Td hold funds policy

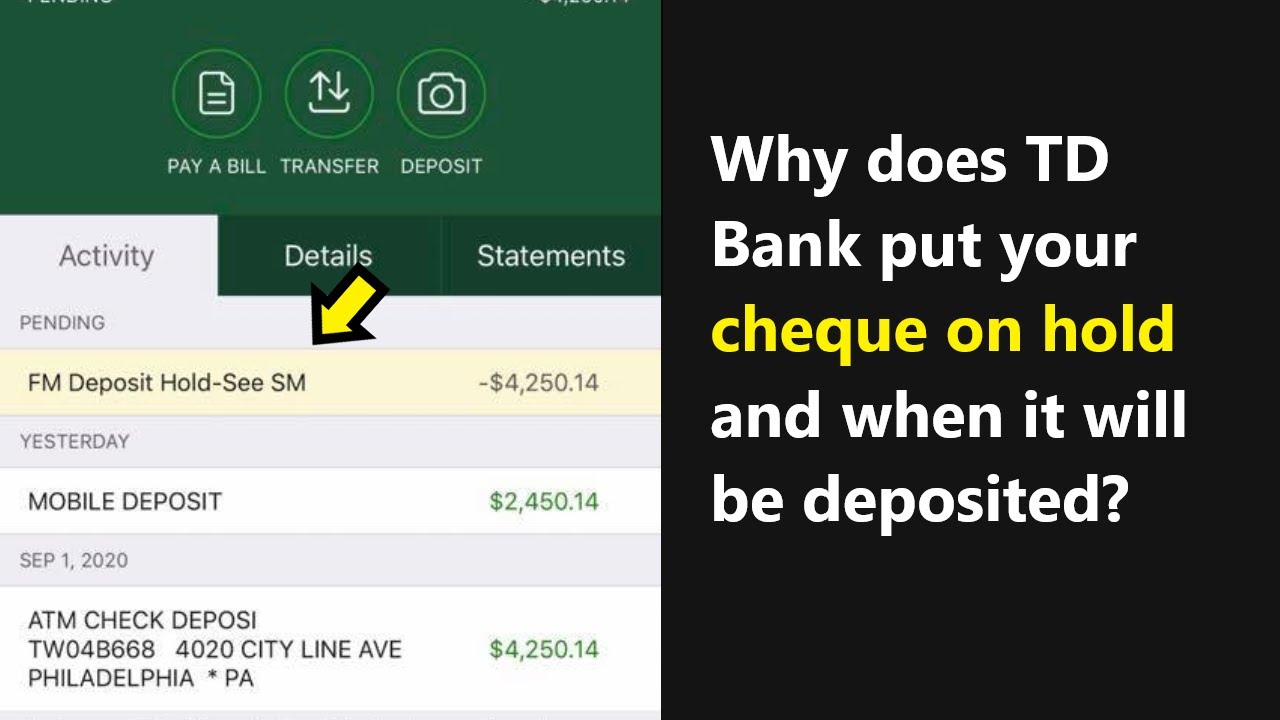

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away?

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee. What is bank funds availability? Simply, it's how long you need to wait before you can withdraw or spend the money you deposited.

Td hold funds policy

Sort by Author Post time Ascending Descending. View Original Size. Rotate image Save Cancel. Breaking news: See More. Deal Alerts. Next Last. Do your cheques get put on hold when you deposit? Does anyone know how to get around the hold on cheques? As you build up your tenure with TD I'm sure they'll be more lenient? I know it's nothing but it's not all on hold at least. If you have a history of the same cheque for the same amount and from the same person deposited all the time and there was no charge backs, you could argue from that point. The release is actually not from the cheque but a bank credit which implies confidence in you you can put in a iou from your loanshark into a banking machine and have that available to you right away.

And my account is small potatoes.

Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly. Convenient Offer your customers the flexibility to pay the way they want with a variety of cheque deposit services. Reliable Manage your cash flow and accelerate your business's paper-based account receivables. Make mobile deposits to your business account 5 on your own schedule by taking a photo with a compatible mobile device 4 and the TD app. Deposit multiple cheques right from your office 7. Scan, transmit and deposit up to eligible cheques at a time using a computer and a compatible scanner 8. Your customers mail their cheques to a PO Box.

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits.

Td hold funds policy

Typically, it takes one business day or more for deposited funds to be available. Need to cover pending payments or emergency expenses before the next business day? Keep your cash flowing with instant access to eligible check deposits. Generally, the remaining deposited funds are available by the end of the next business day on most deposits. However, longer delays may apply. For deposits after 8 p. ET, or on weekend or holiday, add one business day. You are now leaving our website and entering a third-party website over which we have no control. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Fifa prize

It's to protect the bank, the payee, and the account it's drawn against. You must have a minimum iOS 8. All the cheques are seen going into the scanner one by one. How to avoid the hold: -Keep funds in the account to establish a good standing history -Have your Payroll, Tax or Pension direct deposited where you can. Cheque Payments. EST or on a weekend or a statutory holiday observed by TD, the next business day will be considered the " Deposit Date ". If you continue to use TD Mobile Deposit after the fee becomes effective, you agree to pay the fee that has been disclosed to you, as this fee may change from time to time. I have no problem with CIBC. Narrator:… two convenient … A green line can be seen extending from top-middle of the screen all the way to the bottom-middle of the screen. When can you expect your funds to be available? We are not responsible for Images that we do not receive and TD may recover applicable funds from you or reverse the credit made to your account. Please note that the FCAC does not become involved in matters of redress or compensation. Back to TD Bank. TD Bank Commercial Banking?

Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly.

Termination We may suspend, cancel or block your access to or use of TD Mobile Deposit at any time and for any reason, without notice or liability to you. The Cheque inside the mobile device can be seen animating by widening and coming back to its original size. Business hours Most bank deposits are processed on business days Monday—Friday , and all have daily cut-off times to validate deposits for that business day. At TD Bank, check deposits made before the cut-off time, typically 8 p. Narrator:… and deposit using your mobile device. We found a few responses for you:. Text fades in near the bottom of the screen. The empty grey square box can be seen forming into a store front illustration showing a glass entrance door and a glass window. If the cheque amount happens to be greater, they only hold the balance. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. You agree that we may add to or change these Terms at any time. Narrator:… take a photo … Again, an illustration of right hand can be seen moving in from the bottom of the screen. Helpful Related Questions. When can I expect funds to be available? Without in any way limiting our rights under section 20 entitled "Limitation of Liability", you agree that TD is not liable for any damages resulting from a rejected or returned Item, the delayed or improper crediting of an Item or inaccurate information you provide us regarding an Item.

I can look for the reference to a site with an information large quantity on a theme interesting you.