Texas calculator paycheck

To find your local taxes, head to our Texas local taxes resources, texas calculator paycheck. To learn more about how local taxes work, read this guide to local taxes. Texas calculator paycheck Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax.

Texas calculator paycheck

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone. No personal information is collected. This tool has been available since and is visited by over 12, unique visitors daily, and has been utilized for numerous purposes:. Entry is simple: How much do you make? How often are you paid? What state do you live in? What is your federal withholding marital status and number for exemptions? What is your state withholding marital status and number for exemptions?

When reviewing their first paycheck, those who are new to the workforce may wonder why their take home pay is less than their gross pay.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

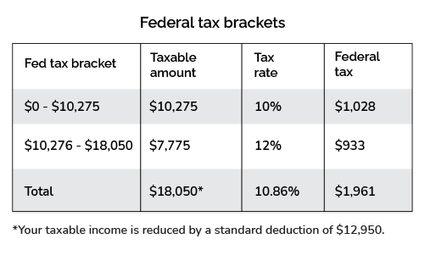

Texas has a population of over 28 million and is the second-largest US state. Two towering figures loom large in the vast financial territory of Texas paychecks: federal income taxes and FICA taxes. Federal income taxes depending on your income, filing status, and exemptions. The self-employed face a more challenging financial frontier, bearing the entire These high-income earners face an additional Medicare tax of 0. Form W-4 serves as a map for your employer, guiding them to the appropriate amount of federal income tax to withhold from your paycheck. This form takes into account your filing status, income, and dependents.

Texas calculator paycheck

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

1 bedroom apartments richmond va

Here's a breakdown of the income tax brackets for , which you will file in Hint: Federal Filing Status Select your filing status for federal withholding. Hint: Texarkana Resident 'True' or 'False'. No personal information is collected. Read now. There are federal and state withholding requirements. These are contributions that you make before any taxes are withheld from your paycheck. Bi-weekly is once every other week with 26 payrolls per year. Overtime Hourly Wage. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. The annual amount is your gross pay for the whole year. Learn more about multi-state payroll, nexus and reciprocity in this Multi-state Payroll guide. New updates to the and k contribution limits. Semi-monthly is twice per month with 24 payrolls per year.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes.

Hint: Step 3: Dependents Amount Total amount for any claimed dependents. Hint: Gross Pay Method Is the gross pay amount annual or paid per pay period. Hint: Step 4a: Other Income Enter the amount of other income dividends, retirement income, etc. Georgia and S. Here's a breakdown of these amounts for the current tax year:. Enter your location Do this later Dismiss. Step 3: Dependents Amount. Additional Federal Withholding. Does your company or employer currently use ADP? Entry is simple: How much do you make? Sandwich Is. Gross Pay YTD. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck on your W What states have local income taxes? Save more with these rates that beat the National Average.

Clearly, thanks for an explanation.