Uniswap v2

Learn to safely invest in crypto assets, uniswap v2. Position yourself for the opportunities offered by the next cycle, probably the biggest in history.

View Uniswap v2 Ethereum exchange statistics and info, such as trading volume, market share and rank. Statistics showing an overview of Uniswap v2 Ethereum exchange, such as its 24h trading volume, market share and cryptocurrency listings. A list of top markets on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. Uniswap is an automated liquidity protocol; it allows anyone with an Ethereum wallet to exchange tokens without the involvement of any central party.

Uniswap v2

Uniswap v2 opens in a new tab can create an exchange market between any two ERC tokens. In this article we will go over the source code for the contracts that implement this protocol and see why they are written this way. Basically, there are two types of users: liquidity providers and traders. The liquidity providers provide the pool with the two tokens that can be exchanged we'll call them Token0 and Token1. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. Traders send one type of token to the pool and receive the other for example, send Token0 and receive Token1 out of the pool provided by the liquidity providers. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has. In addition, the pool takes a small percent as a reward for the liquidity pool. When liquidity providers want their assets back they can burn the pool tokens and receive back their tokens, including their share of the rewards. Click here for a fuller description opens in a new tab. Uniswap v3 opens in a new tab is an upgrade that is much more complicated than the v2.

One of the core upgrades from Uniswap V1 was the introduction of Flash Swaps.

Fiat currencies Crypto Currencies No results for " " We couldn't find anything matching your search. Try again with a different term. In this article, we will answer some of the most common questions about Uniswap V2 and its features. What is Uniswap V2 and how does it work? Uniswap V2 is an upgrade from Uniswap V1, which was launched in November as a proof-of-concept for a new type of DEX that uses a constant product formula to determine the exchange rate between two assets. This enables more diverse and efficient liquidity pools, as well as better prices for traders.

The pages that follow contain comprehensive documentation of the Uniswap V2 ecosystem. It eliminates trusted intermediaries and unnecessary forms of rent extraction, allowing for fast , efficient trading. Where it makes tradeoffs decentralization , censorship resistance , and security are prioritized. Uniswap is open-source software licensed under GPL. You might be wondering about Uniswap V1. The first version of the protocol, launched in November at Devcon 4, is still around. In fact, because of its permissionless nature, it will exist for as long as Ethereum does!

