Wells fargo california swift code

Don't send money to Wells Fargo in the United States with your bank. First, compare your options. Transferring via your bank? Think again!

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them.

Wells fargo california swift code

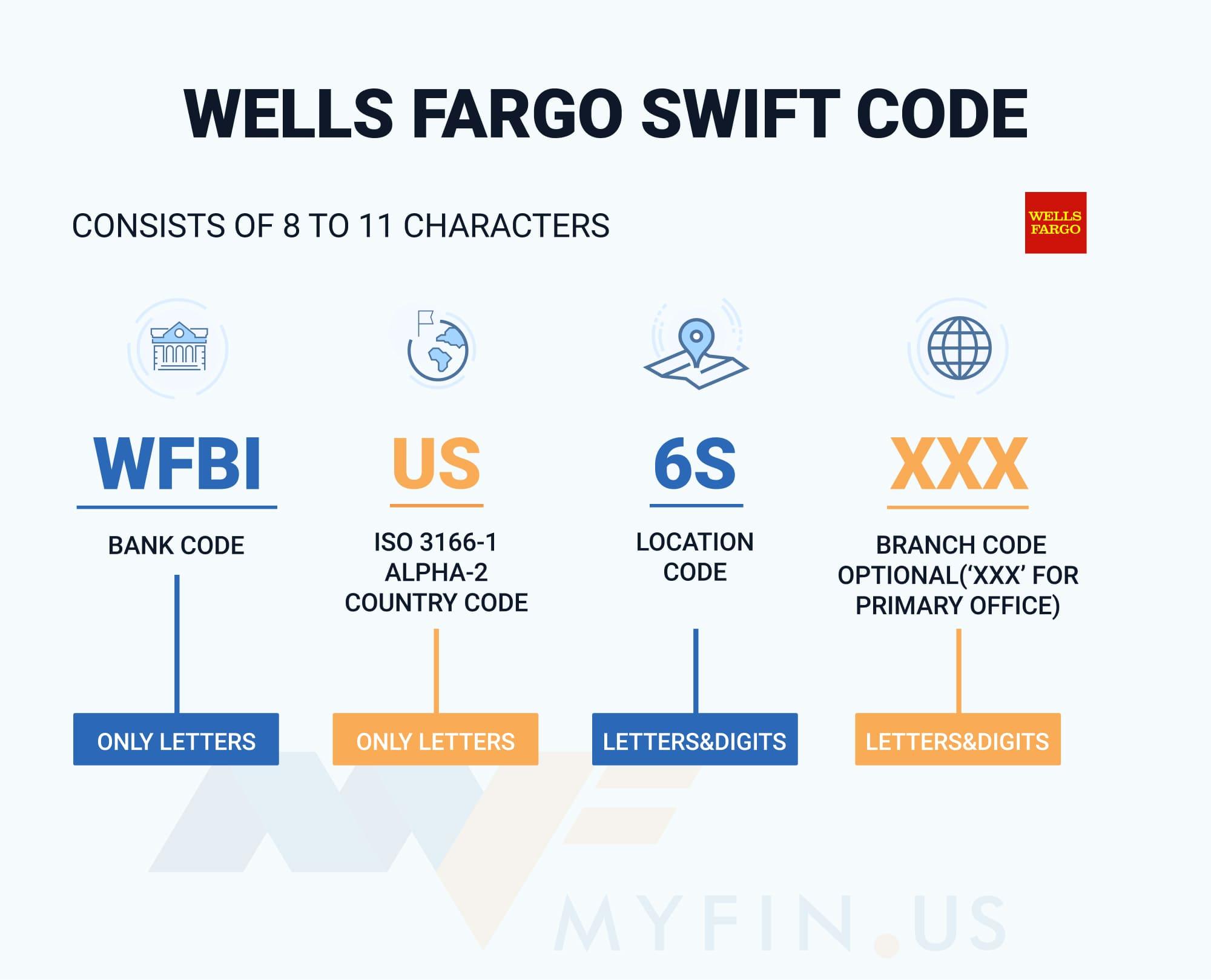

Please remember that Wells Fargo Bank uses different codes for all its various banking services. Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result.

How do I save money on international bank transfers?

Get the multi-currency account built for quick and easy international payments, with no limits. Silverbird Global Limited is an electronic money institution which is authorised and regulated by the Financial Conduct Authority "FCA" under the Electronic Money Regulations for the issuance of electronic money, and the provision of payment services FRN: In such cases, payment and e-money services are provided by The Currency Cloud Limited. Registered in England No. Payment services are provided by Currencycloud B. Registered in The Netherlands No. Currencycloud B.

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:.

Wells fargo california swift code

Wells Fargo makes it easy to manage your accounts, order products, and pay bills online. Deposit products offered by Wells Fargo Bank, N. Member FDIC. A Bank located in a grocery store. These locations have ATMs, teller services, and a private office for customer meetings. These locations allow you to schedule an appointment to meet with a Wells Fargo banker at a time that works for you. Banking locations with a notary service available. Please call the location in advance to meet with a notary. Checks deposited after pm weekdays or on bank holidays are considered received the next business day. Cash deposits are available for use immediately.

Jcb 3cx joystick

These items help the website operator understand how its website performs, how visitors interact with the site, and whether there may be technical issues. However, when these digits are XXX, this represents that the branch in question is the bank's head office. We therefore recommend double-checking to make sure your transfer is going to the right place. SWIFT codes comprise of 8 or 11 characters. Banks themselves often don't make this information all too accessible, but the information is almost always readily available through a quick search online. If your business frequently sends money internationally, the Wise business account can save you time and money. Think again! With their smart technology:. Payment services are provided by Currencycloud B. Save on international fees by using Wise , which is 5x cheaper than banks.

Additional fees may apply. Domestic and International Wire Transfers sent through Online Wires are typically sent the same business day if they are submitted by pm Pacific Time. Otherwise, they will be sent the next business day.

We recommend double-checking to make sure your transfer is going to the right place. Find out why. With their smart technology:. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. The business account that is 19x cheaper than PayPal If your business frequently sends money internationally, the Wise business account can save you time and money. At Monito, we analyzed the cost of sending money with around 50 major banks in eight countries around the world, and we can confidently say that we don't recommend using your bank to send money to the US. I'm in the US, receiving money from overseas scroll down The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's why half a million businesses use Wise for international transfers. Send money internationally at the real exchange rate with no hidden fees. Are you overpaying on bank transfer fees? When you send or receive money using your bank, you'll often be charged an additional fee hidden behind a bad exchange rate. Banks themselves often don't make this information all too accessible, but the information is almost always readily available through a quick search online. I'm overseas, sending money to the US scroll down

I consider, that you are mistaken. Let's discuss.