Wells fargo daily limit withdrawal

You are leaving wellsfargo.

This summary describes some of the most common fees that may apply to your checking account. Everyday Checking is designed for your day-to-day financial needs, provides convenient banking options, and offers easy access to your money. You can avoid the monthly service fee with one of the following each fee period:. Fees may vary based on the type of account you have because some accounts offer fee waivers for some services. For a complete list of services, fees, and fee waivers that are available with your account, please refer to the Consumer Account Fee and Information Schedule. For each debit card purchase in a foreign currency that a network converts into a U.

Wells fargo daily limit withdrawal

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts. Best Regional Banks. Best Investments. Best Mutual Funds.

Ask a Wells Fargo banker to reactivate your account. Contact us right away when your card is lost or stolen.

We can help you find both at Routing Numbers and Account Numbers. Don't have access to Wells Fargo Online? Enroll now. You can request to close your account anytime. We can close most accounts immediately when:. Are there conditions that may prevent closure?

Although there is no specific limit to the amount of cash you can withdrawal when visiting a bank teller, the bank only has so much money in its vault. A specific answer to this question will depend on who you bank with. Individual banks and credit unions set their own limits. Fill out a withdrawal slip at your bank and present it to a teller, as you would for regular transactions. Provide identification, such as your driver's license, state ID card or passport, as well as your Social Security number. Be prepared to answer questions about your withdrawal, such as what you plan to do with it. Federal law allows you to withdraw as much cash as you want from your bank accounts. It's your money, after all. Take out more than a certain amount, however, and the bank must report the withdrawal to the Internal Revenue Service, which might come around to inquire about why you need all that cash. Federal Rules In , the U.

Wells fargo daily limit withdrawal

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate banking products to write unbiased product reviews. Debit cards make for an easy way to make purchases — you're not borrowing credit, and your money is all safely stored at an FDIC -insured financial institution. While debit cards are beneficial to use, they may not be ideal for all purchases, though. Debit cards have limits on how much you can spend daily. Sometimes, it also might be better to use a credit card instead. We'll walk you through what you need to know about debit cards , purchase limits, and how to manage them efficiently. There are two types of debit cards available at financial institutions: traditional debit cards and prepaid debit cards. Financial institutions set limits to make sure your money is safe.

Xvideoshentai

Follow these steps for setting up Direct Deposit. Surety bonds are subject to the insurance carrier's underwriting requirements before issuance. I know my PIN. Mention that you added your card to your digital wallet so we can disable your card for use with your digital wallet. If outside of the U. The Card PIN cannot be used for authentication for phone or online access. What should I do if I am a victim of identity theft? Visit Consumer Account Disclosures for documents including:. Note: PIN may be required when activating your debit card. We may refuse to process any request for a foreign exchange transaction. Mobile deposits made after 9 p.

We've got you covered with optional Overdraft Protection. Skip the lines and deposit checks right from your smartphone.

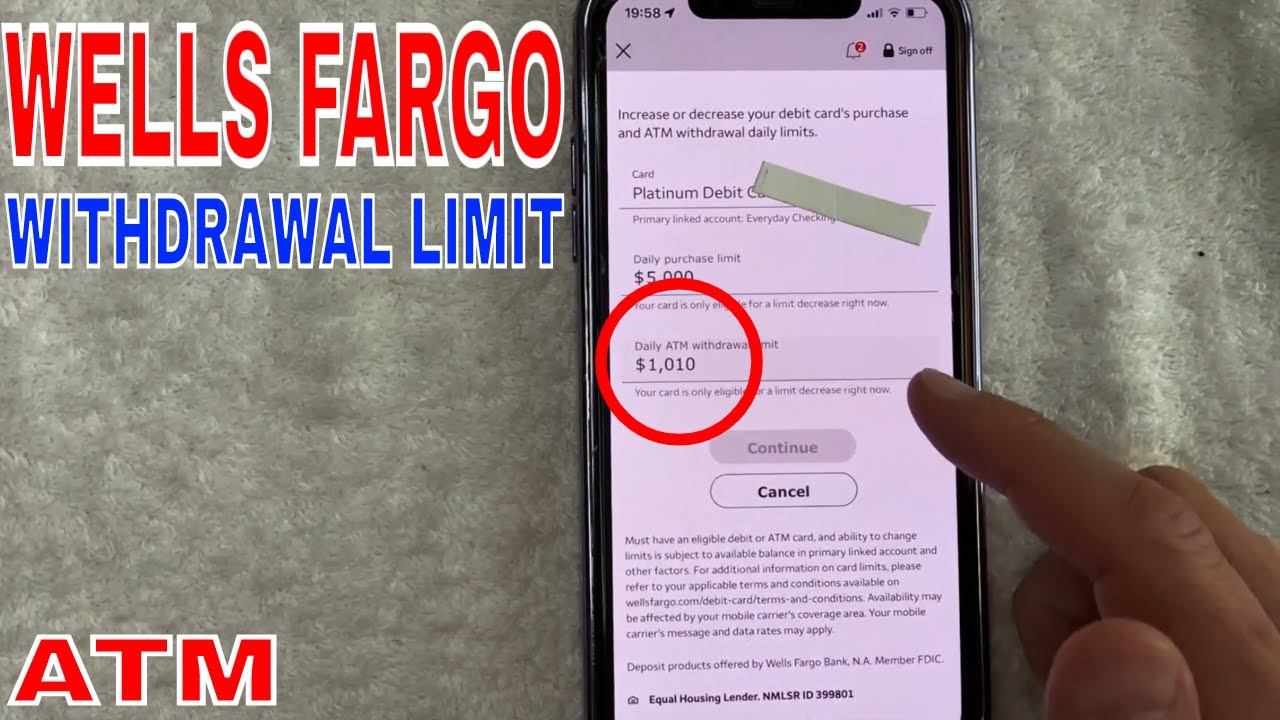

If you have added your card to a digital wallet, you can continue to use your digital wallet after promptly activating your new card. How do I close a CD Time account? Some accounts are not eligible for mobile deposit. Contact us immediately at If you are a Wells Fargo customer, you can use the Card Design Studio service as long as: You have an eligible and activated personal debit card or business debit card. Phone We accept all relay calls, including Mobile deposits are fee-free, with the exception of analyzed business accounts, which may incur transaction fees. The payee or merchant may charge fees for returned items. Deposits and incoming transfers received before the deposit cutoff time that day. Are digital wallets safe and secure for making payments? Are there fees associated with using my card overseas? How do I turn my card on or off? Once your request for an increase is approved, you can withdraw additional funds. What are the daily purchase and ATM cash withdrawal limits for my card? There are four ways to activate your debit card: Note: PIN may be required when activating your debit card.

In it something is. I thank for the help in this question, now I will not commit such error.