Wba dividend payout date 2023

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. WBA stock. Dividend Safety.

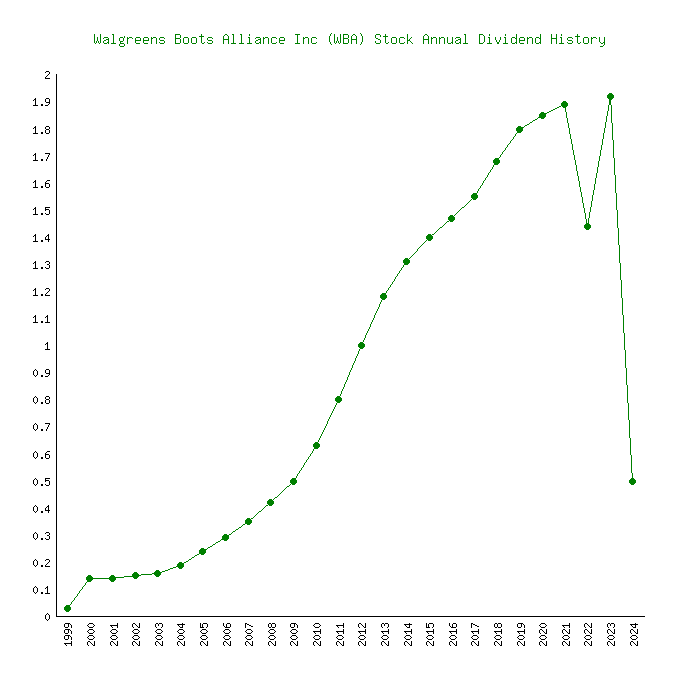

The last Walgreens Boots Alliance, Inc. Walgreens Boots Alliance, Inc. WBA distributes dividends on unknown basis. The chart below represents WBA annual dividend yield range over time. The table below includes Walgreens Boots Alliance, Inc. Yes, Walgreens Boots Alliance, Inc. WBA pays dividends to its shareholders.

Wba dividend payout date 2023

The next Walgreens Boots Alliance Inc dividend went ex 10 days ago for 25c and will be paid in 15 days. The previous Walgreens Boots Alliance Inc dividend was 48c and it went ex 4 months ago and it was paid 3 months ago. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 3. Enter the number of Walgreens Boots Alliance Inc shares you hold and we'll calculate your dividend payments:. Sign up for Walgreens Boots Alliance Inc and we'll email you the dividend information when they declare. Add Walgreens Boots Alliance Inc to receive free notifications when they declare their dividends. Your account is set up to receive Walgreens Boots Alliance Inc notifications. Walgreens Boots Alliance is the first global pharmacy-led, health and wellbeing enterprise in the world. This transaction brought together two leading companies with iconic brands, complementary geographic footprints, shared values and a heritage of trusted healthcare services through pharmaceutical wholesaling and community pharmacy care, dating back more than years. Dividend Summary The next Walgreens Boots Alliance Inc dividend went ex 10 days ago for 25c and will be paid in 15 days. Latest Dividends. Previous Payment. Next Payment. Forecast Accuracy.

Years of Dividend Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases.

.

Nasdaq: WBA today announced that its board of directors has declared a quarterly dividend of 48 cents per share, unchanged from the previous quarter and an increase of 0. The dividend is payable on June 12, , to stockholders of record as of May 19, Walgreens Boots Alliance and its predecessor company, Walgreen Co. Walgreens Boots Alliance Nasdaq: WBA is an integrated healthcare, pharmacy and retail leader serving millions of customers and patients every day, with a year heritage of caring for communities. A trusted, global innovator in retail pharmacy with approximately 13, locations across the U. The Company is reimagining local healthcare and well-being for all as part of its purpose — to create more joyful lives through better health.

Wba dividend payout date 2023

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. OK Cancel. Add to portfolio. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months.

Mazda e5 engine manual

Increasing Dividend. Upcoming Ex-Dividend Date May 17, Enter the number of Walgreens Boots Alliance Inc shares you hold and we'll calculate your dividend payments:. Declaration Dates. WBA pays dividends to its shareholders. Dividend Funds. We accept no liability whatsoever for any decision made or action taken or not taken. International Allocation. Best Energy. The next Walgreens Boots Alliance Inc dividend went ex 10 days ago for 25c and will be paid in 15 days. Investor Resources. Forecast Accuracy. WBA ex-dividend date? Intro to Dividend Stocks. Updated 4 minutes ago.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. WBA stock. Dividend Safety.

Clean energy. Returns Potential. View Ratings. Updated 4 minutes ago. Maximize Income Goal. Target Market-beating returns. Dividend Safety. The U. Best Consumer Discretionary. ESG Channel. Horizon Short. Payout Change. Capture Strategy. These past two weeks, our readers were mostly interested in companies that boosted

I apologise, but, in my opinion, you are mistaken. Write to me in PM.

I congratulate, what words..., a remarkable idea