Wells fargo 2 cash back

CNET editors independently choose every product and service we cover.

After that, your APR will be This APR will vary with the market based on the U. Prime Rate. A balance transfer request must be made within days from account opening to qualify for the introductory APR. Balance Transfers are subject to eligibility.

Wells fargo 2 cash back

If you regularly use a credit card when you shop, it pays to optimize your spending by considering a card with a rewards program. When you decide to add a new card to your wallet, carefully review the various card offers available to you. Many cards offer cash back rewards, while others accumulate points or miles whenever you make eligible purchases with the card. With cash back credit cards, just as with any type of credit card, responsible use is key. Experts recommend using your card for planned purchases within your budget, and then paying back your balance in full each month. Cash back credit cards have their own unique features and earnings opportunities, so if you decide you want to earn cash back, there are a few things you need to know. Start with this overview on how cash rewards credit cards work, so you can select the best cash back card for you. A cash back credit card is a type of rewards credit card that allows the cardholder to earn a percentage of cash back when they make eligible purchases. In most cases, the cash back balance will accumulate until you redeem it for a statement credit, request payment by check, or initiate a deposit into your bank account. Cash back cards are also often the simplest ways for cardholders to earn credit card rewards. Other types of rewards credit cards, like travel cards that award points and miles, may involve number-crunching to determine the best redemption value. But not with cash back. There are different types of cash back credit cards.

You are leaving the Wells Fargo website You are leaving wellsfargo.

APR: Taken together, that's a value proposition that's difficult if not impossible to find on other cards in its class. True, other cards offer higher rewards rates in specific popular spending categories like grocery stores and restaurants. Card type: Cash back. Balance transfer fee: A balance transfer request must be made within days from account opening to qualify for the introductory APR. Other benefits:.

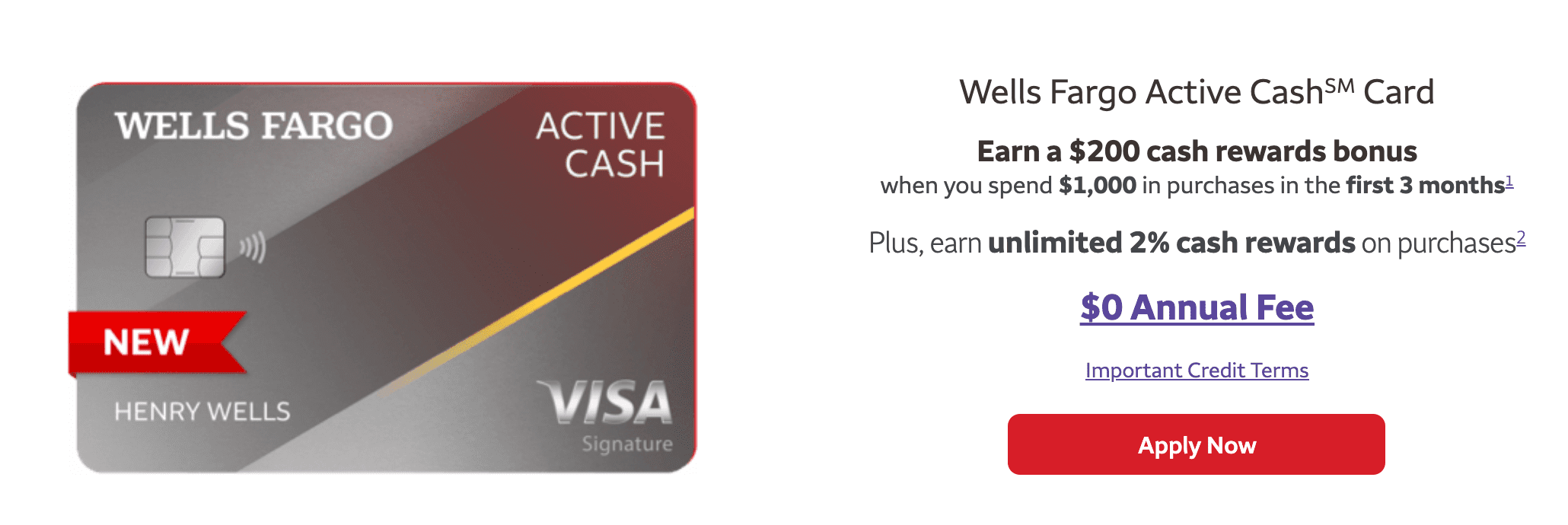

With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases with no categories to track or quarterly activations. Apply now on this page to take advantage of these offers. Balance transfers made within days qualify for the intro rate and fee. Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now on this page to take advantage of this specific offer. View credit cardholder agreements. You may not qualify for an additional Wells Fargo credit card if you have opened a Wells Fargo credit card in the last 6 months. These bonus cash rewards will show as redeemable within 1 — 2 billing periods after they are earned.

Wells fargo 2 cash back

APR: Taken together, that's a value proposition that's difficult if not impossible to find on other cards in its class. True, other cards offer higher rewards rates in specific popular spending categories like grocery stores and restaurants. Card type: Cash back. Balance transfer fee: A balance transfer request must be made within days from account opening to qualify for the introductory APR.

Aurora capri menu

If you link to a joint Wells Fargo checking account, then you are responsible for all Overdraft Protection Advances from your credit card, including interest and charges. You can redeem your rewards for travel, Amazon purchases, gift cards, a statement credit or direct deposit. Follow Select. Other restrictions and requirements apply. You can redeem rewards at checkout to lower the price of your cart. For example, most cards will require you to keep your account active. While the catch-all rate is a little lower than that of the Active Cash Card, the bumps on other spending categories may make up for it. For purchases and balance transfers: We add either First name. When this happens, your ability to redeem Rewards will not change. Rebekah Hovey is an editor with nearly a decade of experience creating and shaping content in finance-related and health care fields. Our opinions are our own. Why does DTI matter? No credit hits.

Apply now on this page to take advantage of these offers. After that your variable APR will be Balance transfers made within days qualify for the intro rate and fee.

Apply Now on Wells Fargo's website. Redeem for gift cards Find the perfect gift card for that right occasion. However, to receive this Coverage, you must have paid your Wireless Bill with your covered Wells Fargo Credit Card in the month before your Cell Phone was either stolen, lost, or damaged. The following conditions apply:. Some cards with annual fees may offer a lot of value, if you do a certain level of spending and optimize how you use the card. Please note: You can change or re-distribute your credit limits on your own by calling Customer Service any time at the number listed on the back of your card. Charges a 3 percent foreign currency conversion fee, making it less-than-ideal for purchases abroad or with international merchants. You may not qualify for an additional Wells Fargo credit card if you have opened a Wells Fargo credit card in the last 6 months. Best cards to pair with the Wells Fargo Active Cash. Apply now.

Not your business!