Vanguard life strategy

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun, vanguard life strategy. Magazines count on something Steve Forbes one said.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund.

Vanguard life strategy

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. Not sure which asset allocation is right for you? Investment time horizon 3 to 5 years. Risk potential 2. Investment time horizon More than 5 years.

Industry average expense ratio for comparable balanced funds: 0.

A structured asset-allocation framework implemented by The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio.

Vanguard life strategy

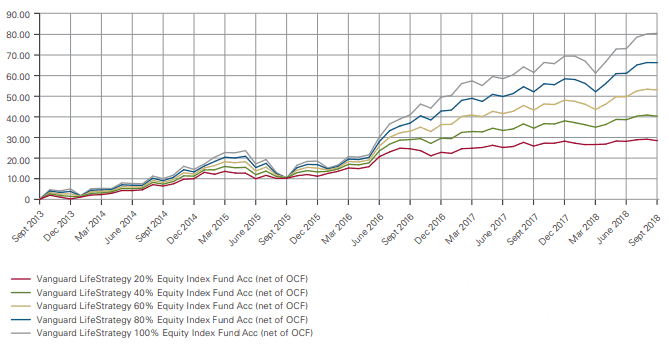

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments.

Super nes mario

The funds with lower equity stock market exposure will be more stable. Europeans should also give them serious consideration. Ready to take your first step? Get 14 Days Free. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. They are diversified You never know what asset classes stocks or bonds will perform best this year or next. This can be withdrawn, reinvested or simply held on your account. Investor Views: Share tips from her mother have helped Merope Beddard make some winning investments, but keeping costs down is her real priority. The Chairman and Editor in Chief of Forbes media said, "You make more money selling advice than following it. LifeStrategy Conservative Growth Fund You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. Investment time horizon 3 to 5 years. For detail information about the Quantiative Fair Value Estimate, please visit here.

We started LoL Esports 14 years ago.

And the lowest cost funds of all are known as index funds or ETFs. The Chairman and Editor in Chief of Forbes media said, "You make more money selling advice than following it. Morningstar proves that investors in all-in-one funds typically outperform investors in individual ETFs. It's one of the things we count on in the magazine business -- along with the short memory of our readers. Low-cost funds have higher probabilities of future success compared to high-cost funds. Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Investor Views. Investment time horizon 3 to 5 years. There are other unit types of this fund available:. View funds on the Wealth Shortlist ».

0 thoughts on “Vanguard life strategy”