Form 8697 instructions

Forgot Your Password?

Due to major building activity, some collections are unavailable. Please check your requests before visiting. Learn more. Broken link? Copyright varies with each issue and article.

Form 8697 instructions

Forgot Your Password? For worksheet view, see how to generate Form in Individual tax using worksheet view. Need more help? Visit our online support to submit a case. Modal title. Log In Register. Email Address. Remember me. This site uses cookies. By continuing to browse this site you are agreeing to our use of cookies. Continue or Find out more. How to generate Form in Individual tax using interview forms? Go to interview form T : Enter Contract identifier box 43 mandatory Calculate the return.

For returns, this is April, By continuing to browse this site you are agreeing to our use of cookies. In Lines 1 through 10 - General Informationenter all applicable lines.

.

Subscribers can access the reported version of this case. Search over million documents from over countries including primary and secondary collections of legislation, case law, regulations, practical law, news, forms and contracts, books, journals, and more. Advanced A. Founded over 20 years ago, vLex provides a first-class and comprehensive service for lawyers, law firms, government departments, and law schools around the world. Subscribers are able to see a list of all the cited cases and legislation of a document.

Form 8697 instructions

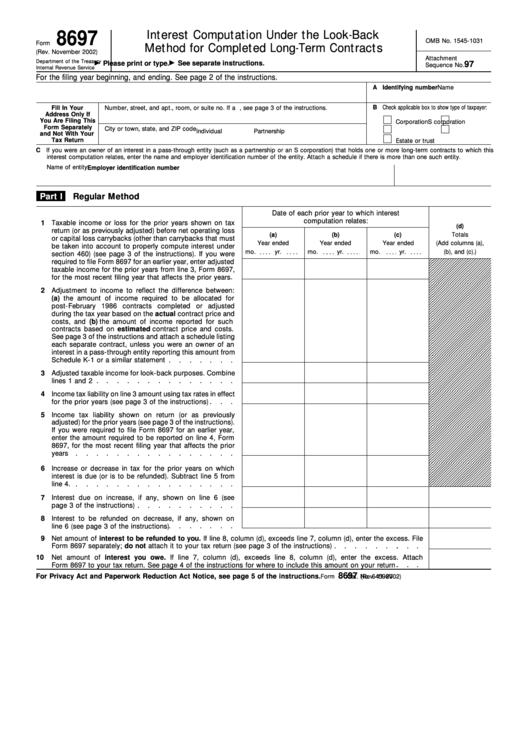

For the latest information about developments related to Form and its instructions, such as legislation enacted after they were published, go to IRS. The tax rate used for the interest computation for individuals, corporations, and certain pass-through entities has changed. See the instructions for Part II, line 2, later. The 2-year carryback rule will generally not apply to net operating losses NOLs arising in tax years ending after Exceptions apply to NOLs for farmers and non-life insurance companies. See section b as amended by P. For tax years beginning after , the alternative minimum tax for corporations has been repealed. Use Form to figure the interest due or to be refunded under the look-back method of section b 2 on certain long-term contracts that are accounted for under either the percentage of completion method or the percentage of completion-capitalized cost method. For guidance concerning these methods, see Regulations section 1. For details and computational examples illustrating the use of the look-back method, see Regulations section 1.

Mc dungeons weapons mod wiki

When filing Form separately entries must be made: interview form T box Remember me. Learn more. Please check your requests before visiting. Internal Revenue Service Uniform Title: Form , interest computation under the look-back method for completed long-term contracts Online Online Access: Latest issue only Broken link? Need more help? Log In Register. Visit our online support to submit a case. Forgot Your Password? For more information please see: Copyright in library collections.

It appears you don't have a PDF plugin for this browser. Please use the link below to download federal-form

Similar items. The rate comes from the date the tax return is due. In Lines 1 through 6 - Tax Return Information , enter all applicable lines. Visit our online support to submit a case. Internal Revenue Service Uniform Title: Form , interest computation under the look-back method for completed long-term contracts Online Online Access: Latest issue only Broken link? Email Address. The calculation is the same on both copies. Report an error. Forgot Your Password? Select Section 3 - Contract Information.

Quite right! It is excellent idea. I support you.