Uniswap v2

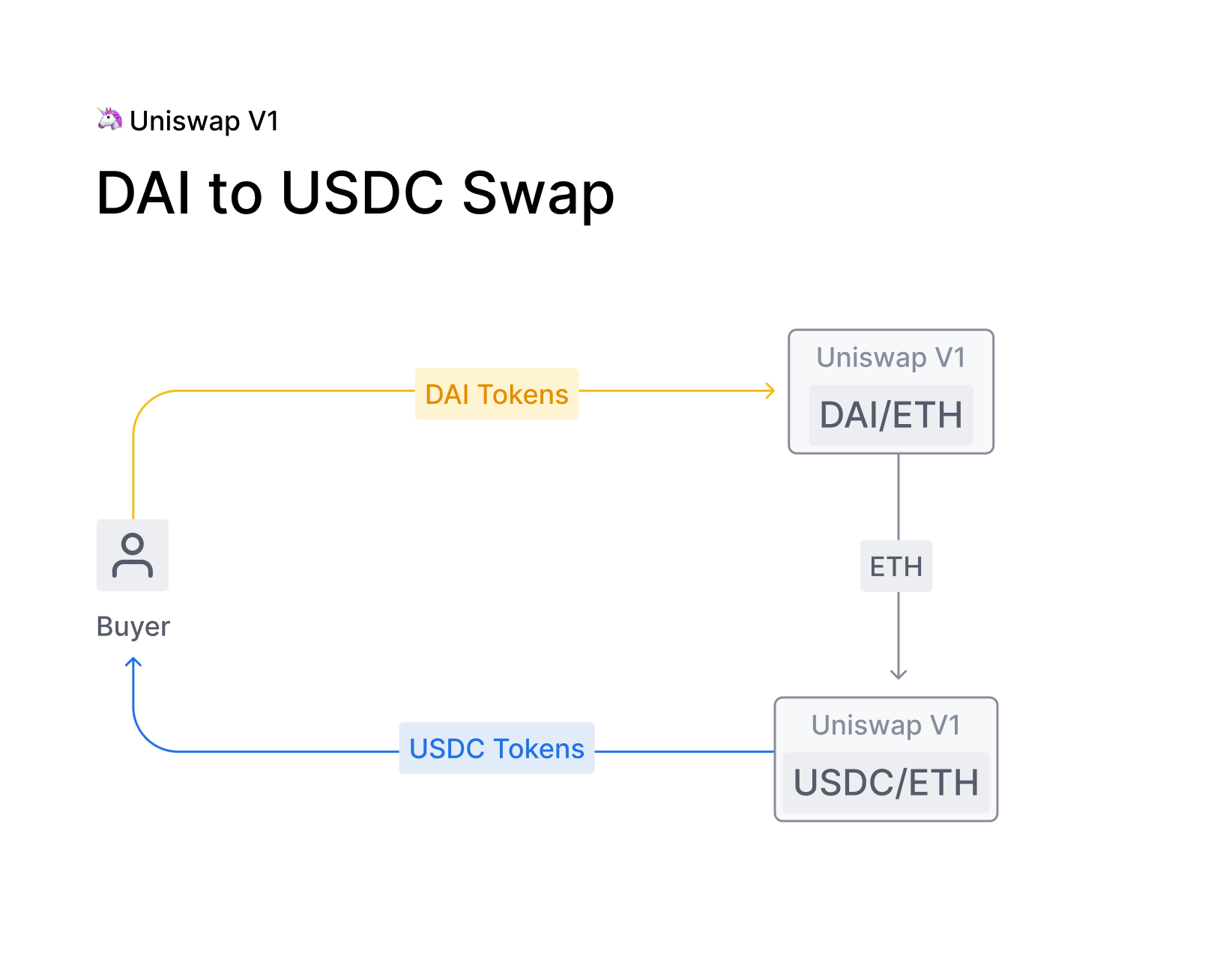

Uniswap V1 was the proof-of-concept for a new type of decentralized marketplace. As a venue for pooled, automated liquidity provision on Ethereum, the Uniswap protocol Uniswap functions without upkeep, providing an unstoppable platform for ERC20 token conversion. Uniswap V1 will continue to work for as long as Ethereum exists , and so far, it has worked very nicely for a wide variety of use cases. However, pooled automated liquidity remains nascent technology, and we have only just begun to realize its potential. For this reason, last year we raised a seed round and formed a dedicated team to research and develop Uniswap alongside the broader Ethereum community. Uniswap V2 is our second iteration of Uniswap and includes many new features and improvements. This article will serve as a high-level overview of these changes including:. Since ETH is the most liquid Ethereum-based asset, and does not introduce any new platform risk, it was the best choice for Uniswap V1. If two ERC20 tokens are not paired directly, and do not have a common pair between them, they can still be swapped as long as a path between them exists.

Airbnb vietnam ho chi minh

Call the initialize function to tell the new exchange what two tokens it exchanges. We use cookies to offer you a better browsing experience. Liquidity providers LPs earn more fees because their money is concentrated in the area where trading activity is happening the most. Ethereum News. These two functions allow feeSetter to control the fee recipient if any , and to change feeSetter to a new address. GitHub Organization. Overall, there are more than 1, coins and tokens available for trading. Watch Animated Crypto Video Explainers. There is a class of security vulnerabilities that are based on reentrancy abuse opens in a new tab. Liquidity provider fees are the only type of Uniswap V2 exchange fees that users must pay. It supports an impressive array of trading pairs, catering to both novice and experienced traders. This formula applies to all Uniswap V2 trading pairs. If there is new liquidity on which to collect a protocol fee.

Seamlessly swap and provide liquidity on v2 on all supported chains directly through the Uniswap interface. With both v2 and v3 available across all supported networks, users have the flexibility to choose between simplicity with v2 and more advanced features with v3. While v3 offers advanced capabilities for more active liquidity providers LPs , v2 offers a more simple LP experience.

This is achieved by measuring the relative price of the two assets at the beginning of each block, and accumulating historical data over time. The governance members vote on protocol changes and either approve or reject changes related to all Uniswap iterations. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. It uses an EVM assembly dialect called Yul opens in a new tab. It supports an impressive array of trading pairs, catering to both novice and experienced traders. That way we know how much liquidity to burn, and we can make sure that it gets burned. This function calculates the address of the pair exchange for the two tokens. Markets The Uniswap V2 crypto exchange is known for the large number of listed assets that users can swap. Try again with a different term. In both cases, the trader has to give this periphery contract first an allowance to allow it to transfer them. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has. There are the addresses of the contracts for the two types of ERC tokens that can be exchanged by this pool. The user has already sent us the ETH, so if there is any extra left over because the other token is less valuable than the user thought , we need to issue a refund. Website Traffic. Idiomes CA.

0 thoughts on “Uniswap v2”