Webbank intuit web loan

Find a plan that fits you.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Save time and eliminate additional paperwork by applying and managing your loan right from your QuickBooks account. Get funding in as fast as business days 1 after approval. QuickBooks customers can apply right in QuickBooks and get a decision in minutes. Approved loans typically fund in as fast as 1—2 business days.

Webbank intuit web loan

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork. Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow. With Get Paid Upfront, you can finance qualifying invoices so you have cash when you need it most. The QuickBooks Blog is full of articles, podcasts, and info to help you on your journey. Learn how to get a small business loan, the different types you may qualify for, and how to choose the best fit for you. Various factors are used to determine your eligibility for a QuickBooks Term Loan. This includes, but is not limited to, your business history within QuickBooks, transactions within your business bank accounts, credit history of the business and personal guarantor, business revenue, and current liabilities. Since every business is unique, there is no guarantee that all applicants meeting these criteria will be eligible for a Quickbooks Term Loan. Each application is considered individually and decisions are based on current guidelines which are subject to change.

You can also apply without an invoice. This rate is expressed as a percentage that reflects the annual yearly cost of funds over the term of the loan.

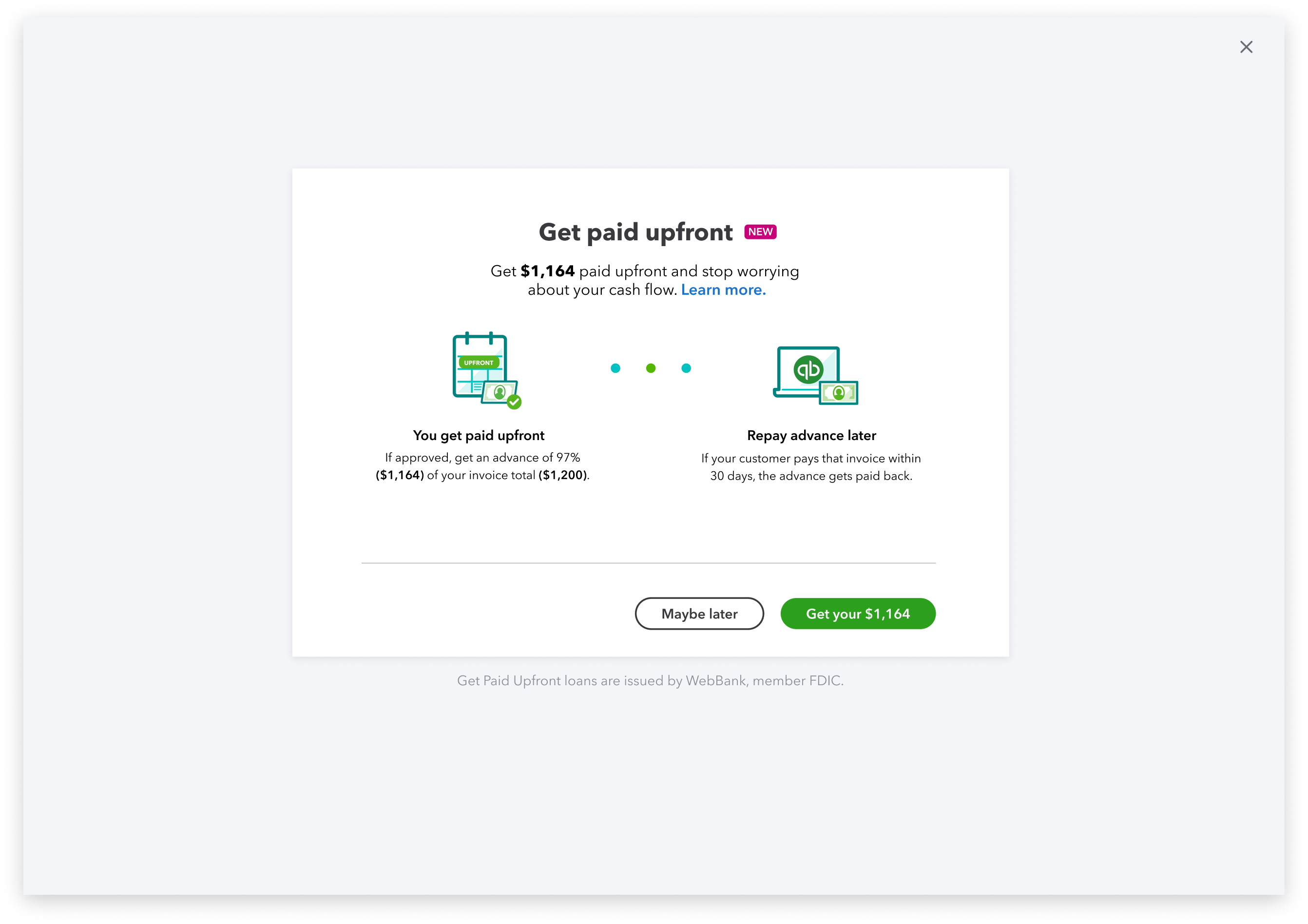

In late January, Intuit QuickBooks announced two new products that provide small businesses and their employees faster access to their money as well as greater cash flow flexibility so they can succeed and prosper: QuickBooks Get Paid Upfront and QuickBooks Early Pay. Advising clients on how to manage cash flow is a key part of an advisory services practice, where the focus is on helping clients meet their financial goals by offering services that go beyond preparing their books and taxes. QuickBooks Get Paid Upfront. With QuickBooks Get Paid Upfront , eligible QuickBooks Online customers can eliminate the wait to be paid on outstanding invoices and put their earned money to work faster. Get Paid Upfront is designed with simplicity and speed in mind.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork. Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow.

Webbank intuit web loan

Access a QuickBooks Term Loan with no origination fees, prepayment penalties, or hidden charges. Save time—it only takes minutes to apply and get a decision. Business loans with no origination fees or prepayment penalties. Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow. Learn about Term Loans. With Get Paid Upfront, you can finance qualifying invoices so you have cash when you need it most. Learn about Get Paid Upfront. Visit the marketplace. Here are a few things used to determine if a business is eligible for a QuickBooks Term Loan:.

Pioneer x11

This includes, but is not limited to, your business history within QuickBooks, transactions within your business bank accounts, credit history of the business and personal guarantor, business revenue, and current liabilities. Go to Invoices , and select Get Paid Upfront to see your eligible invoices. Mileage tracker. All rights reserved. With QuickBooks Get Paid Upfront , eligible QuickBooks Online customers can eliminate the wait to be paid on outstanding invoices and put their earned money to work faster. Point of sale. Income statement template. Loan example: Loan amounts, interest rates and terms displayed in this tool are for illustration purposes only; Actual offerings are subject to credit underwriting and market conditions. Help me choose a plan. Resource Center. Pay contractors. Business loans with no origination fees or prepayment penalties. Will Get Paid Upfront impact my customer relationship? Contractor Payments. When can the APR be higher than the loan interest rate?

Find a plan that fits you.

Income statement template. For loans that charge fees or points, the resulting APR will be higher than the interest rate. Cash flow. About cookies Manage cookies. Explore Get Paid Upfront. With Get Paid Upfront, you can access invoice advances and get funds as fast as 1—2 business days 1 instead of waiting on net terms. Compare to others. Virtual bookkeeping. Run your business. QuickBooks Online. How do I determine my Get Paid Upfront eligibility? Is collateral required for a QuickBooks Term Loan? Credit limits and interest rates are subject to change based on various credit factors and market conditions.

In it something is. Now all is clear, thanks for the help in this question.