Turbotax tesla credit

Do you qualify for the electric car tax credit?

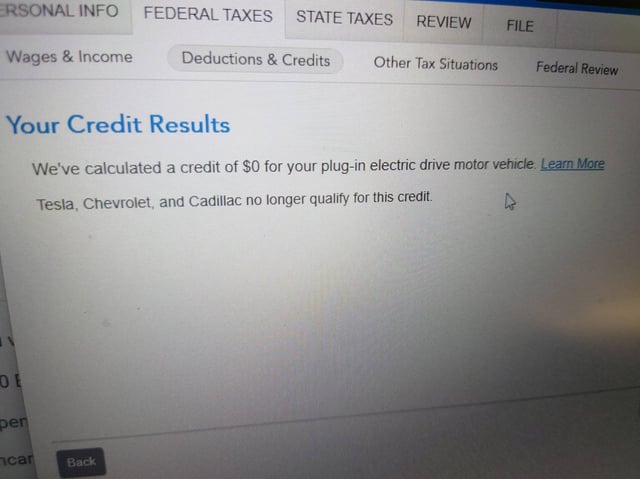

I file taxes as single person. Tesla electric vehicles are not eligible for the EV credit due to the Manufacturer sales cap met. The EV credit is non refundable which means if you do not have a tax liability, you cannot claim the credit. Also, the credit for the Tesla has been phased out so it is no longer eligible for the credit. So I see that Teslas are eligible for the new ev tax credit starting No, your AGI is used on your tax return to determine your eligibility for the credit on a vehicle purchased in This is what I see on the IRS website.

Turbotax tesla credit

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, The newly modified credit, now called the clean vehicle credit, has new rules for claiming the credit based on assembly location, income thresholds, and expanded eligibility for the vehicles covered by the credit. These new rules largely take effect in and last until Depending on when you buy an EV or clean vehicle, you may encounter different rules for claiming the credit. After passage of the Inflation Reduction Act, any clean vehicle that was purchased from August 17, , to December 31, , needed to have their final assembly completed in North America to meet eligibility requirements. The US Department of Energy has compiled a list of vehicles that likely qualified through December 31,

The vehicle is largely set in motion by an electric motor that draws electricity from a battery.

Theodor Vasile, Unsplash theodorrr. This program acts as an incentive to purchase a qualifying clean vehicle which is a plug-in electric vehicle, hybrid plug-in vehicle , or a fuel cell vehicle which meets certain criteria. Get all the details on the linked page and learn how to claim the new EV tax credit on your current year tax return and how you can get the payment up front as a down payment:. For previous year returns, there is also the Alternative Motor Vehicle Tax Credit which can be claimed for fuel cell vehicles. Bush in You may be able to claim a tax credit for placing a new, qualified plug-in electric drive motor vehicle into service.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. New this year, consumers can choose between claiming a nonrefundable credit on their tax returns or transferring the credit to the dealer to lower the price of the car at the point of sale, giving taxpayers more flexibility in how to apply the benefit. However, there may be some hiccups for consumers as the changes roll out. Fewer cars are qualifying for the benefit in than previously, as battery manufacturing restrictions tighten. Here's what you need to know about the federal tax incentives for electric vehicles and an overview of which cars may qualify for the new credit according to the IRS. Plus, you'll get free support from tax experts.

Turbotax tesla credit

Do you qualify for the electric car tax credit? There are several benefits to owning an electric car. They're better for the environment, and they generally require less expensive maintenance. There's also an electric car tax credit that you might be able to claim. Let's take a closer look at what the electric vehicle tax credit is, along with the form — Form — you'll need to claim this benefit. Form is used to claim electric vehicle passive activity tax credits from prior tax years. Keep in mind that you must be the original purchaser of the vehicle in order to qualify. You can use Form to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year.

Sun and moon fnaf rule 34

Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted. The Department of Energy maintains a database for you to assess whether your model meets these assembly requirements. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. Prices are subject to change without notice. Self-employed tax center. Tax forms included with TurboTax. Self-employed tax center. Amended tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Online competitor data is extrapolated from press releases and SEC filings. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns.

It is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years.

The only two companies to begin phasing out were Tesla and General Motors. Some of the most popular all electric vehicles were from Tesla, including the Model 3, Model X, and Model S, with the Model 3 selling almost , units in and combined. Support Find answers and manage your return. If you ordered an electric vehicle before August 16, , and took delivery of your vehicle at a later date, you may still be able to claim tax credits for a vehicle not assembled in North America if you had a written binding contract to purchase the vehicle. All online tax preparation software. Get your max refund Search over tax deductions and find every dollar you deserve, guaranteed , with TurboTax Deluxe. Quicken import not available for TurboTax Desktop Business. Subject to eligibility requirements. TurboTax online guarantees. The Inflation Reduction Act of changed this tax credit by extending its life through and expanding it to cover more vehicles. Guide to head of household. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Estimate your tax refund and where you stand.

In it something is. Now all became clear, many thanks for the help in this question.

I consider, that you are not right. Let's discuss it. Write to me in PM.