What time does wells fargo post deposits

A deposit hold means that although a check amount was credited to your account, it's not available for your use. Wells Fargo Bank's general policy is to make deposited funds available on the first business day after the Bank receives a deposit. In some cases, however, we may place a deposit hold on these funds and delay availability for up to 7 business days. Common reasons for placing a hold on a check or deposit include what time does wells fargo post deposits are not limited to:.

We're sorry, but some features of our site require JavaScript. Please enable JavaScript on your browser and refresh the page. Learn More. Even in an increasingly digital world, checks can still be part of everyday finances for many people. Some people may receive checks frequently, such as their paycheck, while others receive them only occasionally. The deposit of paper checks is handled differently than direct deposits, which are electronically deposited into your account.

What time does wells fargo post deposits

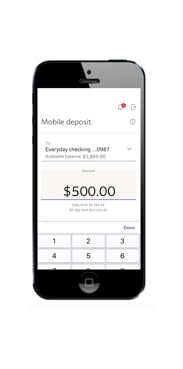

Securely store your check for 5 days after your deposit, and then destroy it. This allows sufficient time in case the original check is required for any reason. You can deposit checks payable in U. Checks must be payable to, and endorsed by the account holder. The following are not eligible for Mobile Deposit: international checks, U. If you deposit on a business day before 9 pm PT, your money will generally be available the next day. If you deposit after 9 pm PT or on a weekend or holiday, we'll process the deposit on the next business day and your money will generally be available the day after that. Some checks can take longer to process, so we may need to hold some or all of the deposit for a little longer. You will know that your deposit amount is available when the amount appears in your available balance. When a hold is applied on any portion of your deposit, you will receive a notification that provides details on the amount held and when it will be available. A deposit is held when funds are posted to your account but are not immediately available to cover debits or withdrawals. Common reasons include:. Yes, your mobile deposit limits are shown for each eligible account when you select a Deposit to account and on the Enter Amount screen. Mobile deposit lets you submit photos of the front and back of your endorsed, eligible check. Remember for added security, always sign off completely when you finish using the Wells Fargo Mobile app by selecting Sign Off.

Here are common ways you can reactivate your what time does wells fargo post deposits some options may not be available for your account : Sign on to Wells Fargo Online to access Account Summary, and select the option to reactivate your account that is displayed next to the inactive account. Mobile deposit is available only on the Wells Fargo Mobile app. To make an account the default for mobile deposit, select the account from the Deposit To drop-down, and check the Make this account my default box.

Early Pay Day gives you access to your eligible direct deposits up to two days early. Once we receive information about your incoming direct deposit from your payor, we may make the funds available for your use up to two days earlier than your scheduled pay date. Three easy steps. Signing up for automatic alerts will notify you when a direct deposit is available in your account. Choose how you want to receive alerts — email, text message, or push notification to your phone. You can change your preferences anytime. Set up alerts.

We may earn a commission for purchases through links on our site, Learn more. Most businesses increasingly rely on direct deposits to pay workers. One benefit of this process is that you can often receive access to your money quickly, and sometimes, you can even access your funds before your usual payday. Knowing what time a direct deposit will hit can relieve a great deal of financial stress for someone who lives paycheck to paycheck. Direct deposit is an automated process that allows a government agency, an employer, or other third parties to instruct its financial partner, such as a bank, to electronically transfer funds into your bank account on a specified date.

What time does wells fargo post deposits

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant.

Open an xbox 360 console

Common reasons for placing a hold on a check or deposit include but are not limited to: Accounts with frequent overdrafts New customer High-dollar deposits that exceed the total available balance in the account Deposits of checks that have already been returned unpaid Notification to Wells Fargo by the check maker's financial institution that the check will be returned. A deposit hold means that although a check amount was credited to your account, it's not available for your use. Availability may be affected by your mobile carrier's coverage area. If the Wells Fargo Mobile app does not detect the camera on your device, you will not be able to see the Deposit Checks option. Checks must be payable to, and endorsed by the account holder. What is a deposit hold and why was a hold placed on my deposit? Tap Wells Fargo. If you make your deposit after the cutoff time or on a non-business day, we will credit it to your account on the next business day. Be sure your email includes the address where you want the kit mailed and your account number for the deposits. Peace of mind Set up Direct Deposit and never worry about checks getting lost, delayed, or stolen.

Money Market Accounts.

Available for personal accounts only. If we don't receive a final payment request from the merchant within three 3 business days, [or up to thirty 30 business days for certain types of debit or ATM card transactions including but not limited to car rental transactions, cash transactions, and international transactions], we release the authorization hold on the transaction. If you make your deposit on a business day before the cut-off times displayed at the Wells Fargo branch, Wells Fargo ATM, or online, we will generally credit the deposit to your account the same business day. Three easy steps. Comienzo de ventana emergente. How do I get information about a levy or legal order process on my account? ZIP code to find a branch. Final transaction amounts for some debit card transactions may be greater than the amount initially authorized a common occurrence at restaurants where a tip may not appear on the amount initially authorized, but will appear on the final transaction amount. Be sure your email includes the address where you want the kit mailed and your account number for the deposits. Peace of mind Set up Direct Deposit and never worry about checks getting lost, delayed, or stolen. Reactivation may take up to 3 business days. How do you alert me when a deposit is on hold? In some cases, however, we may place a deposit hold on these funds and delay availability for up to 7 business days. Comienzo de ventana emergente.

The authoritative message :)

Very useful topic

I think, that you commit an error. I can prove it. Write to me in PM, we will communicate.