Vmfxx vs hysa

But with more banks offering high-yield savings accounts HYSAsmoney market accounts may not be as advantageous as they were before. When it comes to money market accounts vs.

Post by controlledmonkey1 » Wed Nov 22, am. Post by mamster » Wed Nov 22, am. Post by patrick » Wed Nov 22, am. Post by gotoparks » Wed Nov 22, am. Post by controlledmonkey1 » Wed Nov 22, pm. Post by welderwannabe » Wed Nov 22, pm.

Vmfxx vs hysa

When it comes to earning a decent yield on their savings , consumers may wonder: Should I choose a money market fund or a high-yield savings account? The purpose of each is similar. They generally serve as repositories for emergency funds or savings earmarked for the short term, perhaps to buy a car, home or vacation, said Kamila Elliott, a certified financial planner and CEO of Collective Wealth Partners, based in Atlanta. That's because money market funds and high-yield savings accounts are stable and allow for easy access — two essential traits when saving money you can't afford to lose and might need in a pinch, said Elliott, a member of the CNBC Advisor Council. Here's a look at more stories on how to manage, grow and protect your money for the years ahead. Plus, their yields are often higher than those of a traditional bank savings account. They've risen sharply over the past year and a half as the Federal Reserve has increased its benchmark interest rate to tame inflation. By comparison, traditional savings accounts pay a paltry 0. That means they carry Federal Deposit Insurance Corp. FDIC insurance. Money market funds , on the other hand — while also generally safe — are a bit riskier, experts said. They are mutual fund investments, offered by brokers and asset managers. The funds typically hold safe, short-term securities which, depending on the fund, may be U. Treasury bonds or high-grade corporate debt, for example. Money funds have only " broken the buck " a few times in history — perhaps most notably during the financial crisis, when the Reserve Primary Fund's share price fell to 97 cents, triggered by the Lehman Brothers bankruptcy.

Types of Investments Tax Free Investments. Kat Tretina.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice.

Vmfxx vs hysa

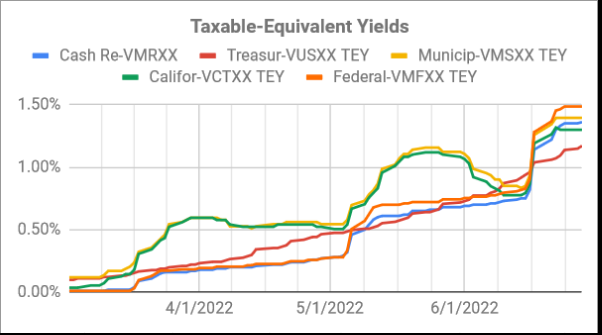

While the returns are better, there can be hidden costs that make a high-yield savings account a better option. Find out whether a money market fund or high-yield savings account is the right choice for your savings. Vanguard is one of the largest brokerages in that U. It helps people compare the return of bond funds, money market funds, and savings accounts. Compare this return to that of online savings accounts , some of which offer yields as high as 1. While it is true that money market funds offer a better return, the actual difference is not very big. When you invest money in a money market fund, the company that manages that fund then invests that money for you. Generally, money market funds invest in high-quality, low-risk, short-term assets. These investments include short-term government bonds.

Affliction warlock dragonflight

Our editorial team does not receive direct compensation from our advertisers. They usually have higher minimum deposit requirements than savings accounts: Although the minimum deposit requirements vary by bank or credit union, money market accounts often require you to have hundreds or even thousands to open an account. Instead, money market funds are insured by the Securities Investor Protection Corp. Money Market Fund vs. Savings accounts and money market accounts are bank products. Skip to Main Content. Other factors to consider include how much risk you want to assume and whether you want a tax-advantaged savings vehicle. Bankrate logo How we make money. Post by mamster » Wed Nov 22, am. MMAs are on-demand, interest-bearing accounts held at a bank or credit union. Current rates are just a "snippet in time," however, McBride said. As of this writing, the average rate for a traditional savings account was just 0. Since they aren't bank accounts, money funds don't carry FDIC insurance.

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media. More folks have started paying attention to money market funds amid the Federal Reserve's aggressive rate-hiking campaign, but they aren't exactly a scintillating topic, nor a breathtaking investment. They're effectively an investment vault — a place for investors to safely stash their cash until they find somewhere to deploy it.

Savings accounts and money market accounts are bank products. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The national average savings account pays a 0. Calculators Refinance Calculator. Post by controlledmonkey1 » Wed Nov 22, am. What Is Conservatorship? No matter how simple or complex, you can ask it here. Mercedes Barba. And that Vanguard might have some advantages. Founded in , Bankrate has a long track record of helping people make smart financial choices. Cash management account vs. At the same time, very few banks give you direct access to funds in a savings account.

Something any more on that theme has incurred me.