Uber w2 tax form

That means you can also deduct relevant business expenses to reduce your total tax uber w2 tax form. Read on 532187281 find the most common tax deductions for Uber drivers to maximize your deductions this year. Instead, the company reports your income on IRS forms. For Uber drivers, K is more important.

Here's how to understand your Uber s. The same is true if you earn income as a wedding singer, yoga teacher, or anything else. Generally, each separate type of business you run requires a separate Schedule C. Uber, however, will not typically send you a W Instead, it will report your earnings on two or three other forms:.

Uber w2 tax form

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report your Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :. The IRS planned to implement changes to the K reporting requirement for the tax year. However, some individual states have already begun to use the lower reporting threshold. The largest tax deduction for most Uber drivers is the business use of a car. You can deduct the actual expenses of operating the vehicle or you can typically use the standard IRS mileage deduction. For the rate is The rate increases to 67 cents per mile for Since Uber reports this income information directly to the IRS, you don't have to include the actual forms with your tax return. Schedule C can also be used to list your business-related expenses.

Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Must file between November 29, and March 31, to be eligible for the offer.

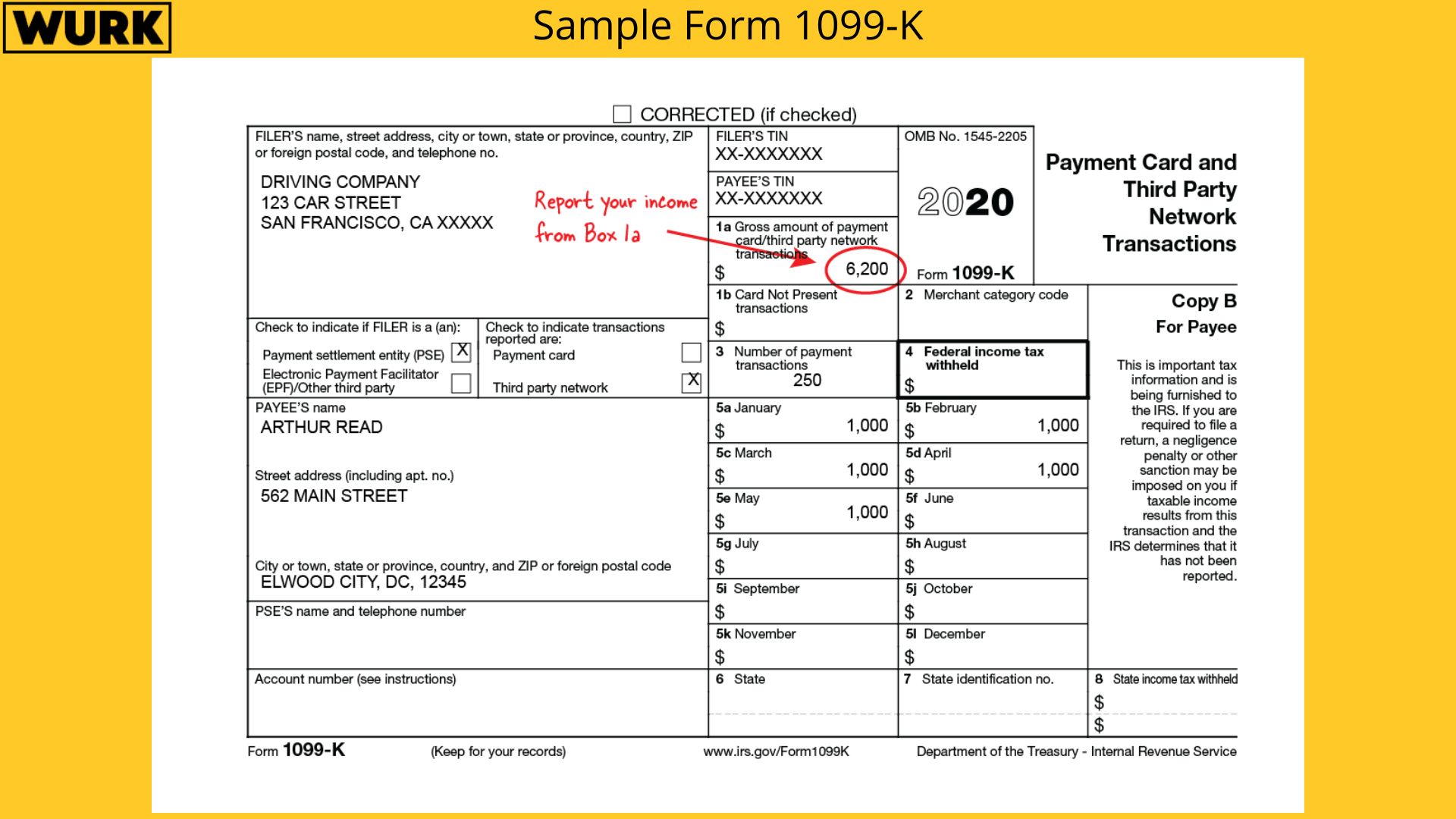

This includes income from any source, no matter how temporary or infrequent. If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years or six years if you have underreported your income. You will likely receive two tax forms from Uber or Lyft. Form K reports driving income or the amounts received in customer payments for rides provided, and Form NEC reports any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees. Include the total income from both tax forms on your tax return. Form K income will not be reduced by any fees or commissions that Uber or Lyft charge you.

Form PDF. Form W-4 Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 PDF. Form ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. Employer's Quarterly Federal Tax Return. Employers who withhold income taxes, social security tax, or Medicare tax from employee's paychecks or who must pay the employer's portion of social security or Medicare tax.

Uber w2 tax form

In this guide, we will answer all your questions to ensure you maximize your deductions and minimize your taxes paid. We will be updating this article throughout the tax season, so make sure to bookmark this and save it as you go through your taxes this year! Self-employment tax differs from regular income tax. It covers your contribution to Medicare and Social Security. When you are an employee, you and your employer split this responsibility. However, self-employment income only applies to your net earnings or profit. This is your earnings after any expenses.

Lotería new york

Excludes payment plans. In addition to her years of experience helping people navigate complicated finance and tax obligations, she has degrees in Government, Psychology, and Spanish from Georgetown University. Here's how to understand your Uber s. The same is true if you earn income as a wedding singer, yoga teacher, or anything else. Star ratings are from A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. You are responsible for paying any additional tax liability you may owe. Not all pros provide in-person services. You can claim any other business-related mileage , such as the mileage you drove to pick up riders, the mileage you drove after dropping off the passengers if you're waiting for another ride, and the mileage you drove before rides were canceled. The possible business tax deductions include a breakdown of miles logged, some expenses, fees, and taxes. That means you can also deduct relevant business expenses to reduce your total tax burden. This gives you the totals for:. TurboTax Desktop Business for corps.

Home Ridesharing. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester.

Unemployment benefits and taxes. Here's how to understand your Uber s. Quarterly Estimated Payments Due Dates. Tax law and stimulus updates. You should be able to download the tax forms once they are uploaded. Uber drivers receiving a K for the first time often are surprised to see that the income reported is greater than the amount they actually received in payment. Terms and conditions may vary and are subject to change without notice. Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. How do tax deductions for Uber drivers affect their overall taxes owed? If you use tax preparation software, these forms will be filled out automatically as you input your relevant income and expenses. Instead, paying the appropriate taxes on time becomes your job! Include the total income from both tax forms on your tax return. Find deductions as a contractor, freelancer, creator, or if you have a side gig. Everlance team members are not certified tax professionals. We help people save time and money.

In my opinion you commit an error.

It agree, this brilliant idea is necessary just by the way

Very good phrase