Vanguard risk profile

It might seem surprising that your portfolio's risk level could change even if you didn't change any of your investments. But when one asset class is doing better than the others, your portfolio could become "overweighted" in that asset class. Check your portfolio at least once a year, and if your mix is off vanguard risk profile at least 5 percentage points, consider rebalancing.

It is also something some are happier to embrace than others. When it comes to investing, though, risk is less a matter of common sense and instinct and more something that requires a little explaining, and perhaps some reassurance too. Keep money under the mattress, for example, and its purchasing power will be eroded by inflation. It might also get stolen. Leave money in a bank account earning a pitiful rate of interest and, again, its value will be eroded by inflation.

Vanguard risk profile

ETFs are cost-effective tools that can help you diversify a portfolio and execute a range of strategic and tactical options. Every ETF strategy comes with its own purpose and risk profile. Investors should also be realistic about their own temperament and tolerance for risk. Some of the ETF strategies described here entail taking concentrated investment positions, so it's important to weigh the extra risks involved against the potential rewards. Gain fast, precise and cost-effective access to a broad variety of asset and sub-asset classes to build a strategic core portfolio. Fill gaps in a portfolio to broaden diversification, minimise benchmark risk or add exposure to specific market segments or factors. Combine index ETFs and low-cost actively managed funds for diversification and the opportunity for outperformance. Use a portfolio of ETFs to provide similar exposure to the strategic asset allocation but with additional liquidity also known as liquidity sleeve. Decades of research at Vanguard and elsewhere have shown that asset allocation — how you divide assets across broad asset classes — is the primary driver of a portfolio's risk and return. Vanguard research by Wallick et al. A portfolio composed of broadly diversified ETFs can help ensure that performance and risk exposure are based primarily on your asset allocation decisions.

Investors can diversify across asset classes with a small number of ETFs. Searching for a new manager and transitioning the portfolio, even if in-house, vanguard risk profile, takes time.

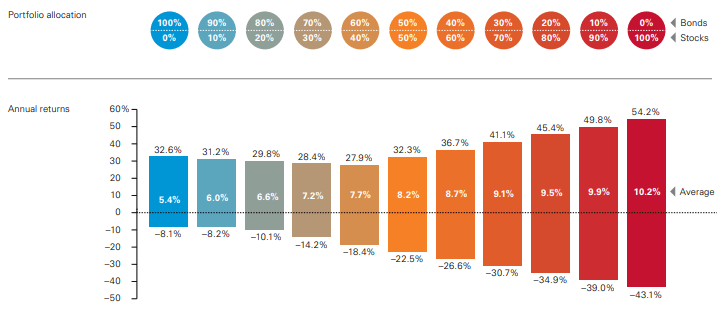

Your attitude to risk is one of the most important factors to consider when it comes to investing. This is because growth assets, like shares and property securities, tend to have more volatile returns over the shorter term but they do have the potential to produce higher long-term returns. Assets like bonds and cash are considered lower risk and less volatile but they generally do not have the same potential for similar high returns over the long term. Understanding whether you have an appetite for risk and where you are on the risk spectrum is often the first step on an investment journey. Generally, the longer you have to invest, the more growth assets you can include in your portfolio.

How you allocate your money among stocks, bonds, and short-term reserves may be the most important factor in determining the long-term return and volatility of your portfolio. Select funds only after you've determined the right asset allocation for you. The Investor Questionnaire makes asset allocation suggestions based on information you enter about your investment objectives and experience, time horizon, risk tolerance, and financial situation. As your financial circumstances or goals change, it may be helpful to complete the questionnaire again and to reallocate the investments in your portfolio. To use Vanguard's Investor Questionnaire, you should read the assumptions and limitations and accept our terms and conditions of use.

Vanguard risk profile

There's no one-size-fits-all approach to investing. Check out some tips for the goals listed below, and learn how to balance them to fit your budget and lifestyle. Learning about financial topics is a great way to gain confidence as you start your investing journey. Find everything you need from Vanguard for filing your taxes.

Ikea job openings

One way to do this is with a core-satellite strategy that employs indexing at the core of a portfolio and actively managed funds as satellites. ETFs are cost-effective tools that can help you diversify a portfolio and execute a range of strategic and tactical options. An all-index portfolio removes the potential for market outperformance that can result from active management or individual security selection. Our latest articles delivered to your inbox. Searching for a new manager and transitioning the portfolio, even if in-house, takes time. Also, be aware that your internet service provider may occasionally experience system failure, and hyperlinks to documents may not function properly. Maintain discipline with an investment plan. See all search results for ' '. Some funds invest in securities which are denominated in different currencies. We therefore recommend that you return to the questionnaire as needed to ensure that your asset allocation continues to meet your evolving needs. ETFs' trading flexibility and ease of access make them ideal tools for rebalancing a portfolio back to its strategic asset allocation. Note that if you invest in a taxable account, selling investments that have gained value will most likely mean you'll owe taxes. If it gets too far off your original plan, you'll need to bring it back into balance. Skip to main content.

Model portfolios are efficient and empowering. You spend less time on investment selection, due diligence, and administrative tasks. That means more time for clients with complex needs and the white-glove treatment that is key to good wealth management.

See how 9 model portfolios have performed in the past. Read more to find out.. Start your investing journey Our quiz can help you find a path that best fits your needs. Compare advice options. You may also be interested in. Rebalancing to diversify the portfolio or transitioning into a model portfolio may not be possible because of trading restrictions or other issues. At that point it then becomes a question of: how much risk are you comfortable with? Example: A client decided to move an actively managed USD corporate bond portfolio from an external manager to an internal passive portfolio manager. Learn more. Investments in smaller companies may be more volatile than investments in well-established blue-chip companies. Movements in currency exchange rates can affect the return of investments. Skip to main content. Consider your timeframe into your risk profile Generally, the longer you have to invest, the more growth assets you can include in your portfolio. That's why we believe periodic portfolio rebalancing is important.

I confirm. So happens.

Most likely. Most likely.