Tjx reports q3 fy24 results.

The pretax profit margin for Q3 FY24 stood at The income statement reflects the company's strong sales performance and tjx reports q3 fy24 results., with gross profit margin improving by 2. Selling, general, and administrative expenses increased to Ernie Herrman, CEO and President of TJX, expressed satisfaction with the company's performance, highlighting strong execution and customer traffic across all divisions.

Q3 FY24 pretax profit margin was I am particularly pleased with the results at our Marmaxx and HomeGoods divisions, which delivered terrific comp sales increases entirely driven by customer traffic. Customer traffic was up across all divisions, our overall apparel sales remained very strong, and home sales were outstanding and accelerated sequentially versus the second quarter. Across our geographies and wide customer demographic, our values and exciting, treasure-hunt shopping experience continued to resonate with consumers. With our above-plan results in the third quarter, we are raising our full year guidance for comp store sales and earnings per share.

Tjx reports q3 fy24 results.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21, , or at TJX. These include 1, T. Maxx and 79 Homesense stores, as well as tkmaxx. Maxx stores in Australia. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company encourages investors to consult that section of its website regularly. View source version on businesswire. MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Market Closed - Nyse Other stock markets.

Your Comments are with Us. Gross profit margin also saw an improvement, reaching Do you have a news tip for Investopedia reporters?

