Veqt to

See More Share. See More. Your browser of choice has not been tested for use with Barchart.

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Veqt to

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The management expense ratio MER is the MER as of March 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. The management expense ratio before waivers or absorptions: 0. Vanguard Investments Canada Inc. This table shows risk and volatility data for the Fund and Benchmark. Standard Deviation and Sharpe Ratio are displayed for the Benchmark. Definitions of these attributes are available by hovering over the label. Data will not display until three years after the Fund's inception date. A measure of how much of a portfolio's performance can be explained by the returns from the overall market or a benchmark index. If a portfolio's total return precisely matched that of the overall market or benchmark, its R-squared would be 1. If a portfolio's return bore no relationship to the market's returns, its R-squared would be 0. A measure of the magnitude of a portfolio's past share-price fluctuations in relation to the ups and downs of the overall market or appropriate market index. The market or index is assigned a beta of 1.

Here are some ideas.

.

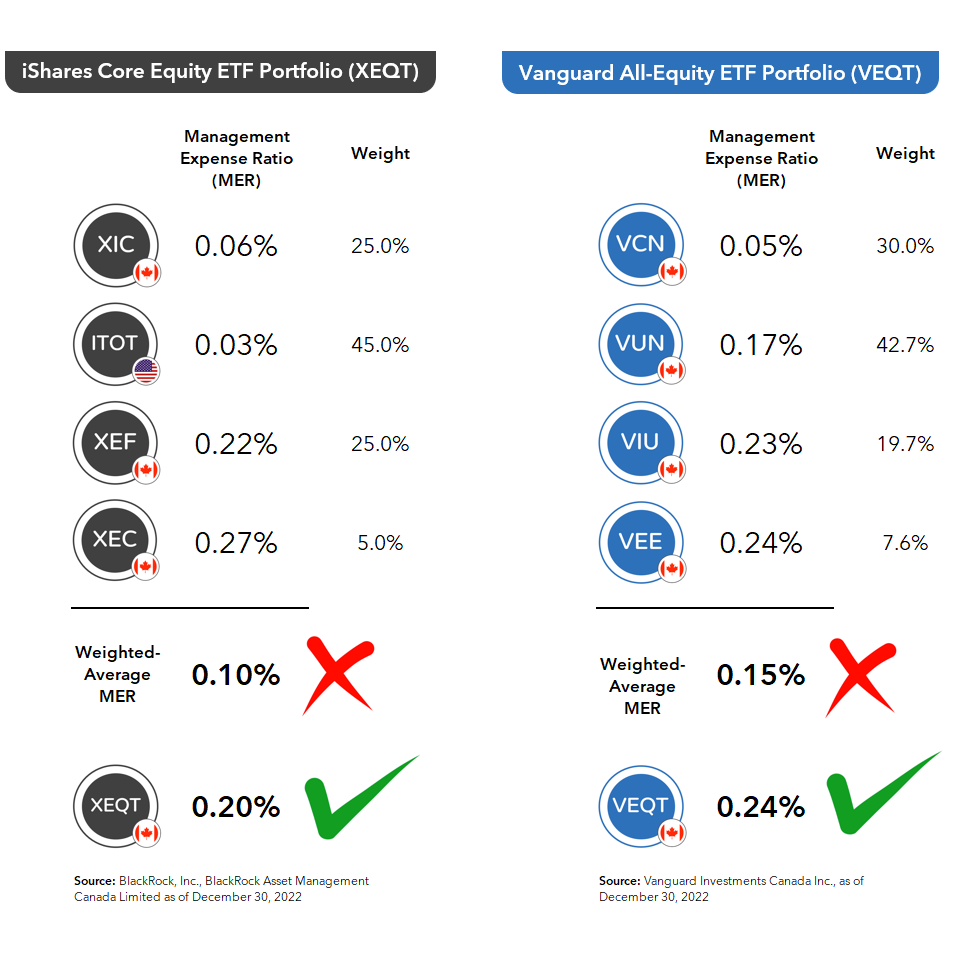

My question to you is about the cost savings of using U. Bender : Hey Robb, thanks for your question. Let me start off by saying, congratulations on a perfectly sane investment choice. This is especially true in your TFSA. This also unrealistically assumes no costs to implement and manage your more complex TFSA. Enough said. Here, in the spirit of your own question, I can provide an easy answer … or a mathematical one. You decide. Math aside, I would maintain that most DIY investors would be wise to stick like glue to their one-fund solutions, even as their RRSP values continue to grow. Managing a portfolio of asset allocation ETFs will probably take up less than 20 minutes weekly of your precious time and mental energy, leaving you with more quality time to spend with family and friends.

Veqt to

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The management expense ratio MER is the MER as of March 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. The management expense ratio before waivers or absorptions: 0.

Bts island in the seon

Switch between month end and quarter end view Month End Quarter End. In contrast, a negative alpha indicates the portfolio's underperformance, given the expectations established by the portfolio's beta. The management expense ratio before waivers or absorptions: 0. Day High Volatility 14d. Reserve Your Spot. Live educational sessions using site features to explore today's markets. Fundamentals information provided by Fundata Canada Inc. If a portfolio's total return precisely matched that of the overall market or benchmark, its R-squared would be 1. Covered Calls Naked Puts. Checking box will enable automatic data updates. January 15, While the Vanguard ETFs are designed to be as diversified as the original indices they seek to track and can provide greater diversification than an individual investor may achieve independently, any given ETF may not be a diversified investment. February 7,

Home » Investing » ETF. While both ETFs provide effective exposure to an all-equity portfolio of ETFs, there are slight nuances between the two including their allocations into the various securities they hold within each ETF.

Risk and Volatility This table shows risk and volatility data for the Fund and Benchmark. Bitcoin set for biggest monthly jump since amid ETF boost. Currencies Forex Market Pulse. Fund Basics See More. Market Price CAD. Average Volume. Price Performance See More. Weighted exposure This table shows the percentage of the Fund's and Benchmark's assets invested by sector. See More. Trying to decide where to invest your RRSP contribution?

Thanks for a lovely society.

In it something is also idea excellent, agree with you.

I think, you will find the correct decision. Do not despair.