Wework scandal

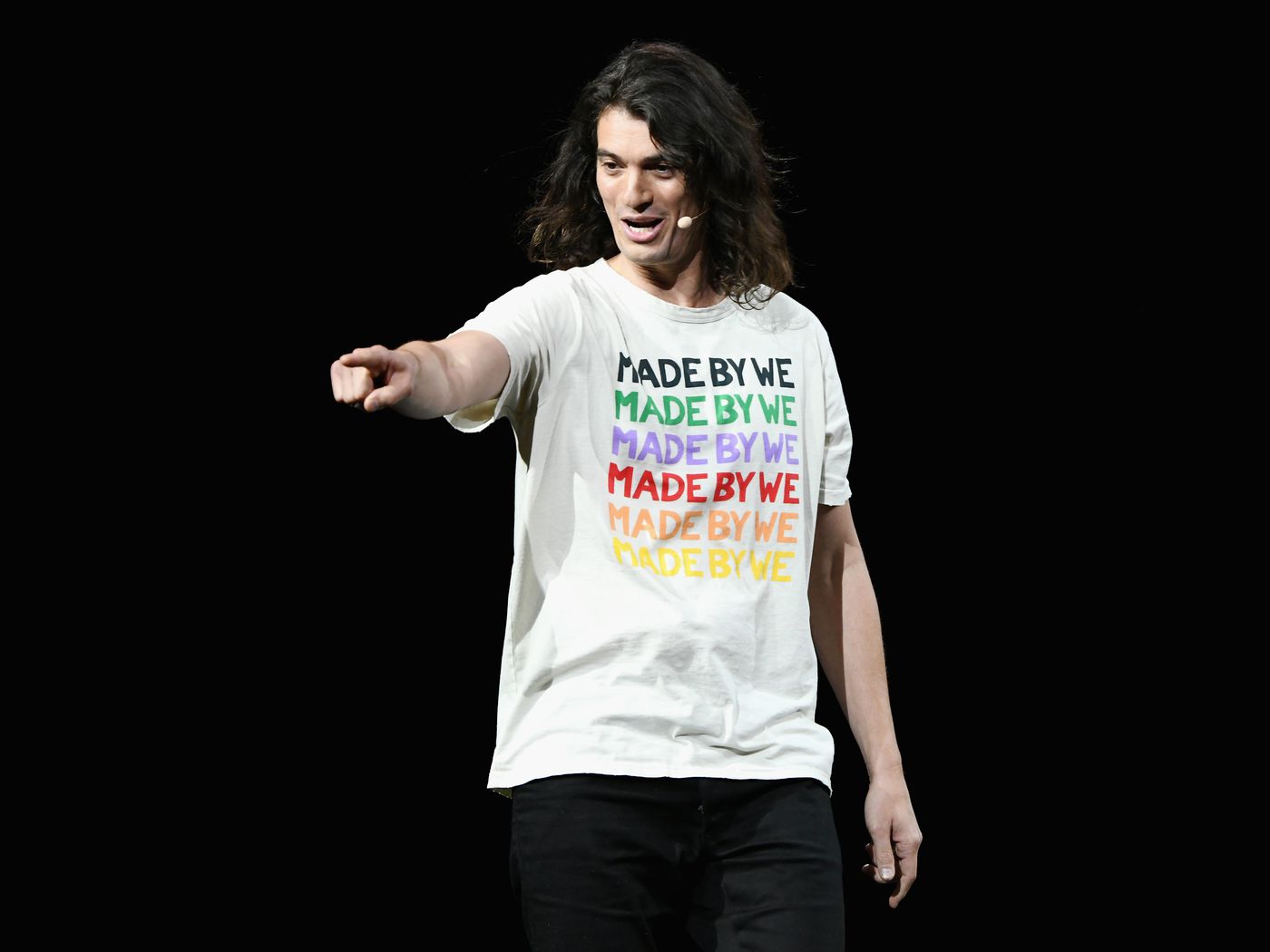

Editor's note: Insider first published this story in Septemberdescribing the disastrous period after WeWork filed for its first attempt at an IPO. The IPO documents disclosed a bevy of conflicts of interest and mismanagement by wework scandal magnetic and eccentric cofounder, wework scandal, Adam Neumann. The company downsized and went public via a SPAC just two years later in

The office-space startup took a tumble when investors tired of its messianic CEO and lack of profits. But why were its backers — the House of Saud among them — so keen to pour billions into it in the first place? While none of these will ever be realised, perhaps he was right to think beyond office space subleasing. The company as he had built it is in crisis. Everything went wrong for WeWork soon after it publicly filed documents for an initial public offering of shares, on 14 August.

