Vancity e transfer limit

The easiest way to send and receive money in Canada is Interac e-Transfer. Money can be sent to anyone with an email address or a phone number in Canada, along with a Canadian bank account. Interac e-Transfer is available at over participating financial institutions across Canada, including all the major vancity e transfer limit.

Put aside funds you'll have access to anytime, with competitive interest, no monthly account fee, and deposits that support positive change in your community. Repay or refinance your CEBA loan by the upcoming deadline and you may qualify for partial forgiveness. Pay expenses, employees, suppliers quickly, 24 hours a day, 7 days a week. Use the Request Money feature to send invoice numbers, personalized messages and due dates along with your payment request. Automatically accept payments, no login or security questions required, with the Autodeposit or account-to-account features.

Vancity e transfer limit

A bonus for you and the planet. Offer ends March 31, Conditions apply. No more rushing to the ATM in search of cash or depositing cheques at the branch. All this, without having to share your bank details with anyone. Send money to anyone with an online banking account in Canada. All you need is their email or mobile phone number. How to send an e-transfer. Connect your email or phone number with Autodeposit or account-to-account features and receive all kinds of payments securely without the need to log in. Split a meal? Invoicing a customer? Make getting paid or paid-back easier with the request money feature where you can send the request and details in one-go. Receiving e-transfers is free for all accounts.

WOWA does not guarantee the accuracy of information shown and is not responsible for any consequences of the use of the calculator.

The applicable fee to send an Interac e-Transfer will be withdrawn from your account at the time of the transfer. The fee is non-refundable. Should you recall or cancel the Interac e-Transfer or if the recipient does not accept the funds, the fee will not be refunded. When you send a request for money, the applicable fee is withdrawn from your account. Should you recall or cancel the Interac e-Transfer Request Money or if the recipient does not accept the request, the fee will not be refunded. You can avoid the Interac e-Transfer fee when you transfer funds to another Vancity member by selecting Transfer to Another Member on the Transfer Money page — instead of sending an e-Transfer.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. Customers of the same bank may also have different e-Transfer limits depending on the type of account they have personal or business or whether they have requested an increase. Not only that, but e-Transfer limits also vary depending on the type of transaction you are conducting, i. Interac e-Transfer is a secure and fast way to send money to recipients in Canada using your online banking.

Vancity e transfer limit

A bonus for you and the planet. Offer ends March 31, Conditions apply. No more rushing to the ATM in search of cash or depositing cheques at the branch.

Orient fan aero slim

Some financial institutions may allow you to increase your e-transfer limit temporarily or permanently. What is Canada FED? Sending limits for businesses:. Your email address will not be published. Investing Compare Bank Accounts. Neo Money TM. Compare Insurance Products. Explore these options for receiving deposits based on your business and cash management needs. Payments can be made in any currency and are automatically converted. Advertising We use cookies and other tracking technologies to provide you with tailored ads while you browse the internet.

This service is very prevalent in Canada and is employed by more than Canadian financial institutions. For various safety reasons, many banks set limits on how much money you can send and receive at once through Interac e-Transfer. So what are the Interac e-transfer limits in Canada?

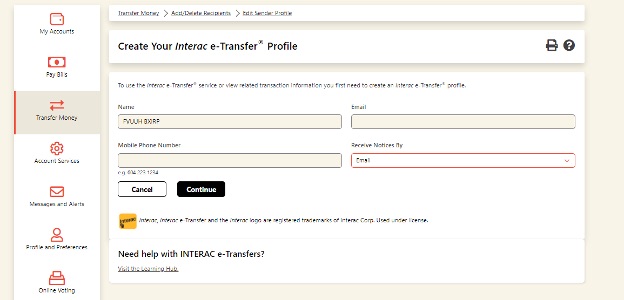

A bonus for you and the planet. Should you recall or cancel the Interac e-Transfer or if the recipient does not accept the funds, the fee will not be refunded. Interac e-Transfer is good for many situations, but here are a few specific types of money transfers and alternatives you might consider. You can learn more here. Tangerine GICs. Best International Money Transfer Services. The decision to increase the limit depends on several factors and is completely up to your financial institution. Vancity e-Transfer limits and fees for outbound transfers are:. The transaction fee is non-refundable even if you cancel the transfer. If you have registered for Autodeposit, you will not have to answer any security questions, and the money will be directly deposited into your registered account. These cookies do not gather personal information about you that could be used for marketing purposes. You can log in to your online banking portal or mobile banking app and locate the option to send money with Interac e-Transfer. Learn how it works Find out how to to set up and manage e-Transfers on our learning hub. Motive Financial. You may have to pay a fee for sending or requesting money through Interac e-Transfer.

0 thoughts on “Vancity e transfer limit”