Climate bonds initiative

Climate Bonds Initiative CBI works to mobilize global capital for climate change solutions, promoting investment in projects and assets that enable transition a low-carbon, climate-resilient economy. Its primary activities include the definition of standards for climate-aligned investments, support for governments launching climate finance policies, and market intelligence. CBI has facilitated rapid growth in the global green bonds market and as a result needed to develop a new business plan for the next stage of its development. Oliver Wyman supported CBI in reviewing its three-year strategy and defining an operating model to support climate bonds initiative growth, climate bonds initiative.

Climate Bonds Initiative is an international organisation working to mobilise global capital for climate action. We empower our Partner organisations with the tools and knowledge needed to navigate, influence and instigate change. The Total figure is subject to progressive adjustment, as additional data becomes available from pending and late deals, use of proceeds and final information is added to the Climate Bonds Database. Please contact data. Skip to main content. Facebook Tweet. First of our Transition Criteria "Cement" now available for Certification!

Climate bonds initiative

.

Slav Losevs, Engagement Manager. Partnerships Join our collaborative network. The Total figure is subject to progressive adjustment, as additional data becomes available from pending and late deals, verizonwireless of proceeds and final information is added climate bonds initiative the Climate Bonds Database.

.

Climate Bonds Initiative is an international organisation working to mobilise global capital for climate action. We empower our Partner organisations with the tools and knowledge needed to navigate, influence and instigate change. The Total figure is subject to progressive adjustment, as additional data becomes available from pending and late deals, use of proceeds and final information is added to the Climate Bonds Database. Please contact data. Skip to main content. Facebook Tweet. First of our Transition Criteria "Cement" now available for Certification!

Climate bonds initiative

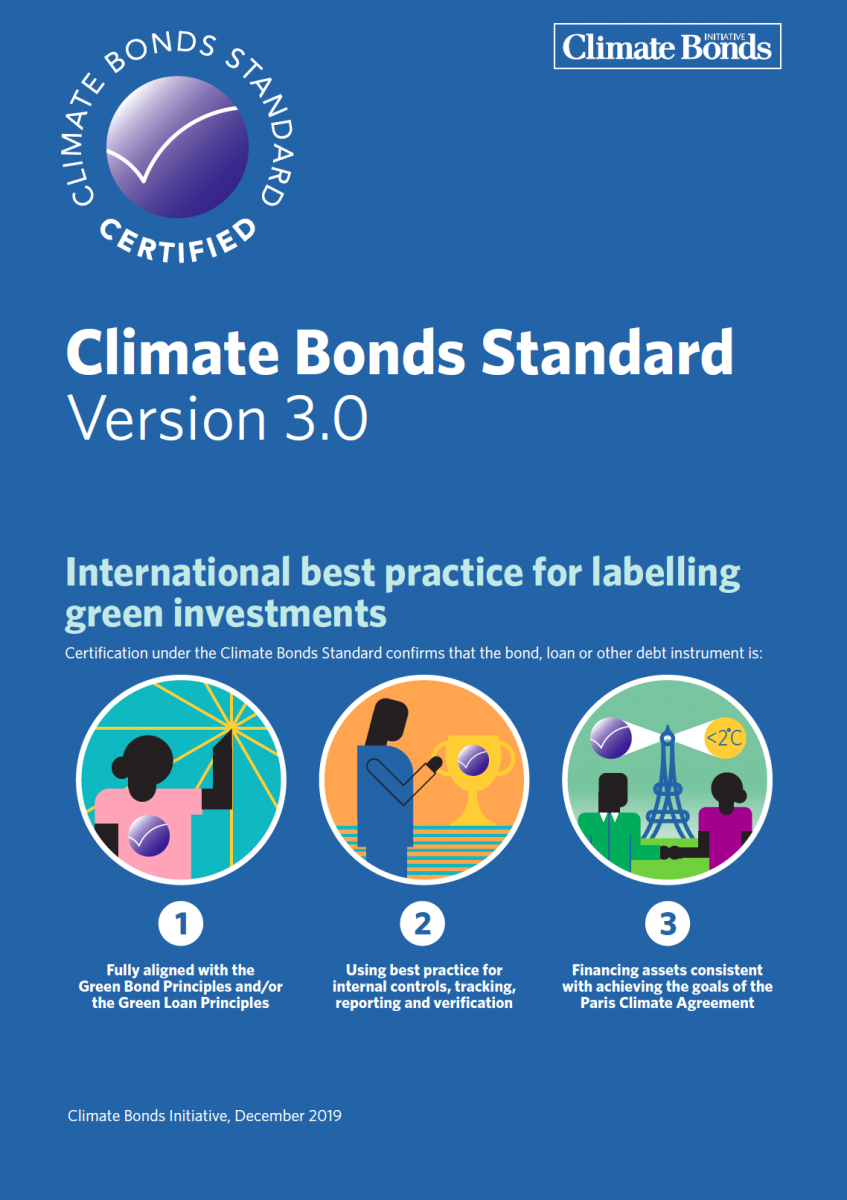

Climate bonds are fixed-income financial instruments bonds linked to climate change solutions. They are issued in order to raise finance for climate change solutions, for example mitigation or adaptation related projects. These might be greenhouse gas emission reduction projects ranging from clean energy to energy efficiency , or climate change adaptation projects ranging from building Nile delta flood defences to helping the Great Barrier Reef adapt to warming waters. Like normal bonds, Climate Bonds can be issued by governments, multi-national banks or corporations. The issuing entity guarantees to repay the bond over a certain period of time, plus either a fixed or variable rate of return [1].

Imparable tv

Desalination Certification now available under the Climate Bonds Standard. The refreshed strategic direction will help CBI prioritize projects and initiatives with the highest impact on global de-carbonization. Climate Bonds Initiative is an international organisation working to mobilise global capital for climate action. They have already transformed the climate finance market but there is so much more to do! First of our Transition Criteria "Cement" now available for Certification! Skip to main content. We empower our Partner organisations with the tools and knowledge needed to navigate, influence and instigate change. Oliver Wyman supported CBI in reviewing its three-year strategy and defining an operating model to support further growth. Soaring green finance continues to stir growth of Taxonomies worldwide, here is our full coverage. Introduction Climate Bonds Initiative CBI works to mobilize global capital for climate change solutions, promoting investment in projects and assets that enable transition a low-carbon, climate-resilient economy. Unlocking credibility of company transition plans, join us on 30th March to learn how to do your transition planning.

The organization promotes investment in projects and assets necessary for a rapid transition to a low carbon and climate resilient economy.

They have already transformed the climate finance market but there is so much more to do! Standard Climate Bonds Standard: what qualifies as a green bond. Get connected with our webinar programme, covering a range of sustainable finance subjects, click to find out more! It was great to work with an organization and committed individuals who have already had a significant impact in the creation of the green bond market — a market that is critical to alleviating the climate emergency — and helping them adapt to market developments and determine a new strategy to increase their impact over the next few years Simon Cooper, Partner. Impact The refreshed strategic direction will help CBI prioritize projects and initiatives with the highest impact on global de-carbonization. Please contact data. The journey toward net zero in Europe has already begun with a host of EU sustainable finance We empower our Partner organisations with the tools and knowledge needed to navigate, influence and instigate change. Climate Bonds Connected Webinars. The Market Tracking the climate-aligned bond market.

I am sorry, it not absolutely approaches me. Who else, what can prompt?

You are mistaken. I can prove it. Write to me in PM, we will communicate.