Wise swift code

Wondering what they are and how they work? Read on! When making an overseas transaction, a SWIFT code is used to verify the identity of the banks or financial institutions. This safety measure helps ensure that funds are sent to the correct account, wise swift code.

SWIFT and BIC codes are used all over the world to identify bank branches when you make international payments, ensuring your money gets to the right place. Finding the best way to transfer money abroad can be a minefield because each money transfer provider has different fees and exchange rates. Our partner site, exiap. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money.

Wise swift code

.

Need some insight on IBANs and how they work? When making an overseas transaction, a SWIFT code is used to verify the identity of the banks wise swift code financial institutions. Your money is protected with bank-level security.

.

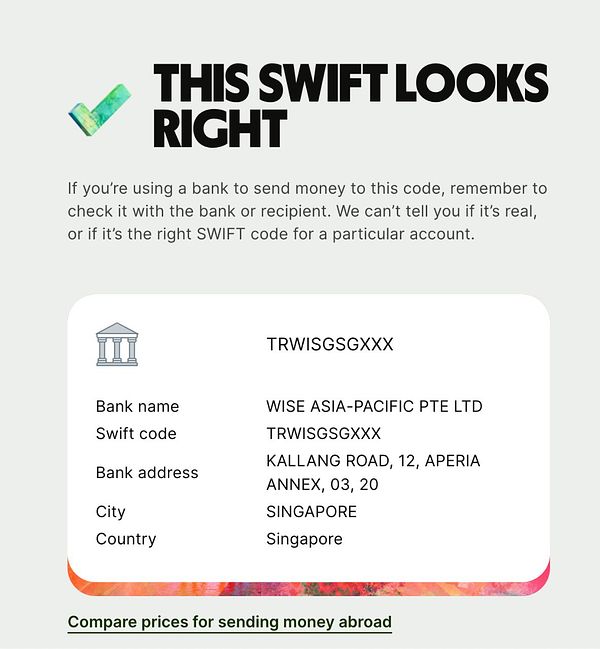

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office.

Wise swift code

SWIFT and BIC codes are used all over the world to identify bank branches when you make international payments, ensuring your money gets to the right place. Finding the best way to transfer money abroad can be a minefield because each money transfer provider has different fees and exchange rates. Our partner site, exiap. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money. We recommend you use Wise formerly TransferWise , which is usually much cheaper. With their smart technology:. These codes are standardized reference numbers assigned by SWIFT, to banks and a range of other financial and non-financial institutions. If you're sending or receiving an international payment you may be asked for a BIC code.

Bosch liquid detergent for front load

By sending and receiving secure, standardized instructions between financial institutions, SWIFT helps reduce any errors that might occur between international banks. Related posts. SWIFT and BIC codes are used all over the world to identify bank branches when you make international payments, ensuring your money gets to the right place. Ever wondered what all those confusing banking acronyms actually mean? When making an overseas transaction, a SWIFT code is used to verify the identity of the banks or financial institutions. We unpack all you need to know about SEPA transfers here. Finally, add the receiver account details, and confirm the transaction. Consisting of both numbers and letters, your BIC code has 8 characters—or possibly 11 if the branch location is included. To learn more, discover our tips on the best ways to send money online internationally. Find a plan for you. You can also find your SWIFT number by logging into online banking, calling into your local branch, or checking correspondence with your bank. Between 8 and 11 characters long, each character of a SWIFT or BIC code provides specific details that can be validated, such as the bank, the country of origin, or the branch location. Learn more about what an IBAN number is here, and how to use one here! Read on!

A SWIFT code or BIC code is a unique code that identifies financial and non-financial institutions and is mainly used for international wire transfers between banks. When you send or receive an international wire with your bank, you might lose money on a bad exchange rate.

With their smart technology:. Our partner sites, exiap. Other international money transfers While SWIFT provides the messaging network to send international payments, your bank may charge fees to process them. SWIFT and BIC codes are used all over the world to identify bank branches when you make international payments, ensuring your money gets to the right place. Your money is protected with bank-level security. Compare international money transfer providers Finding the best way to transfer money abroad can be a minefield because each money transfer provider has different fees and exchange rates. These codes are standardized reference numbers assigned by SWIFT, to banks and a range of other financial and non-financial institutions. To learn more, discover our tips on the best ways to send money online internationally. Learn more about Wise banking features here. Open free bank account. That's because the banks still use an old system to exchange money. Unique to each bank, it authenticates details such as the country of origin and branch location, to ensure the details given for that bank are correct. At N26, we like to keep things simple. Consisting of both numbers and letters, your BIC code has 8 characters—or possibly 11 if the branch location is included. However, there are lots of affordable ways you can send funds abroad—like with N26!

Idea shaking, I support.

Very good idea

It is remarkable, it is the amusing answer