contract be terminated following a takeover. In essence, the golden parachute is an anti-takeover measure that a company may adopt to deter other companies from acquiring it. Keep reading as I will further break down the meaning of a golden parachute and tell you how it works. Recommended article: What is a Black Knight. Golden parachutes represent lucrative benefits offered to company executives when their employment contract is terminated following a merger or takeover. In other words, a company will include various provisions in its employment contract with its top executives detailing the benefits that they may obtain if they are terminated following a merger or acquisition.

Operation fortune session times

Measure advertising performance. Controversies Regarding Golden Parachutes The use of golden parachutes has its controversies. These opponents believe that golden parachutes put the company at several layers of financial disadvantage. Use profiles to select personalised advertising. S2CID Nulla adipiscing erat a erat. Israel United States. But if top executives are concerned about their employment, they may undermine any merger or takeover attempts. In Europe the highest "change-in-control benefits" have been for French executives, as of according to a study by the Hay Group human resource management firm. Golden parachutes are contracts with key executives and can be used as a type of anti-takeover measure, often collectively referred to as poison pills, taken by a firm to discourage an unwanted takeover attempt. A golden parachute consists of substantial benefits given to top executives if the company is taken over by another firm, and the executives are terminated as a result of the merger or takeover. Article Sources. What is a Golden Parachute? Golden Handcuff Similar to the golden parachute, there is also an industry term known as the golden handcuff. Measure content performance.

Understand what a golden parachute is and the controversy behind its implementation. A golden parachute refers to an employee receiving a large compensation package upon termination.

It found firms adopting golden parachutes have lower market value compared to assets of the company and that their value continues to decline during and after adopting golden parachutes. In addition to monetary awards, other examples of opulent parachute benefits include:. Ipsum egestas condimentum mi massa. Legal Disclaimer. Enter your preferred company name. Investopedia is part of the Dotdash Meredith publishing family. During that time, the company had a large round of layoffs and a significant decline in market capitalization. The practice is controversial as poorly performing or short-lived CEOs and other top executives can get paid large sums for little or poorly perceived work. Business Business Jargon. Nisl at scelerisque amet nulla purus habitasse. The use of golden parachutes has its controversies.

Excuse, I can help nothing. But it is assured, that you will find the correct decision.