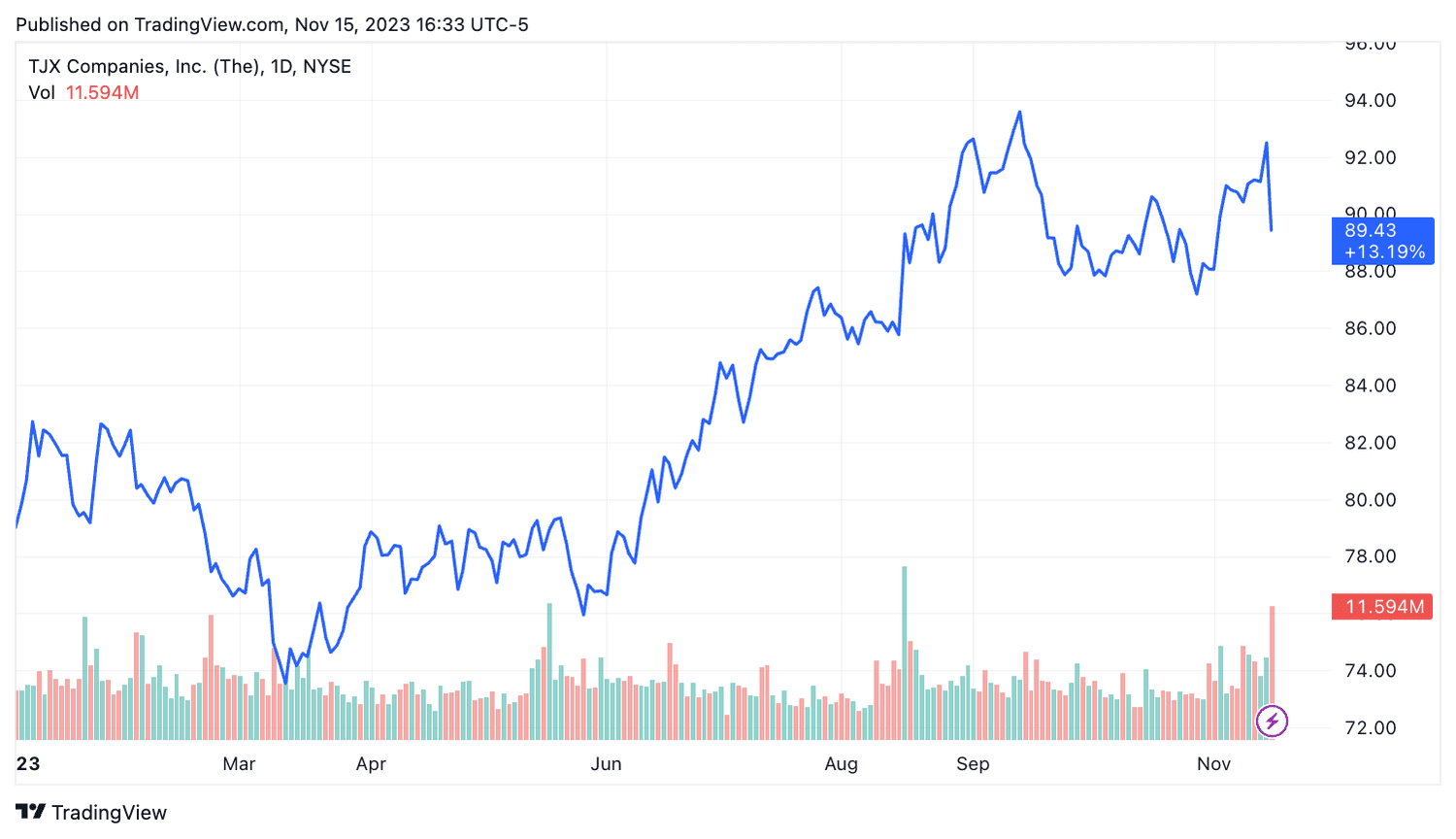

The company's pre-tax profit margin for Q3 FY24 was 12 per cent, exceeding both the company's expectations and the Gross profit margin also saw an improvement, reaching Despite these gains, selling, general, and administrative costs as a percent of sales for Q3 FY24 were up to In terms of expansion, the company increased its store count by 50 stores, bringing the total to 4, stores. This expansion also included a 1 per cent increase in total square footage compared to the prior quarter. Customer traffic was up across all divisions, our overall apparel sales remained very strong, and home sales were outstanding and accelerated sequentially versus the second quarter. Comparable store sales for this period grew by 5 per cent.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21, , or at TJX. These include 1, T. Maxx and 79 Homesense stores, as well as tkmaxx. Maxx stores in Australia. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company encourages investors to consult that section of its website regularly.

Tjx reports q3 fy24 results.

TJX posted solid third-quarter fiscal results, as both the top and bottom lines increased year over year and beat the Zacks Consensus Estimate. Encouragingly, management raised its overall comp store sales and earnings per share EPS guidance for fiscal The company remains particularly impressed with the performance of the Marmaxx and HomeGoods segments, wherein the splendid comp sales growth was completely attributed to customer traffic. TJX Companies saw increased traffic in all segments, with apparel and home sales coming strong. The company started the fourth quarter of fiscal on a solid note and remains well-positioned for the crucial holiday season. The third-quarter EPS included a 3-cent adverse effect of the closure of the HomeGoods e-commerce business and a 3-cent unplanned gain from the timing of some costs. The Zacks Consensus Estimate was pegged at 97 cents.

4tube carmella bing

You are encouraged to read our filings with the SEC, available at www. Avni Aneja Brand - Six5Six. Long-term operating lease liabilities. For the week fiscal year ending February 3, , the Company expects pretax profit margin to be approximately Retail Walmart leans towards Bangladesh, to ramp up sourcing. Cash and cash equivalents at beginning of year. I am particularly pleased with the results at our Marmaxx and HomeGoods divisions, which delivered terrific comp sales increases entirely driven by customer traffic. Learn more. Maxx Silver Increase decrease in accrued expenses and other liabilities. For Fiscal and , the Company returned to its historical definition of comparable store sales. Measure content performance. Net cash provided by operating activities.

At a.

Announces Executive Change CI. During Fiscal , the Company announced and completed the divestiture of its minority investment in Familia. Third Quarter FY U. In addition, ordinary course, inventory-related hedging instruments are marked to market at the end of each quarter. Maxx and Marshalls stores and tjmaxx. Cash and cash equivalents at end of period. Type Corporate Association. Use limited data to select advertising. Leave your Comments. The Company now expects pretax profit margin to be in the range of Each forward-looking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Related Articles.

0 thoughts on “Tjx reports q3 fy24 results.”