Us10y

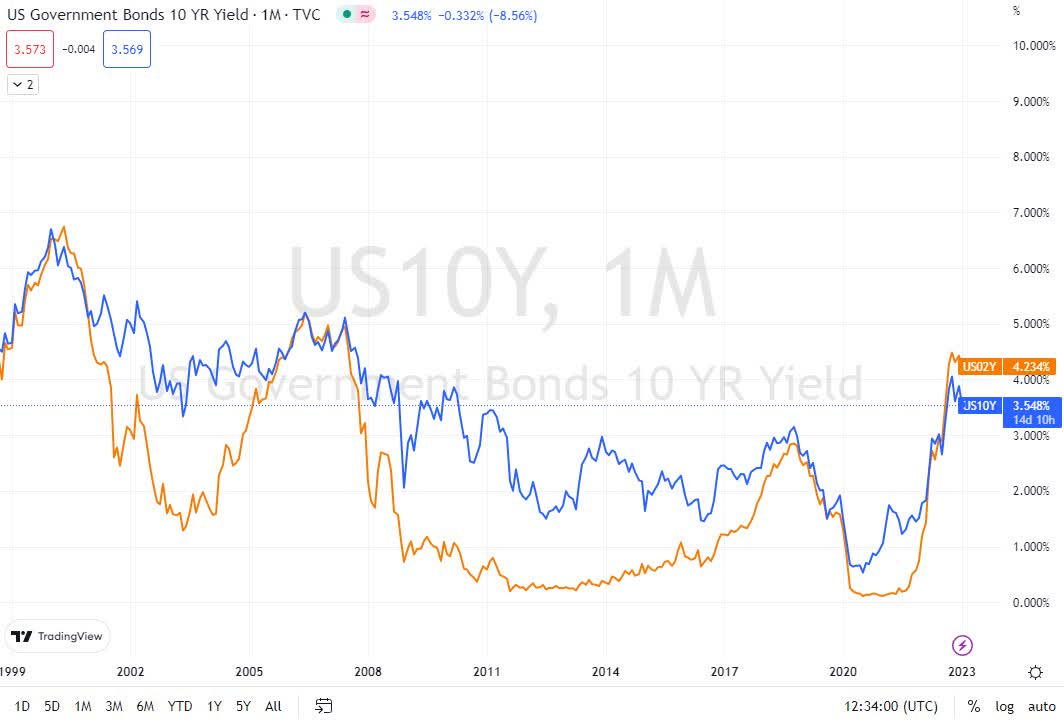

The U. During the previous leg of the 1. Based on the moves from Treasury yields during the previous week, us10y, it seems that Fed's rate cuts are coming. This is what the market is saying, however, us10y still need this input from the Fed, us10y.

See all ideas. EN Get started. Market closed Market closed. No trades. US10Y chart.

Us10y

This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker. Previous Close 4. Customize MarketWatch Have Watchlists? Log in to see them here or sign up to get started. Create Account … or Log In. Go to Your Watchlist. No Items in Watchlist There are currently no items in this Watchlist. Add Tickers. No Saved Watchlists Create a list of the investments you want to track. Create Watchlist …or learn more.

Philippines 10 Year Government Bond. Show more ideas.

.

To view interactive charts, please make sure you have javascript enabled in your browser. Saved settings are a quick way to catalogue and access your favourite indicators, overlays, and chart preferences for access later. Sign in or register now to start saving settings. Saved charts are a quick way to catalogue and access your favourite companies and settings you've selected. Sign in or register now to start saving charts.

Us10y

The year Treasury yield slipped on Wednesday as investors digested testimony about monetary policy from Federal Reserve Chairman Jerome Powell, saying the central bank is not quite ready to cut rates. The yield on the year Treasury lost nearly 3 basis points, sitting at 4. The 2-year Treasury rose less than 1 basis point to 4. In prepared remarks for congressionally mandated appearances on Capitol Hill Wednesday and Thursday, Powell said policymakers remain attentive to the risks that inflation poses and don't want to ease up too quickly. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year," Powell said. He reiterated that lowering rates too quickly risks losing the battle against inflation and likely having to raise rates further. Powell also said the central bank would like to see more data when questioned by the House Financial Services Committee on Wednesday. He's also slated to appear before the Senate Banking Committee on Thursday. They have also broadly steered clear of laying out a timeline for cuts.

Boruto timeskip release date

This is what the market is saying, however, we still need this input from the Fed. Last week it also printed inverted hammer candle stick. No Saved Watchlists Create a list of the investments you want to track. Bond brokers. Portugal 10 Year Government Bond. ET by Vivien Lou Chen. In this idea, - Shows parabolic trends in logaritmic scale. Interactive Brokers. My philosop. My overall bias was bullish and still is on a macro perspective up to 4. There are indications that the market is exerting considerable pressure at this juncture: price action is LegendSince Updated. As we know US10Y is one of the most important parameters for all investors. Use stoplosses please. Maturity date.

See all ideas. EN Get started. Market closed Market closed.

During the previous leg of the 1. No Items in Watchlist There are currently no items in this Watchlist. All News Articles Video Podcasts. Currency traders wonder whether Powell's testimony will deliver a jolt to sleepy U. This week was not easy for those looking to short back down to broken resistance; 4. This is what the market is saying, however, we still need this input from the Fed. Open 4. Feb 15 The Bond Dilemma. Australia 10 Year Government Bond. Powell tells Congress no rush to cut rates Mar. News Flow.

I consider, that you commit an error. Write to me in PM, we will discuss.

I congratulate, this rather good idea is necessary just by the way