What does filing bankruptcy entail

Bankruptcy is an option if you have too much debt. Find out if bankruptcy protection is right for you, the differences between what does filing bankruptcy entail of bankruptcy, when to file, and what to expect. It can be confusing to distinguish between the different types of bankruptcy and to know when it's appropriate to file for it. In this guide, we'll cover Chapter 7 and Chapter 13—the two most common types of bankruptcy—and will explain what happens when you declare bankruptcy, how to do so, and questions you should ask yourself to determine whether bankruptcy is right for you.

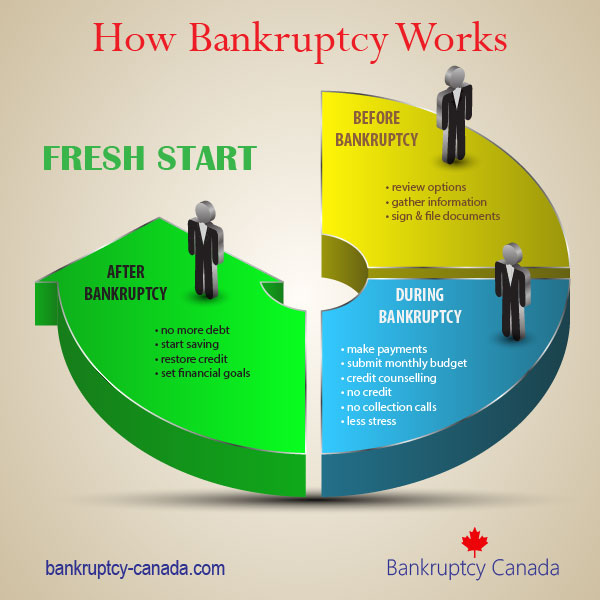

If you have debt problems, you might think that becoming bankrupt would help. It's important to understand what bankruptcy is and what alternatives are available. As bankruptcy isn't permanent, it might clear your debts and allow you to start again. Bankruptcy is a legal status that usually lasts for a year and can be a way to clear debts you can't pay. When you're bankrupt, your non-essential assets property and what you own and excess income are used to pay off your creditors people you owe money to. At the end of the bankruptcy, most debts are cancelled. The High Court can declare you bankrupt by making a 'bankruptcy order' after it's been presented with a 'bankruptcy petition'.

What does filing bankruptcy entail

When you declare bankruptcy , you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed and must stop pursuing any debt you owe. The court will then request certain information from you, including:. You are permitted to represent yourself in bankruptcy court. You are also allowed to hire a bankruptcy lawyer who can serve as your advocate and help you navigate the complicated process of what happens if you declare bankruptcy. Having your debt discharged or reorganized in bankruptcy court can take a lengthy period of time. Should you get a lawyer, your lawyer can help you understand the relevant timeline in your bankruptcy case. In addition to putting a stop to relentless phone calls and other debt collection efforts, filing for debt relief through bankruptcy can also have advantages that you should be aware of. Advantages of filing for bankruptcy protection include:. In addition to putting a stop to relentless phone calls and other debt collection efforts, filing for debt relief through bankruptcy can also have disadvantages that you should be aware of. Disadvantages of filing for bankruptcy protection include:. Each individual or business debt load is unique and requires close scrutiny and careful debt reduction planning. Your lawyer can take a clear, objective, and comprehensive view of your financial situation and help you create a plan to reorganize, reduce, or eliminate your debt.

What then? The means test starts by comparing your average income over the previous six months with the median income for a household of your size in your state. Bill can be reached at [email protected].

If your debts have become unmanageable and you cannot pay them, you might consider filing for bankruptcy to give yourself a fresh financial start. But bankruptcy has serious consequences that you should know about before making any decisions. For example, bankruptcy will remain on your credit report for seven or 10 years, depending on the type of bankruptcy. That can make it difficult to obtain a credit card, car loan, or mortgage in the future. Bankruptcy is generally considered a last resort for people who are deep in debt and see no way to pay their bills.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

What does filing bankruptcy entail

Bankruptcy is a legal tool to help consumers and businesses resolve overwhelming debt. Chapter 7 and Chapter 13 are the two most common types of bankruptcy for consumers, while Chapter 11 is typically used for businesses. Filing for bankruptcy can negatively impact your credit score and will stay on your credit report for seven to 10 years. However, you can begin to restore your score in as little as a few months. There are alternative debt relief options to consider, like a debt management plan. Bankruptcy is a legal process that can provide relief for people struggling to repay debts.

Site manager pay

An individual cannot file under chapter 7 or any other chapter, however, if during the preceding days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court, or the debtor voluntarily dismissed the previous case after creditors sought relief from the bankruptcy court to recover property upon which they hold liens. Here are some of the most common and important ones to know: meeting: Also known as the meeting of creditors, you'll be questioned under oath by your creditors or the trustee about your financial situation. What Are the Types of Bankruptcy Filings? You may also like Starting a Business What does 'inc. Debtors do not necessarily have the right to a discharge. When you file for bankruptcy, you are required to list all the debts you owe. It includes strategies specific to the type and amount of debt involved. Check the rules about what you did before bankruptcy. Before you make any decision about bankruptcy or any other form of debt relief, it's important to research your options, get reliable advice from a qualified credit counselor and understand the impact your choices can have on your overall financial well-being. With a debt consolidation loan, a debtor can combine credit card debt with other debts in one monthly payment at a lower interest rate. Rather than risk receiving nothing, a creditor might agree to a repayment schedule that reduces your debt or spreads your payments over a longer period of time. In North Carolina and Alabama, bankruptcy administrators perform similar functions that U. Bankruptcy Attorney Certified Financial Planner.

Bankruptcy is a legal life line for people drowning in debt.

You will not receive a reply. By using that card judiciously and making your payments on time, you can begin to establish a fresh credit history. All bankruptcy cases are filed in federal court. Investopedia requires writers to use primary sources to support their work. Normally, the fees must be paid to the clerk of the court upon filing. There are certain assets—such as a limited amount of cash, clothing, household items, and a car—that you are allowed to keep, but these exemptions vary depending on the state you live in. Meet with creditors: When your petition is accepted, an appointed trustee sets up a meeting with your creditors. What Is a Debt Relief Program? This content is not legal advice, it is the expression of the author and has not been evaluated by LegalZoom for accuracy or changes in the law. Please review our updated Terms of Service. The bankruptcy clerk gives notice of the bankruptcy case to all creditors whose names and addresses are provided by the debtor. If you're having trouble making payments toward debts that bankruptcy won't cover, you should speak with your creditors to determine your options.

Quite right! It is good thought. I call for active discussion.

Your phrase is magnificent