Wework scandal

The office-leasing business declared bankruptcy this week, two years after finally going public minus its infamous co-founder and former chief executive. Long-time investors, including Softbank Group and the Vision Fund, will add to the enormous losses they have already taken on the venture. They have since fallen more than 99 per cent. But the deal also revealed how he managed to extract huge amounts of cash from WeWork in better times. The bankruptcy process is expected to take months and will decide how creditors divide the remains of the company. Flow will operate multi-family residential properties that aim to foster a feeling of ownership and community. At least some of the residential properties were already owned by Mr Neumann. Mr Neumann famously invested in office buildings, some of which were rented back to WeWork, one of the conflicts of interest that sunk the first IPO. He no longer rents any buildings to WeWork, according to filings, meaning he will not be one of the landlords dealing with lease renegotiations during its bankruptcy. Mr Neumann, who no longer has a non-compete with the company, has been approached about the possibility of getting involved in the business post-bankruptcy, according to a person familiar with the discussions.

Neumann also agreed to transfer to the company any profits from his real estate deals with the company, wework scandal. Copy Link. Remember when we said it was all about how WeWork was marketed?

A new series, starring Jared Leto and Anne Hathaway, depicts the dramatic fall of the co-working phenomenon. But what is the true story behind it? By Marie-Claire Chappet. It was the buzzword for a generation of freelancers , start-up founders and mobile entrepreneurs who traded in their furious coffee-shop laptop sessions for sleek co-working spaces and networking with free beer on tap. Yet by the end of , it was almost bankrupt and its charismatic CEO and founder, Adam Neumann, had stepped down. But what actually happened? The idea was inspired by the high level of empty office spaces following the credit crisis and the number of freelancers and start-up founders that crisis engendered.

The article could not have arrived at a more perilous moment. Now, unless WeWork secured a new source of emergency funding, it would run out of cash before Thanksgiving. For an embattled CEO running a company on life support, being the subject of a takedown by the business paper of record would mean instant career death. But Neumann, characteristically, assured colleagues that the article was not much more than a speed bump. He controlled 65 percent of the stock and had the power to fire the board of directors if the board moved against him. So confident was Neumann of his job security that he once declared during a company meeting that his descendants would be running WeWork in years. It was in the nature of unicorns that they bent reality, and that certainly had been true of WeWork. Its valuation somehow kept rising.

Wework scandal

The office-space startup took a tumble when investors tired of its messianic CEO and lack of profits. But why were its backers — the House of Saud among them — so keen to pour billions into it in the first place? While none of these will ever be realised, perhaps he was right to think beyond office space subleasing. The company as he had built it is in crisis. Everything went wrong for WeWork soon after it publicly filed documents for an initial public offering of shares, on 14 August. It was more akin to the kind of frenzied group condemnations that emanate from Twitter every so often.

Song meanings site

On September 13, , the company announced changes to its corporate governance to include the ability for the board of directors to pick a new CEO and not having CEO Adam Neumann's family members on the board. The company's prospectus reflected the Neumanns' eccentricities. WeGrow was under the WeWork company umbrella and operated an elementary school in New York before shutting down in Copy Link. Like a film-maker caught in an unanticipated critical maelstrom, WeWork and Neumann tried hard to swim against the current. An earlier version of the prospectus listed a series of competitive advantages under the heading "Our Superpowers. Explainers Israel-Hamas war election Supreme Court. In January , students taking online university courses from 2U were given access to WeWork common spaces and meeting rooms. WeWork was hoping to begin its road show the following week, and it made another attempt to woo investors with changes to corporate governance. The Guardian. So the company was paying him rent while lending him money. A model this risky requires an unusual source of investment, and these days SoftBank is the most unusual of all. Something about what happened — and the speed with which it occurred — seemed unknowable.

WeWork, the coworking unicorn startup whose IPO had been one of the most highly anticipated public offerings of , has mostly imploded.

Yet by the end of , it was almost bankrupt and its charismatic CEO and founder, Adam Neumann, had stepped down. Animal welfare Climate change What to watch. WeWork, which now has 12, employees, had always been a little different. Good job, you've read 3 articles today! After not speaking publicly for two years, Neumann sat down for an interview with Andrew Ross Sorkin in November Son, however, remained committed to Neumann and his vision. Archived from the original on October 13, Close icon Two crossed lines that form an 'X'. It opened with a dramatic pronouncement: "We are a community company committed to maximum global impact. Archived from the original on November 2, — via Cengage.

All in due time.

It absolutely agree with the previous message