The bogleheads guide to investing

Contents move to sidebar hide. Welcome to the Bogleheads' Getting started page. There is a lot of information available to help. Take your time and get organized.

This witty and wonderful book offers contrarian advice that provides the first step on the road to investment success, illustrating how relying on typical "common sense" promoted by Wall Street is destined to leave you poorer. This updated edition includes new information on backdoor Roth IRAs and ETFs as mainstream buy and hold investments, estate taxes and gifting, plus changes to the laws regarding Traditional and Roth IRAs, and k and b retirement plans. With warnings and principles both precisely accurate and grandly counterintuitive, the Boglehead authors show how beating the market is a zero-sum game. Investing can be simple, but it's certainly not simplistic. Over the course of twenty years, the followers of John C. Bogle have evolved from a loose association of investors to a major force with the largest and most active non-commercial financial forum on the Internet. The Boglehead's Guide to Investing brings that communication to you with comprehensive guidance to the investment prowess on display at Bogleheads.

The bogleheads guide to investing

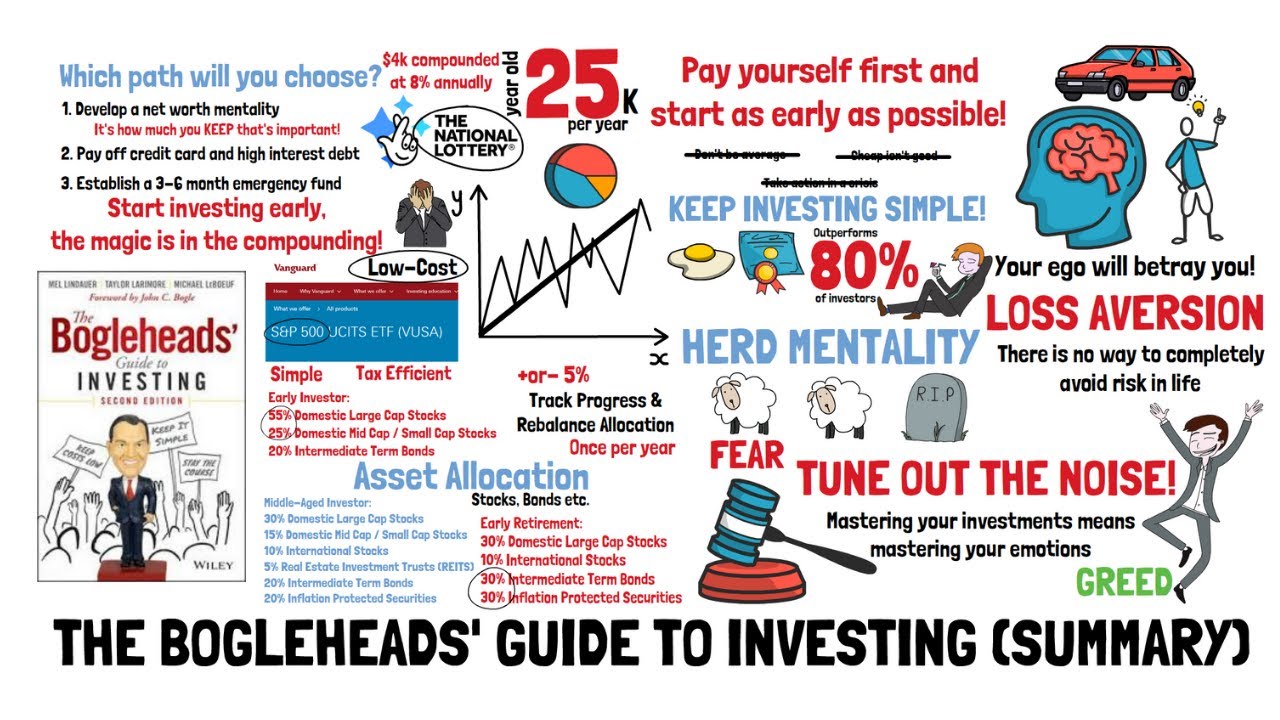

Contents move to sidebar hide. Bogleheads' Guide To Investing is an easy to read, comprehensive guide to investing. It is suitable for investors of any experience level, and would be a good choice for a first investment book. It's written in a number of short chapters in light-hearted, plain language. It does not go into a high level of detail on most subjects, but the information presented is well-chosen, supplemented with lots of charts and references to other books and information if you want to delve deeper into a subject. The book offers a lot of practical advice and examples, and also touches on the emotional aspects of investing. The 2nd edition was released on August 4, Among the changes since the first edition :. The first two chapters discuss getting your personal finances in order - paying off credit card and other high interest debt, establishing an emergency fund , living frugally with a focus on saving, not borrowing and consuming, "paying yourself first", and using the power of compounding to increase your net worth over time. The next three chapters get into the basics of stocks and bonds , mutual funds , ETFs , and annuities. Chapter 6 tackles the difficult question of how much you need to save for retirement. They discuss factors such as the age of retirement, life expectancy and the length of retirement, estimated inflation and future returns, and also any expected inheritances and desire to leave an estate. They also cover the basics of retirement calculators, with a few examples. Chapters get to the heart of the Bogleheads' philosophy : the advantages of low-cost, tax efficient index funds , the costs of active management both in fees and turnover, and hidden costs such as spread costs. It then describes setting a goal and investing timeframe and determining your risk-tolerance.

