Ubank savings rate increase

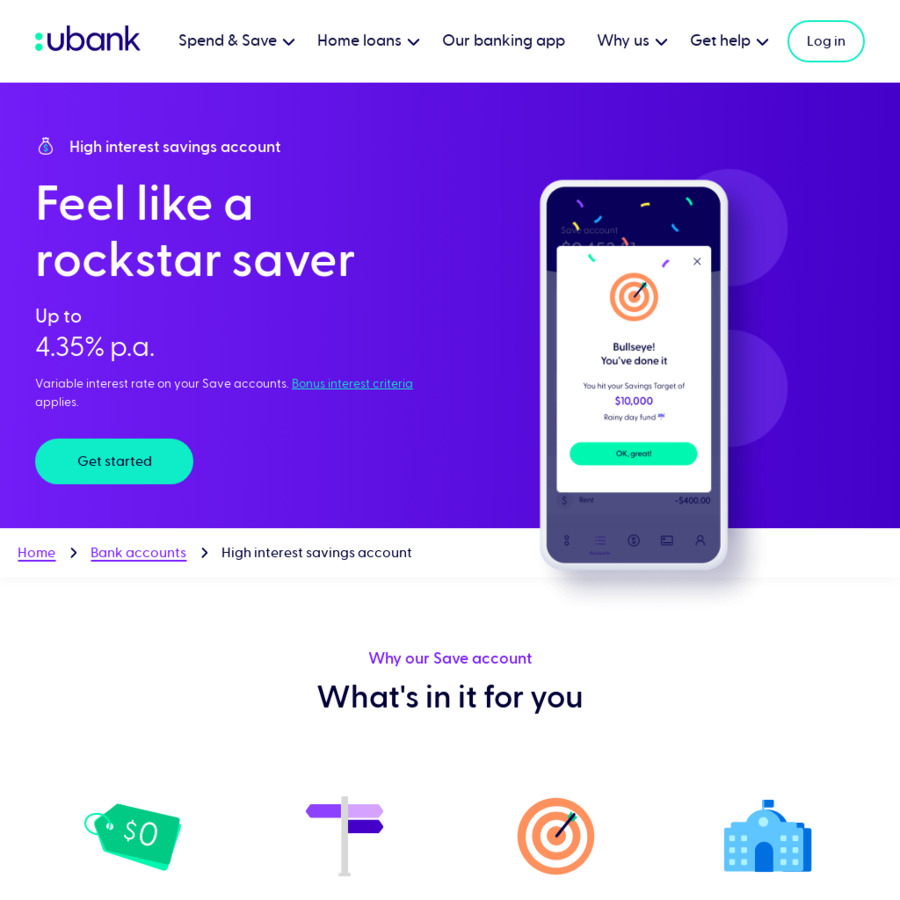

Variable interest rate on your Save accounts. Bonus interest criteria applies. This rate is variable and subject to change.

Following the second RBA rate rise of the year, Aussies anticipate banks to continue the trend of passing on increases to savings accounts and term deposits - watch this space. For the tenth consecutive month , the RBA has handed down another hike to the cash rate, taking it to 3. Last week, Bank of Queensland jumped the gun and increased savings rates out-of-cycle , including one that now features a rate of 5. This page will detail the latest rate change announcements for savings accounts and term deposits following the RBA's March 25 basis point rate hike - be sure to check back here regularly. Keep updated.

Ubank savings rate increase

The standard rate sits at 0. Sound like a winner? That rate puts the Save Account among the top earning savings accounts in our database. Plus, if you're not on track to earn your bonus interest, ubank will send you a reminder to help you make the most of your savings account. Just remember to keep push notifications on! Best of all, if you meet the requirements above, you'll receive the 5. Account can only be opened through iOS or Android app, but may be accessed through internet banking. Great savings accounts, with no fees. Recommend as either a primary or secondary bank account. Very easy to use online, simple features, and never have any issues.

Intro rate for 4 m on ths then 4. Fact Checked. As a guide, this is how the Editorial Star Ratings should be interpreted:.

By submitting your information you agree to the terms and conditions and privacy policy. The Reserve Bank has held the cash rate at 4. The last time the RBA paused its cash rate hike cycle, a number of customers saw small adjustments in home loan variable rates and likewise for savings accounts and term deposits. Most economists believe that there are no more hikes and possible cuts in the latter half of the year. This could mean that savings account and term deposit interest rates could have peaked, with slight adjustments made in the meantime as inflation continues to slow.

Savers rejoice, homeowners not so much as the RBA lifts the cash rate once again by 25 basis points in June. Aussies anticipate banks to continue the trend of passing on increases to savings accounts and term deposits - watch this space. The RBA has handed down its 12th cash rate hike, taking the rate to 4. This page will detail the latest rate change announcements for savings accounts and term deposits following the RBA's June 25 basis point rate hike - be sure to check back here regularly. Keep updated. Subscribe for rate change alerts.

Ubank savings rate increase

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. This means savvy savers are ending on a high note. But the Fed has recently hit pause on rate increases. The target range has remained between 5.

Following that synonym

All the term deposit rate changes this week Another week, another round of term deposit rate changes, with new rates from some of Australia's largest banks. Hanan joined Savings. Australia's largest bank has announced its intent to increase savings account rates following the RBA's March decision. Explore our Save account. Learn more about Mozo. Bendigo Bank Reward Saver. Open up to 10 Save accounts and get bonus interest on all of them, including shared Save accounts. Compare other savings accounts. Rabobank increases savings rates Rabobank has increased its High Interest Savings Account and PremiumSaver accounts by 50 basis points. Some term deposit interest rates will increase by up to 0. On 26 September AMP said it will increase its bonus deposit interest rate by basis points 1. In the interests of full disclosure, the Infochoice Group are associated with the Firstmac Group.

Home News Ubank increases savings account rates.

NAB's iSaver rate of 4. By Georgia Indian. No monthly fees on any of your Save accounts. Their interest rates are also very good. Westpac is the second major bank to announce interest rate changes to its savings accounts. Rather, a cut-down portion of the market has been considered. Bonus rate of 5. We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not. You can open up 10 Save accounts. Consistently higher interest on savings than the competition. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice. To be considered, the product and rate must be clearly published on the product provider's web site.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.

I hope, you will find the correct decision. Do not despair.