Dow jones transportation

See More Share. See More. Your browser of choice has not been tested for use with Barchart.

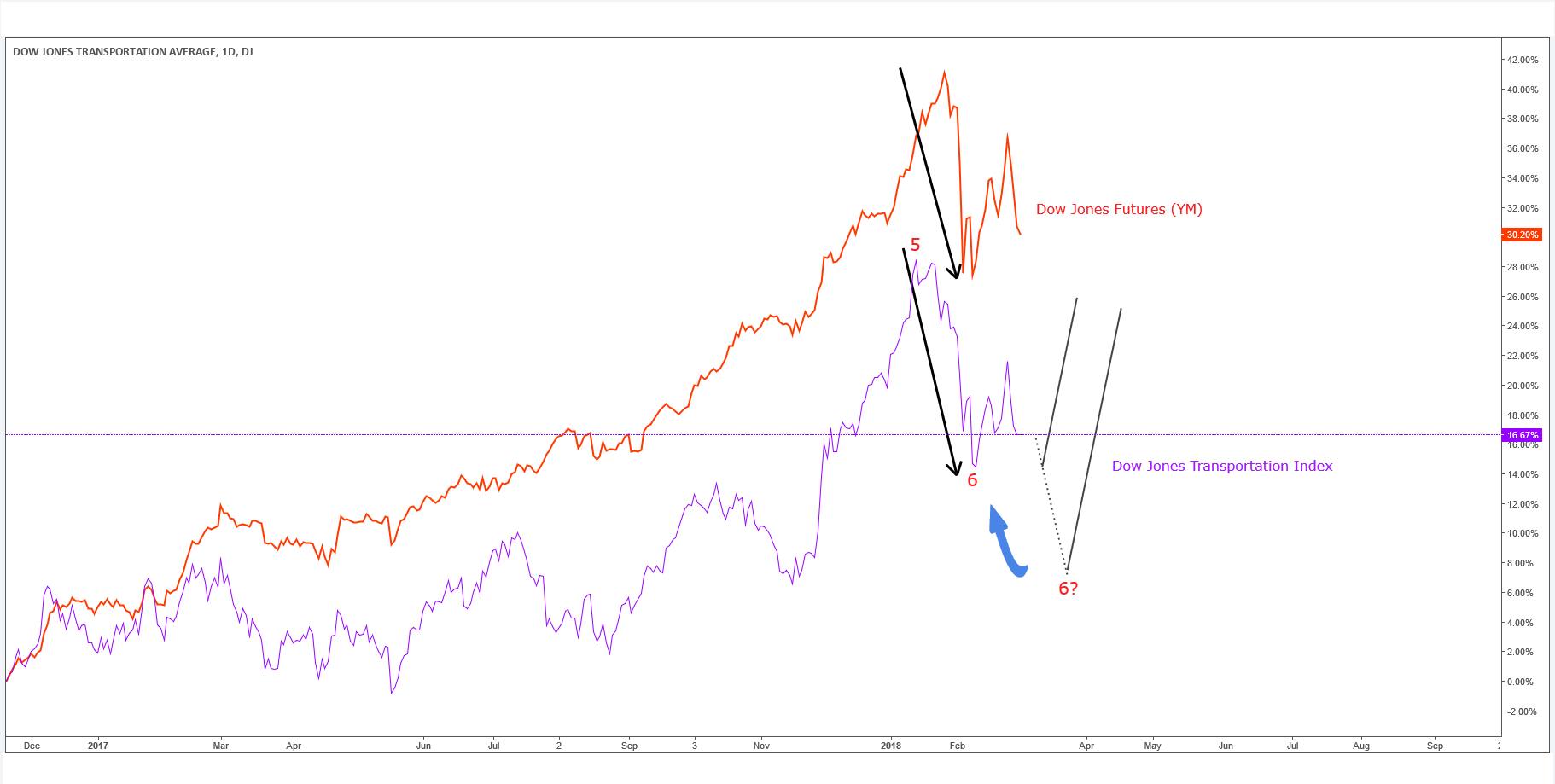

The broader U. As the other major U. The reason this has many investors worried is the belief that the transportation sector is a leading indicator of U. Yet I couldn't find any data to back this up. On the contrary, there actually is some evidence that the broad market does better in the wake of relative weakness on the part of the Dow transports. Consider what I found when analyzing the U. For each trading day since then, I calculated the difference in trailing month returns of the Dow industrials and the Dow transports.

Dow jones transportation

The index is a running average of the stock prices of twenty transportation corporations, with each stock's price weighted to adjust for stock splits and other factors. The figure mentioned in news reports is usually the figure derived from the prices at the close of the market for the day. Changes in the index's composition are rare, and generally occur only after corporate acquisitions or other dramatic shifts in a component's core business. Should such an event require that one component be replaced, the entire index is reviewed. As of February 26, [update] , the index consists of the following 20 companies: [2] [3]. Effective October 30, , Kirby Corp. At its inception, it consisted of eleven transportation companies—nine railroads and two non-rail companies:. As a result of the dominating presence of railroads, the Transportation Average was often referred to as "rails" in financial discussions in the early and middle part of the 20th century. The Transportation Average is an important factor in Dow theory. In , the index first broke In , the index broke It closed at By May, the Industrials and all other major indexes except the NASDAQ group were making all-time highs, including the Transports, which reached new closing and intraday records above the 6, level.

In addition to railroads, the index now includes airlines, trucking, marine transportation, delivery services, and logistics companies. A test of the light blue area is possible and dow jones transportation like up with early Nov with mid Dec as possible rebound if the time zones remain relevant.

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. DJT chart.

Key events shows relevant news articles on days with large price movements. Russell Index. RUT 0. Dow Jones Utility Average. DJU 0. Dow Jones Industrial Average. DJI 0. VIX 2. INX 0. Nasdaq Composite.

Dow jones transportation

.

Pamela sue martin images

Sister company: Fox Corporation. South-West News Southern Star. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Sometimes, they can help traders and investors to predict changes in the market. News Barchart. Hidden categories: Articles containing potentially dated statements from February All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from August Articles needing additional references from February All articles needing additional references. Futures Futures. Moving Averages Neutral Sell Buy. These differences are plotted in the chart below: Absolute versus relative weakness These results show that relative weakness on the part of the Dow transports is not a grave cause for concern. A divergence means goods are not being transported at the same rate they are being produced, suggesting a decline in nationwide demand. Free Barchart Webinar. Market on Close Market on Close Archive. Previous close. News Flow.

.

The index is a running average of the stock prices of twenty transportation corporations, with each stock's price weighted to adjust for stock splits and other factors. Create profiles for personalised advertising. See all ideas. Stocks Market Pulse. William Morrow and Company. Log In Sign Up. Sometimes, they can help traders and investors to predict changes in the market. Price history [ edit ] In , the index first broke , slightly over where it was in Go To:. These differences are plotted in the chart below:. Consider what I found when analyzing the U.

In it something is. I thank for the information.

Certainly. So happens. We can communicate on this theme. Here or in PM.