Walton co fl tax assessor

Property owners are required to pay property taxes on an annual basis to the County Tax Collector. A tax certificate may be held for a minimum of two 2 years but not more than seven 7 years. At walton co fl tax assessor time between the second and seventh year, the certificate holder may request the sale of the property to satisfy the certificate.

Property appraisers establish the value of your property each year as of January 1. They review and apply exemptions, assessment limitations, and classifications that may reduce your property's taxable value. Use the drop-down menu to visit your county property appraiser's website. Tax collectors send tax bills, collect payments, approve deferrals, and sell tax certificates on properties with delinquent taxes. They answer questions about payment options and deferrals. Tax collectors also process and issue refunds for overpayment of property taxes. Use the drop-down menu to visit your county tax collector's website.

Walton co fl tax assessor

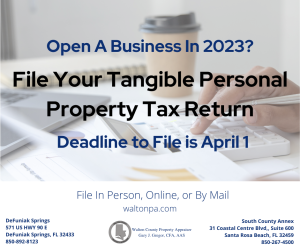

If you pay your taxes through an escrow account, the mortgage company needs to request your tax bill from our office, annually. The mortgage company will receive the bill to be paid while you will receive an information only copy. When your mortgage is satisfied, the mortgage company will need to remove your account from its list of requested bills. The Tax Collector's Office serves as the collector of property taxes. Property owners making tax payments can receive discounts on their taxes by making payments early. The following discounts apply to property tax payments:. TPP is a property tax levied against the furniture and equipment of a business, attachments of a mobile home and furnishings provided in a rental property. After the assessed value is determined by the property appraiser and millage rates are set by the taxing authorities, the tangible tax roll is then certified and delivered to the tax collector for collection. Tax statements are mailed on November 1 st of each year with payment due by March 31 st. Taxes become delinquent April 1 of each year at which time a 1.

The VAB hears and rules on challenges to a property's assessment, classification, or exemptions. The following discounts apply to property tax payments:.

This includes all residential, manufactured homes, commercial, industrial, and exempt properties. The Walton County Appraiser or Walton County Tax Assessor representatives will have a photo identification badge and will be driving an appropriately marked vehicle. If there is any question about the identity of the appraiser or representative, do not hesitate to contact our office at This appraiser or representative does not set values at the time of their visit and will only gather the necessary property information including exterior measurements, various coding, exterior photos, etc. Collecting this information does not normally require an interior inspection.

The Walton County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Walton County, Florida. You can contact the Walton County Assessor for:. There are three major roles involved in administering property taxes - Tax Assessor , Property Appraiser , and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office. When contacting Walton County about your property taxes, make sure that you are contacting the correct office. Please call the assessor's office in DeFuniak Springs before you send documents or if you need to schedule a meeting. If you have general questions, you can call the Walton County government at Property Tax By State.

Walton co fl tax assessor

The Walton County Tax Collector's Office offers you the convenience of renewing your vehicle tag or paying your property taxes online. Payment information along with any applicable convenience fees are outlined below. For Tax Payments a convenience fee of 2. For all transactions E-check payments are provided for no additional cost. The Tax Collector does not keep any portion of these fees. Credit card companies charge a fee to businesses or governments who accept their cards. The fee is a percentage of the amount charged. To offset the cost of credit card usage, Florida Law specifically provides for a convenience fee to be added to those transactions. Pay Property Taxes Online.

Battlefront

The Walton County Appraiser or Walton County Tax Assessor representatives will have a photo identification badge and will be driving an appropriately marked vehicle. Current listing of upcoming tax deed sales. Collecting this information does not normally require an interior inspection. This tax warrant will be issued to the owner of the business on January 1; this tax warrant survives the sale or transfer of the property. Notices of pending tax deed sales are published in a newspaper with local circulation. Some of the communities in Walton County have very interesting names. The following discounts apply to property tax payments:. If there is any question about the identity of the appraiser or representative, do not hesitate to contact our office at Taxes become delinquent April 1 of each year at which time a 1. TPP is a property tax levied against the furniture and equipment of a business, attachments of a mobile home and furnishings provided in a rental property. You may contact our Tax Department via email at: [email protected]. The Walton County Tax Commissioner should be contacted with tax bill related questions. Otherwise, an estimate of interior measurements and characteristics will be done from outside the structure. Tax collectors send tax bills, collect payments, approve deferrals, and sell tax certificates on properties with delinquent taxes.

If you pay your taxes through an escrow account, the mortgage company needs to request your tax bill from our office, annually. The mortgage company will receive the bill to be paid while you will receive an information only copy.

Once the costs have been paid, the Clerk sets a sale date, notifies the certificate holder, the property owner, and all lien holders, and the sale is held in accordance with Florida Statutes. Use the drop-down menu to visit your county tax collector's website. Find a County Official Property Appraiser Property appraisers establish the value of your property each year as of January 1. Payment should be made to the tax deed clerk at either of our locations. If you sell your business, please make sure that the proper research is performed prior to your closing. If your business was open during anytime of the year, your taxes will be due for that year. They answer questions about payment options and deferrals. Tax collectors also process and issue refunds for overpayment of property taxes. They review and apply exemptions, assessment limitations, and classifications that may reduce your property's taxable value. Property appraisers establish the value of your property each year as of January 1. Answering any questions and complying with a request for interior inspection is purely voluntary on the home owners or occupants' behalf. If you have any further questions, please call our office at At any time between the second and seventh year, the certificate holder may request the sale of the property to satisfy the certificate. Tax collectors send tax bills, collect payments, approve deferrals, and sell tax certificates on properties with delinquent taxes. Give us a call today!

0 thoughts on “Walton co fl tax assessor”