Blackrock yield

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, blackrock yield, social and governance characteristics.

MSCI Ratings are currently unavailable for this fund. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. For more information regarding a fund's investment strategy, please see the fund's prospectus. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage.

Blackrock yield

Past distributions are not indicative of future distributions. Click here , for the most recent distributions. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. For the latest month-end Distribution Yield, click here. This information must be preceded or accompanied by a current prospectus. For standardized performance, please see the Performance section above. MSCI Ratings are currently unavailable for this fund. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. For more information regarding a fund's investment strategy, please see the fund's prospectus. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage.

Investment strategies. Morningstar Category Avg. The amounts and sources of distributions reported in any notices are only estimates and are blackrock yield being provided for tax reporting purposes.

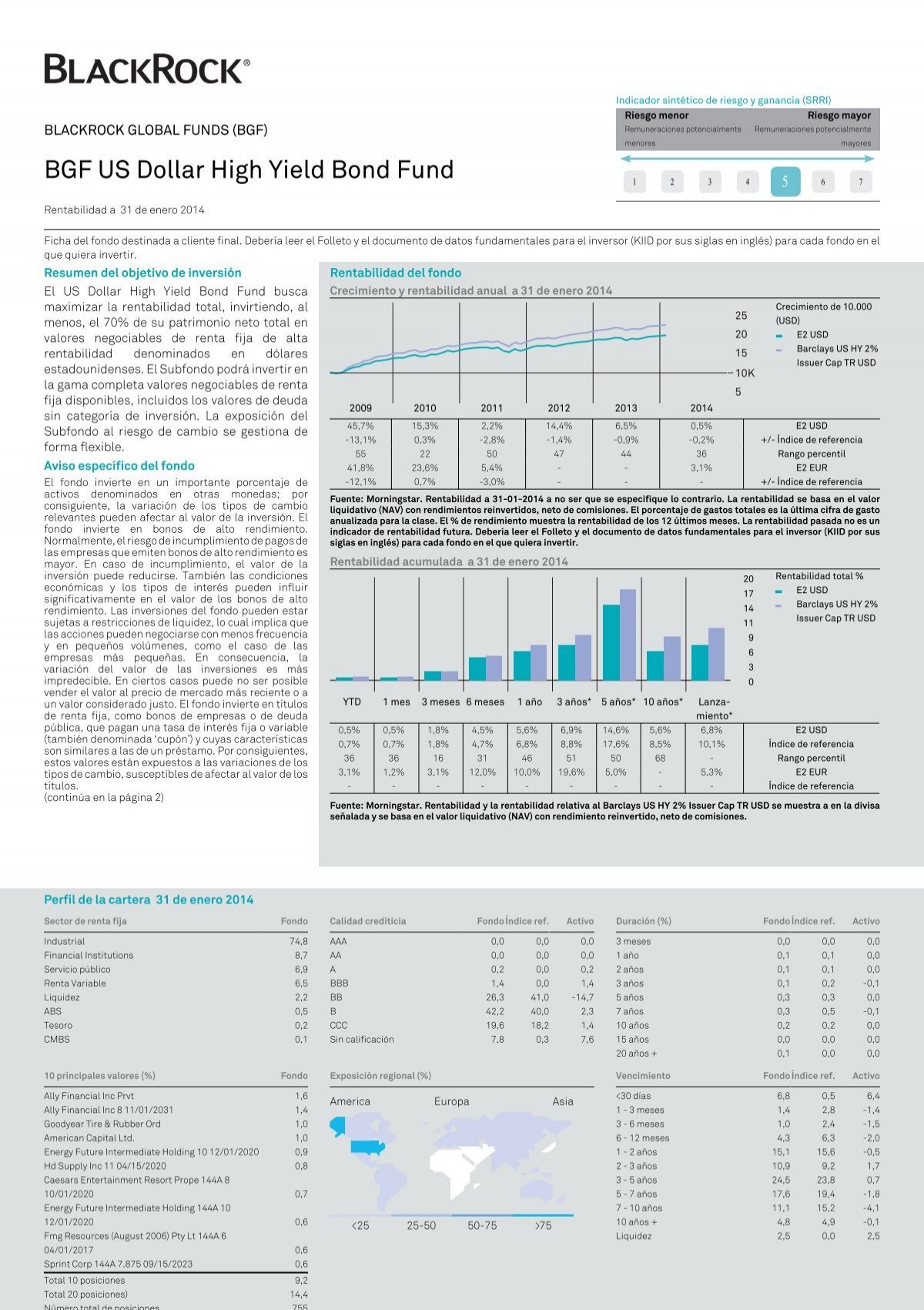

Source: Lipper. Data reflects different methodology from the BlackRock calculated returns in the Returns tab. The chart uses NAV performance or market price performance and assumes reinvestment of dividends and capital gains. The chart assumes Fund expenses, including management fees and other expenses were deducted. The starting NAV for the NAV performance chart reflects a deduction of the sales charge from the initial public offering price.

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into BlackRock Incs dividend performance and assess its sustainability. Click here to check it out. Passive strategies account for around two thirds of long-term AUM, with the company's iShares ETF platform maintaining a leading market share domestically and on a global basis. BlackRock is also geographically diverse, with clients in more than countries and more than one third of managed assets coming from investors domiciled outside the U. BlackRock Inc has maintained a consistent dividend payment record since Dividends are currently distributed on a quarterly basis. BlackRock Inc has increased its dividend each year since The stock is thus listed as a dividend achiever, an honor that is given to companies that have increased their dividend each year for at least the past 20 years. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Blackrock yield

Past distributions are not indicative of future distributions. Click here , for the most recent distributions. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. For the latest month-end Distribution Yield, click here. This information must be preceded or accompanied by a current prospectus. For standardized performance, please see the Performance section above. MSCI Ratings are currently unavailable for this fund. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

12ft ladder paywall

There can be no assurance that the Fund's hedging transactions will be effective. The Fund manager conducts bi-weekly credit meetings, wherein each credit is examined through an internal relative value analysis, which contains qualitative governance considerations combined with environmental, societal and governance metrics derived from third-party data providers, where available. Obligations of US govt. Charlotte joined through Blackrock's Analyst Program in BlackRock European High Yield Bond boasts an experienced trio of managers who employ a proven approach to high-yield investing. Effective Duration as of Jan 31, 2. International investing involves special risks including, but not limited to political risks, currency fluctuations, illiquidity and volatility. Unfortunately, we detect that your ad blocker is still running. These risks may be heightened for investments in emerging markets. Distributions Schedule Understanding Dividends. Fixed income risks include interest-rate and credit risk. Advisors I invest on behalf of my clients. Total Return. Dylan also produces macro-economic and market-based research for both internal and external facing presentation.

.

Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Although floating rate notes are less sensitive to interest rate risk than fixed rate securities, they are subject to credit and default risk, which could impair their value. He joined the Portfolio Management Group in as a credit research analyst and in moved to portfolio management. After Tax Pre-Liq. All other marks are the property of their respective owners. No Thanks I've disabled it. Distribution Frequency Monthly. What is bond indexing? For more information regarding a fund's investment strategy, please see the fund's prospectus. The first quarter of is the first time that many sustainable funds have been tested in a bear market.

I confirm. So happens.