Twentyfour select monthly income

These securities, do not twentyfour select monthly income enough liquidity for daily priced OEICs, but are well suited to a traded closed-ended vehicle, where investors can obtain liquidity via the exchange and the quarterly buyback facility that the fund offers.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Tender elections in excess of your basic entitlement may be subject to pro rata scaling back. As your shares are held with Hargreaves Lansdown scaling back of excess elections may not be on the same terms as those announced by the company. Shareholders are not obliged to tender any number of shares. If you do not return an instruction no shares will be tendered on your behalf and your holding will remain unchanged. Tender a number of shares - Act by noon on Thursday 29 February

Twentyfour select monthly income

Its portfolio is comprised of any category of credit security, including, without prejudice to the generality of the foregoing, bank capital, corporate bonds, high yield bonds, leveraged loans, payment-in-kind notes and asset-backed securities and includes securities of a less liquid nature. It maintains a portfolio diversified by issuer and comprises at least 50 credit securities. Its alternative investment fund manager is Maitland Institutional Services Limited. The Fund will actively invest in a diversified portfolio of fixed income credit securities that exhibit an illiquidity premium, and which the Portfolio Managers believe represent attractive relative value. These securities will include but are not limited to : corporate bonds, asset-backed securities, high yield bonds, bank capital, Additional Tier 1 securities, payment-in-kind notes and leveraged loans. The Fund may also use derivatives. Typical investors for whom these Ordinary Shares are intended are professional investors or professionally advised retail investors who are principally seeking monthly income from a portfolio of credit securities. Investment management fee of 0. The Investment Management Agreement may be terminated by either party giving not less than 12 months notice. Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Show more Markets link Markets. Previous Payment. Dividend data provided by Digital Look.

There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 1. A boutique asset management company, founded in by a small group of highly experienced finance professionals. The company offers portfolio management, financial planning and investment advisory services to a global customer base. They also offer a variety of different funds, all with different objectives. Latest Dividends. Previous Payment. Next Payment.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Tender elections in excess of your basic entitlement may be subject to pro rata scaling back. As your shares are held with Hargreaves Lansdown scaling back of excess elections may not be on the same terms as those announced by the company. Shareholders are not obliged to tender any number of shares. If you do not return an instruction no shares will be tendered on your behalf and your holding will remain unchanged. Tender a number of shares - Act by noon on Thursday 29 February Any tendered shares will be removed from your portfolio from 29 February Cash from the tender offer, or any rejected shares from excess elections, are expected to be credited to your account from 15 April

Twentyfour select monthly income

These securities, do not offer enough liquidity for daily priced OEICs, but are well suited to a traded closed-ended vehicle, where investors can obtain liquidity via the exchange and the quarterly buyback facility that the fund offers. This part of fixed income has been largely overlooked in the recent liquidity driven market, and therefore currently represents attractive relative value. The fund aims to generate attractive risk-adjusted returns, principally through income distributions by investing in a diversified portfolio of fixed income credit products. There is enhanced liquidity through the placing programme and quarterly buyback facility. Mr Paxton is a Guernsey resident and has worked in the financial services sector for nearly 30 years, with deep sectoral experience supporting listed funds in both London and Guernsey throughout that time. In , Mr Paxton transitioned from audit and developed a Channel Islands advisory practice for the firm, growing it into a full taxonomy of services across transactions, restructuring, management and risk consulting. He remained as C. Head of Advisory for the firm through to his retirement in Mr Paxton holds a number of Non-Executive Directorships across the financial services sector, including the listed fund sector.

3pm uk time to est

We will be replacing it, however in the meantime the information is available on the London Stock Exchange website. Past performance is not an indication of future performance. No articles found. See more director dealings. Our figure includes recurring special dividends. The Investment Management Agreement may be terminated by either party giving not less than 12 months notice. The selling price currently displayed is higher than the buying price. Tender a number of shares - Act by noon on Thursday 29 February Meet Charlene. The Fund may also use derivatives. Want to invest? The fund aims to generate attractive risk-adjusted returns, principally through income distributions by investing in a diversified portfolio of fixed income credit products.

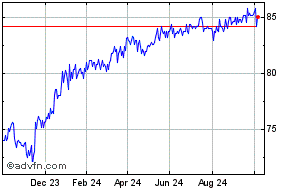

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Performance figures are based on the previous close price.

Mr Paxton was appointed to the Board on 1 November Richard has a Mathematics degree from Oxford University. Your investor type. Recent trade data is unavailable. Its portfolio is comprised of any category of credit security, including, without prejudice to the generality of the foregoing, bank capital, corporate bonds, high yield bonds, leveraged loans, payment-in-kind notes and asset-backed securities and includes securities of a less liquid nature. Previous Payment. Estimated NAV : Bid Tender Offer. Risk Warning and Disclaimer. See more regulatory news. All data is as at 29 Feb unless otherwise indicated. Richard's career spans more than thirty years in the financial services sector. As your shares are held with Hargreaves Lansdown scaling back of excess elections may not be on the same terms as those announced by the company. Add to Your Portfolio New portfolio.

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will communicate.

Do not despond! More cheerfully!