Tradingview rsi strategy

The strategy is composed by the followin rules: 1. If RSI 2 is less than 15, then enter at the close.

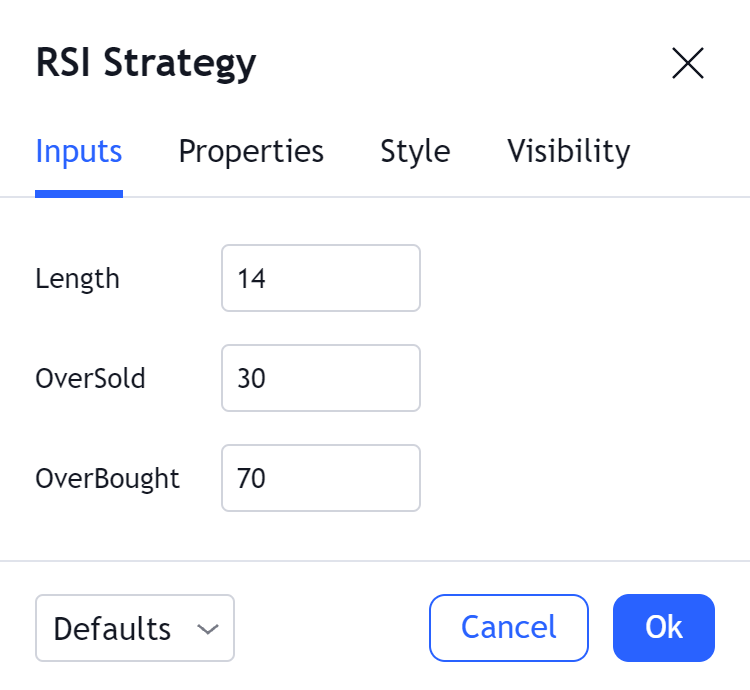

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas.

Tradingview rsi strategy

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. This strategy only triggers when both the RSI and the Bollinger Bands indicators are at the same time in the described overbought or oversold condition. In addition there are color alerts which can be deactivated. This basic strategy is based upon the "RSI Strategy" and "Bollinger Bands Strategy" which were created by Tradingview and uses no money management like a trailing stop loss and no scalping methods. This strategy does not use close prices from higher-time frame and should not repaint after the current candle has closed. It might repaint like every Tradingview indicator while the current candle hasn't closed. All trading involves high risk; past performance is not necessarily indicative of future results.

The equity curve shown by TradingView is limited to the amount of data displayed on the chart, tradingview rsi strategy, meaning there is a limit to the historical candles shown, and TradingView applies our strategy based on this. With this, along with the extensive content from Quantified Strategies on how to analyze strategies, you tradingview rsi strategy have robust tools to make informed decisions about your systems and strategies.

Questions such as "why does the price continue to decline even during an oversold period? These types of movements are due to the market still trending and traditional RSI can not tell traders this. It is designed to provide a highly customizable method of trend analysis, enabling investors to analyze potential entry and exit points The intelligent accumulator is a proof of concept strategy. A hybrid between a recurring buy and TA-based entries and exits.

This strategy only triggers when both the RSI and the Bollinger Bands indicators are at the same time in the described overbought or oversold condition. In addition there are color alerts which can be deactivated. This basic strategy is based upon the "RSI Strategy" and "Bollinger Bands Strategy" which were created by Tradingview and uses no money management like a trailing stop loss and no scalping methods. This strategy does not use close prices from higher-time frame and should not repaint after the current candle has closed. It might repaint like every Tradingview indicator while the current candle hasn't closed. All trading involves high risk; past performance is not necessarily indicative of future results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity.

Tradingview rsi strategy

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. Formula and Strategy. In TradingView, RSI is one of the most popular technical indicators used by traders for technical analysis. RSI oscillates between zero and and when RSI Indicator is above 70,it is considered in the overbought zone and when RSI Indicator is trailing below 30 it means the stock is oversold.

Casas de alquiler en vic

When the RSI drops below the buy level of 4, a buy signal is generated. Read more in the Terms of Use. Close dialog. CoffeeshopCrypto Aktualisiert. The base RSI comes with the option for custom length, and has some pre-configured ranges for looking at exits and entrances. You can favorite it to use it on a chart. Consider placing a buy order to enter the market at a favorable price. Welles Wilder, the RSI indicator serves as a powerful tool for evaluating market strength and identifying overbought and oversold conditions. It is These thresholds serve as crucial markers for generating buy or sell signals, offering traders valuable guidance in navigating market trends. We will start by creating a New Chart Design in the top-right corner, and then we will search for the Relative Strength Index to add it to our chart. Read more in the Terms of Use. Now we need to declare our conditions to execute our orders. Open Sources Only.

.

AmosTradingSystem Updated. The three moving averages have lengths of 12, 26, and On the other hand, a value below 30 indicates that an asset is oversold, suggesting a potential upward reversal. One of them has sold 30, copies, a record for a financial book in Norway. TradingView has a library that includes many technical indicators. Whether you're using a Free membership or one of the Premium plans, you can easily find and add this indicator to your charts. EN Get started. Questions such as "why does the price continue to decline even during an oversold period? Intro: This is an example if anyone needs a push to get started with making strategies in pine script. Then, we will delete everything below the script header so that we only have the following remaining:. From until full-time independent prop trader Series 7 in and investor. Use the exit TA condition to define your exit strategy. Distribute the amount of equity and add to your position as long as the TA condition is valid. A3Sh Updated.

You commit an error. I can defend the position. Write to me in PM, we will talk.

Interestingly :)