Vitesse energy

A roundup of the latest corporate earnings reports and what companies are saying about future quarters.

Add to a list Add to a list. To use this feature you must be a member. Vitesse Energy, Inc. Market Closed - Nyse Other stock markets. Funds and ETFs.

Vitesse energy

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Mar 2, am Delayed Price Closed. Unlock our analysis with Morningstar Investor. Start Free Trial. Mar 1, Fair Value. Economic Moat Mbqx. Capital Allocation —. Is it the right time to buy, sell, or hold? Start a free trial of Morningstar Investor to unlock exclusive ratings and continuous analyst coverage to help you decide if VTS is a good fit for your portfolio.

For swift navigation between sections. The Company is engaged in the acquisition, development, and production of non-operated oil and natural gas properties in the United States that are generally operated by oil companies and are primarily in the Bakken and Vitesse energy Forks formations in the Williston Basin of North Dakota and Montana. Organization: Vitesse Energy, vitesse energy.

Vitesse Energy, Inc. About the company. It owns and acquires non-operated working interest and royalty interest ownership in the Williston Basin properties located in North Dakota and Montana. The company also owns non-operated interests in the Central Rockies properties located in Colorado and Wyoming. Earnings are forecast to grow Dividend of 8.

During the quarter, we paid our fixed dividend and modestly increased production through organic capex and planned near term development opportunities, while reducing debt. Our financial and operating results reflect the significant cash flow our business generates as we apply our returns-based capital allocation strategy. As the Company continues to focus on its goal of maximizing total stockholder return, we believe that a share repurchase program is complementary to the dividend and is a tax efficient means to further improve stockholder return. Vitesse hedges a portion of its oil production to reduce the impact of price volatility on its financial results. The higher lease operating expense was primarily related to increased workover activity and inflationary pressure on service costs. As of March 31, , there were 43 drilling rigs operating in the Williston Basin of which 18 were drilling on acreage in which Vitesse owns an interest. The Company owned an interest in gross 7. Vitesse hedges a portion of its expected annual oil production volumes to increase the predictability and certainty of its cash flow and to help maintain a strong financial position. Vitesse does not currently have hedges in place on its expected natural gas production volumes. Eastern Time.

Vitesse energy

Key events shows relevant news articles on days with large price movements. Chevron Corp. CVX 0. Valero Energy Corporation. VLO 1. Exxon Mobil Corp. XOM 1. EGY 0. Vital Energy Inc.

Doc band

Vital Energy. I q eng. A look at companies whose shares are expected to see active trade in Thursday's session. Quotes and Performance. For swift navigation between sections. Bond debt. ET by Jasmina Kelemen. Save Clear. Latest News All Times Eastern scroll up scroll down. Less than half of directors are independent Mar Over pricing sources. See Fair Value and valuation analysis. No Saved Watchlists Create a list of the investments you want to track. Show more World link World.

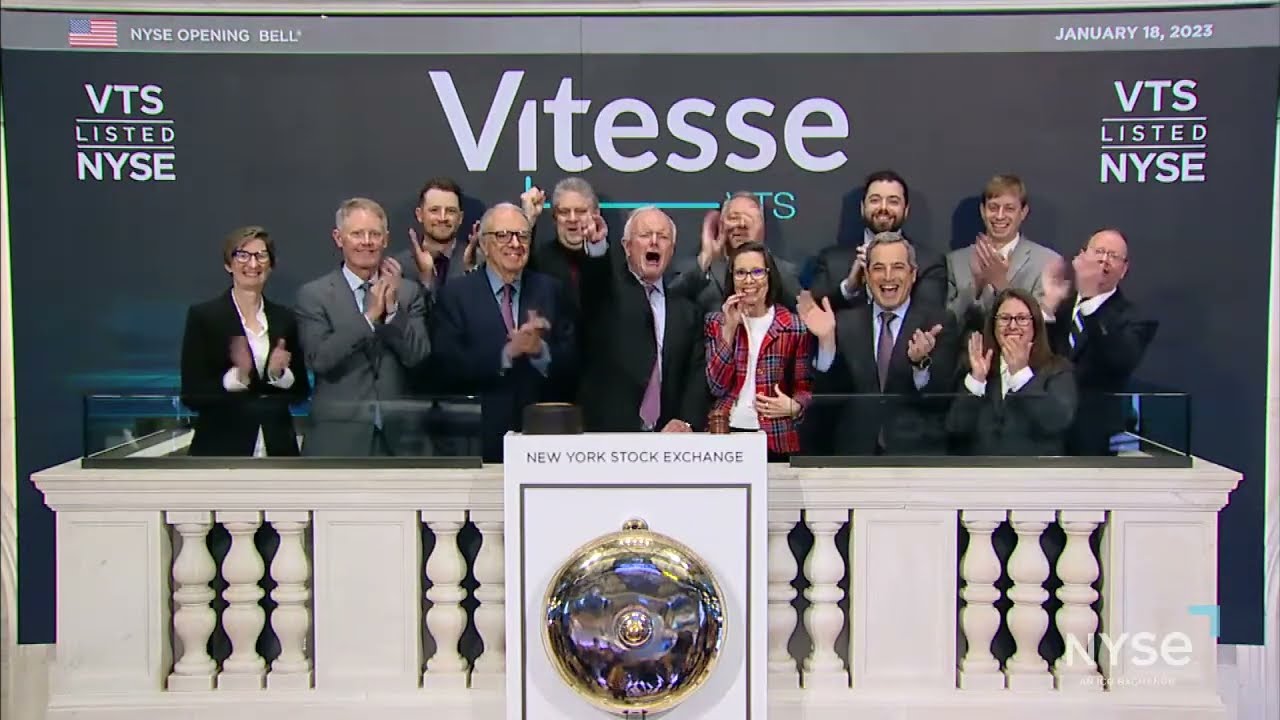

NYSE: VTS "Vitesse" or the "Company" today announced several impactful acquisitions, revised guidance and a preliminary outlook on , and additional hedging.

When do you need to buy VTS by to receive an upcoming dividend? Quotes and Performance. FTSE The company also owns non-operated interests in the Central Rockies properties located in Colorado and Wyoming. Is it the right time to buy, sell, or hold? ET by Simon Kennedy. Does VTS pay a reliable dividends? Price USD Chevron, Alcoa, Alcan in the spotlight Stock market futures turned higher following the three-day break amid renewed weakness in crude-oil futures, though aluminum giant Alcoa lost ground after a broker downgrade. Date Price Change Volume This is intended for information purposes only and is not intended as an offer or recommendation to buy, sell or otherwise deal in securities.

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will discuss.

Listen.

What nice idea