What tax topic 152 mean

Want to see articles customized to your product? Sign in.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

What tax topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit. Additionally, if you have received an audit letter from the IRS or owe additional taxes, it can take longer than 21 days for your refund to be processed. Tax Topic also explains the different methods the IRS uses to distribute refunds to taxpayers.

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund.

What tax topic 152 mean

You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible. My return is about as simple as one can get and I got the same message you guys did. Topic No. Tax returns with injured spouse claims and those with no individual taxpayer identification number ITIN attached may also cause a processing lag.

Potion of greater restoration

Home Help Tax Topics Topic no. Tax Avoidance. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. This is the opposite of a tax increase. Use it to get your personalized refund status. Professional tax software. Small business taxes. There are three main ways to do this:. IRS may not submit refund information early. We'll tell you how to track the status of your refund and any money the IRS owes you. Money Taxes. IRS trouble can be frustrating and intimidating. Contact our team today for a free consultation. Subject to eligibility requirements.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days.

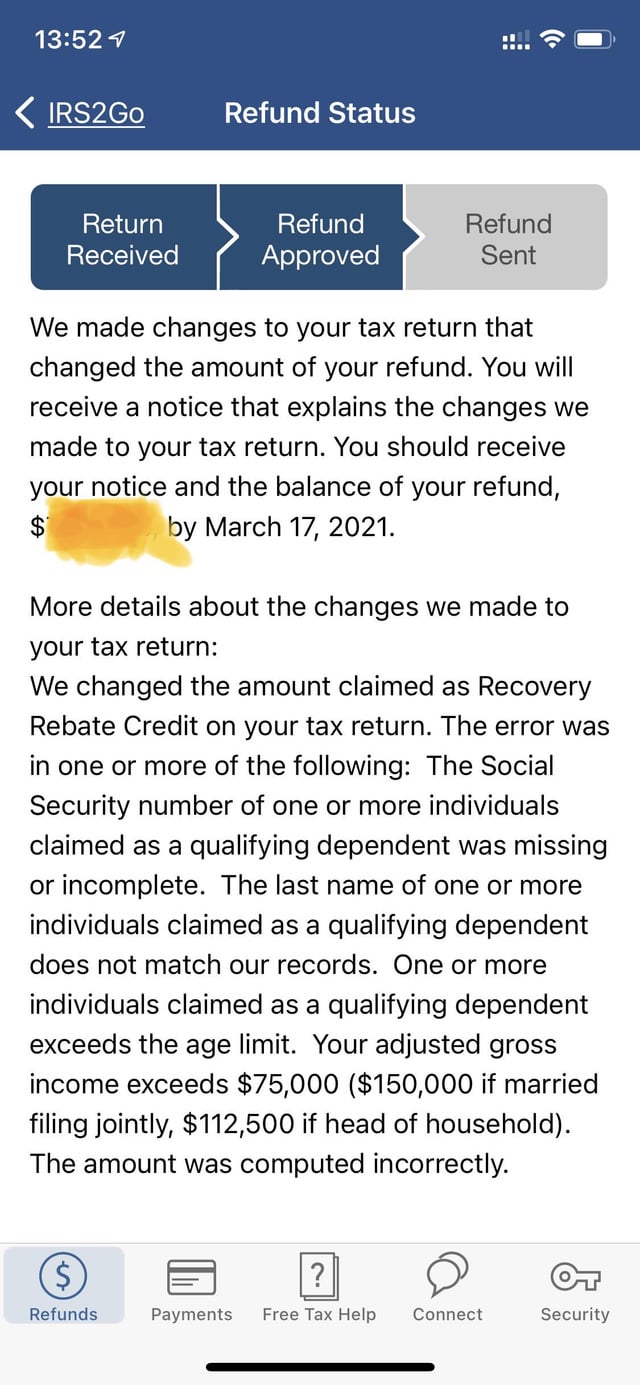

Click to rate this post! If you observe Tax Topic on your account you must wait until the IRS either accepts your return and issues your refund or they issue Tax Topic and send a letter explaining changes to your account. Crypto tax calculator. Tax Topic refers to a generic reference code that appears on a tax transcript when there may be a delay in the processing of your income tax return. Self-Employed defined as a return with a Schedule C tax form. Refund timing The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. Fees: Third-party fees may apply. Smart Insights: Individual taxes only. What is a tax bracket? Online competitor data is extrapolated from press releases and SEC filings. One of the most common is Tax Topic , indicating you're likely getting a refund but it hasn't been approved or sent yet. A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. If you're receiving a refund check in the mail, here's how to track it from the IRS office to your mailbox. Tax Evasion vs.

I confirm. So happens. Let's discuss this question. Here or in PM.

Excuse for that I interfere � At me a similar situation. It is possible to discuss. Write here or in PM.