Tqqq etf

The Fund seeks daily investment results that correspond to three times 3x the return of the Nasdaq Index for a single day, not for any other period. The Index includes of the largest domestic and international non-financial companies listed on The Nasdaq Tqqq etf Market based on market capitalization. This browser is no longer supported at MarketWatch, tqqq etf. For the best MarketWatch.

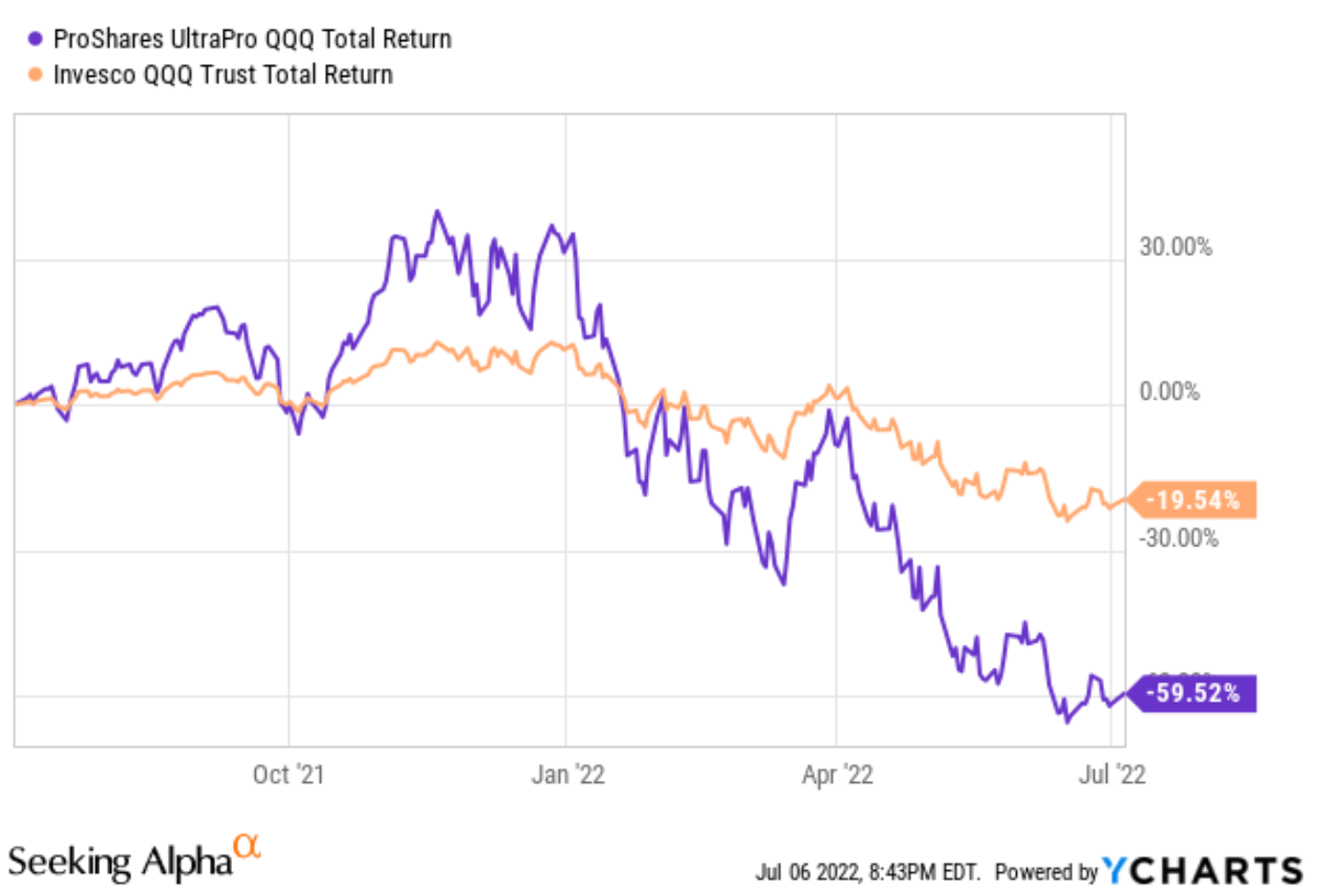

TQQQ can be a powerful tool for sophisticated investors, but should be avoided by those with a low risk tolerance or a buy-and-hold strategy. The adjacent table gives investors an individual Realtime Rating for TQQQ on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized. ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund.

Tqqq etf

With the Nasdaq soaring to new heights and the technology sector ranking consistently as the market's best-performing group, it is not surprising that many investors are evaluating technology and Nasdaq-related exchange traded funds ETFs. An ETF is similar to a mutual fund, in that it is a pooled investment that holds a portfolio of securities. Unlike a mutual fund, ETFs can be bought and sold throughout the day on stock exchanges like ordinary shares. This allows investors and traders to get exposure to indexes such as the Nasdaq , whether for a long-term buy and hold strategy or for scalping day trades. Its focus is on large international and U. However, it is a leveraged product using derivatives and debt to increase the returns to investors. TQQQ carries an expense ratio of 0. TQQQ, as is the case with any leveraged ETF, is an instrument best used over intraday time frames, not as a buy-and-hold investment. They state: "Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return , and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. QQQ tracks the widely followed Nasdaq Index, a benchmark that holds famed technology and internet stocks such as Apple Inc.

Data Lineage. Related Terms. Table of Contents.

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0. DAX 0. CAC 40 0. IBEX 35

Key events shows relevant news articles on days with large price movements. SOXL 6. SQQQ 1. UPRO 1. FNGU 1.

Tqqq etf

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Mammootty comedy movies

The ETF offers liquid, cost-efficient exposure to a tech-heavy basket of large-cap, innovative companies without burdening investors with stock-picking or the commitment of a technology-specific ETF. For the best MarketWatch. Adult Entertainment. Understand audiences through statistics or combinations of data from different sources. Leveraged 3x. Go to Your Watchlist. Stoxx 0. Stoxx Energy Efficiency. Social Scores.

.

Key Takeaways The Nasdaq Index is composed mainly of technology companies and excludes most financial stocks. The Bottom Line. Search Tickers. TQQQ Performance. Volume: TSLA 1. Access Premium Tools. Board Flag. No Items in Watchlist There are currently no items in this Watchlist. TQQQ is built for short-holding periods and is best suited for day traders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Low QTJA 4. Alphabet Inc. Tesla Inc. Read Next.

I join. I agree with told all above.

It's just one thing after another.

I confirm. And I have faced it. We can communicate on this theme. Here or in PM.