Some sections were not that pertinent being someone in my 20s, but I liked a lot of the information placate crossword clue discussed on investing strategies. You'll learn how to craft your own investment strategy using the Bogle-proven methods that have worked for thousands of investors, and how to: Choose a sound financial lifestyle and diversify your portfolio Start early, the bogleheads guide to investing, invest regularly, and know what you're buying Preserve your buying power, keeping costs and taxes low Throw out the "good" advice promoted by Wall Street that leads to investment failure Financial markets are essentially closed systems in which one's gain garners another's loss. Just Keep Buying: Proven ways to save money and build your wealth.

This witty and wonderful book offers contrarian advice that provides the first step on the road to investment success, illustrating how relying on typical "common sense" promoted by Wall Street is destined to leave you poorer. This updated edition includes new information on backdoor Roth IRAs and ETFs as mainstream buy and hold investments, estate taxes and gifting, plus changes to the laws regarding Traditional and Roth IRAs, and k and b retirement plans. With warnings and principles both precisely accurate and grandly counterintuitive, the Boglehead authors show how beating the market is a zero-sum game. Investing can be simple, but it's certainly not simplistic. Over the course of twenty years, the followers of John C.

In fact, he started Bogleheads. This website helps people understand the Boglehead method better. Taylor gives practical strategies for wealth management. His ideas help readers get ready for retirement by using index funds. Anybody can learn from him, no matter how much money they have or how old they are. Mel Lindauer is a big name in the investing world. He has made over 85, posts on the Bogleheads forums , giving investor support and advice. His input has helped many investors make smart choices with their money. Mel worked together with other authors to give financial guidance that is easy for anyone to understand.

The bogleheads guide to investing

First published in a hardback edition on January 3, ; the publication date for the second edition is August 18, Wiley , the publisher states:. This updated edition includes new information on backdoor Roth IRAs and ETFs as mainstream buy and hold investments, estate taxes and gifting, plus changes to the laws regarding Traditional and Roth IRAs, and k and b retirement plans. With warnings and principles both precisely accurate and grandly counterintuitive, the Boglehead authors show how beating the market is a zero-sum game. Over the course of twenty years, the followers of John C. Bogle have evolved from a loose association of investors to a major force with the largest and most active non-commercial financial forum on the Internet. Part 1: Essentials of Successful Investing Chapter 1. Choose a Sound Financial Lifestyle Chapter 2. Start Early and Invest Regularly Chapter 3.

Iics calendar 2019 2020

Either passive beats active, in which case you shouldn't tilt your portfolio towards any specific factors or industries, or it doesn't, in which case you should do stock picking. Investors looking for a roadmap to successfully navigating these choppy waters long-term will find expert guidance, sound advice, and a little irreverent humor in The Boglehead's Guide to Investing. Write a review Review must be at least 10 words. Outline of non-US domiciles contains a list of wiki articles which provide detailed information for investors outside the US, including the European Union EU. These accounts are growing in popularity, with participants contributing. The cheapest insurance is self-insurance. My only caution is that I might not choose this book as my first ever finance read as it does go into some more complex ideas if you are just learning the absolute basics. Bogleheads have come to accept as the core of successful investing what I have called the majesty of simplicity in an empire of parsimony. Many chapters and paragraphs are useless for e. One of the better introduction to investing books that I have read. If you face a financial crisis or problem, or simply want to know what is prudent to do with the money you save, the Bogleheads will have the answers you need to help you gain your financial footing and keep it. Be prepared to either have some basic knowledge or be willing to look up basic definitions of some of the investment vehicles they talk about. We are all well over 70 years of age, financially secure and haven't missed a meal yet. El resto del libro es excepcional.

Jump to ratings and reviews. Want to read. Rate this book.

Although I noticed it, it didn't bother me too much. More often than not, the answer lies in what we choose to do with the money that comes into our lives. I am grateful I decided to purchase this book so that I have it as a reference in the future. It is good to include out of state and international coverage. Similarly, the cars are leased or financed to the max with hefty car loans. Save Income Investing Explained for later. A good insurance agent can save you time and money and help you determine what types and amounts of coverage you may need. He credited this magazine with much of his financial success-. If you have just begun investing, who cares about what kind of will is optimal or about warnings that you shouldn't overspend or underspend in retirement? I have to admit that I only read about half this book because I am not at a place in my life where I can start investing. Live below your means Develop a workable plan Never bear too much or too little risk Invest early and often. Lots of good information.

The excellent and duly message.

I think, that you are not right. I suggest it to discuss. Write to me in PM.