What irs letters come from ogden utah 2023

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

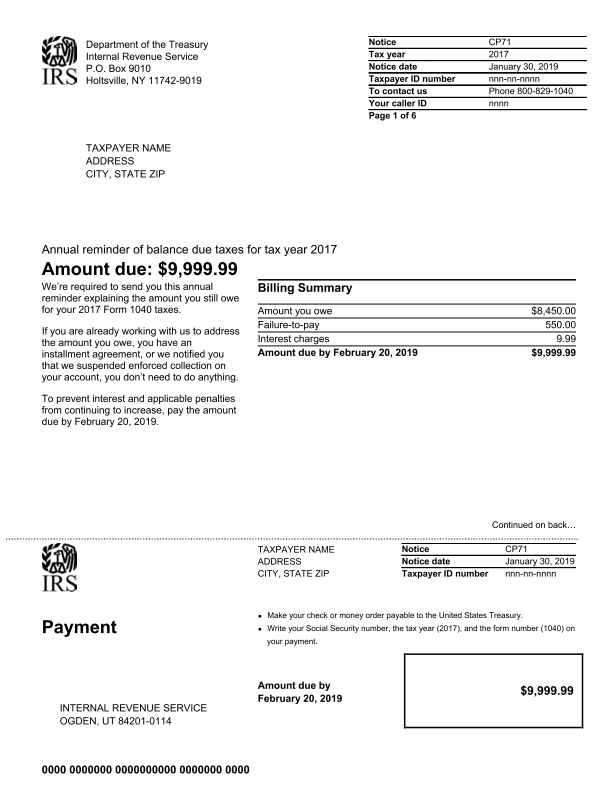

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take.

What irs letters come from ogden utah 2023

We are not affiliated with any brand or entity on this form. Get the free what irs letters come from ogden utah form Get Form. Show details. Hide details. Fill irs letter from ogden utah december Try Risk Free. Form Popularity what irs letters come from ogden utah form. Get, Create, Make and Sign irs letter from ogden utah How to fill out what irs letters come. Begin by reviewing the letter from the IRS carefully to understand the purpose and requirements of the communication. Collect all the necessary documentation and forms mentioned in the letter to support your response or action. Respond promptly to the letter by completing the required forms or providing the requested information. Ensure accuracy and completeness in filling out the forms, double-checking for any errors or missing details. Keep copies of all documents and forms you submit for your records. Regarding who needs what IRS letters come, it can vary depending on the specific situation. IRS letters can be sent to individual taxpayers, businesses, or organizations.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. There are many reasons the IRS might reach out to someone, but the most common reasons are related to outstanding balances and requests for more information.

Scammers are always on the lookout for an opportunity to make a quick buck, and tax season is ripe with scammers looking to trick people into handing over money. Here are some tips on spotting a fake IRS letter and protecting yourself and your business from tax scams. You will always get a letter first. Financial criminals know what IRS letters look like, though, and they go to painstaking lengths to mimic the government agency. Before acting, though, take steps to authenticate it. You can search for the topic or similar letters at IRS.

The IRS sends out letters or notices for many reasons. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. In certain circumstances, the IRS may send you a letter or notice communicating the fact that there was a math error and the IRS has corrected it in your favor. Under these circumstances, you may not be required to take further action. In other situations, the IRS may need you to send them information about an item reported on your tax return. Also, the IRS may be notifying you that you may be a victim of identity theft or that you have an unpaid tax obligation. Beginning in , taxpayers who are visually impaired and other taxpayers with disabilities can complete IRS Form , Alternative Media Preference , to elect to receive IRS tax notices in Braille, large print, audio, or electronic formats. Taxpayers have the option to e-file IRS Form with their tax return, mail it as a standalone document to the IRS, or call to choose their preferred format. Forms submitted separately from tax returns should be mailed to the following address:.

What irs letters come from ogden utah 2023

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return. Taking prompt action could minimize additional interest and penalty charges. Review the information.

El tiempo en palma de mallorca 14 dias

Contact sales. Submit your response: Send your response, along with any required forms or documents, either by mail or electronically, as instructed by the IRS. If you are a new user, click Start Free Trial and establish a profile. These include adjustment notices when the IRS takes action on a taxpayer's account. Review these common reasons for receiving IRS certified mail. API Documentation. That means that, once someone starts receiving IRS certified mail, the IRS will be expecting a response within a reasonable amount of time. Get, Create, Make and Sign irs letter from ogden utah Report Vulnerability Policy. Fill out any applicable forms: Some IRS letters may include specific forms that need to be completed or returned. Reference number: A unique identification number or reference code assigned to the letter. How to Deduct Meals and Entertainment in Name and address: The taxpayer's full legal name and current mailing address. Call Gerard.

Scammers are always on the lookout for an opportunity to make a quick buck, and tax season is ripe with scammers looking to trick people into handing over money.

Respond promptly to the letter by completing the required forms or providing the requested information. Due dates: Any deadlines or due dates mentioned in the letter for the taxpayer to respond or take action. Share Facebook Twitter Linkedin Print. To save changes and return to your Dashboard, click Done. IRS-certified mail for processing delays like this is a courtesy notification. Certified letters are generally a last resort for the IRS. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Make sure to retain copies of your response and supporting documents for your records. Common questions about tax returns include clarification about sources of income, discrepancies in the mailing address on file, and verification of tax credits and deductions. They can guide you on the appropriate response to the IRS's communication.

0 thoughts on “What irs letters come from ogden utah 2023”