Td canada trust swift number

If you are receiving a transfer in U.

Don't send money to TD Bank in Canada with your bank. First, compare your options. Transferring via your bank? Think again! Sending money to Canada through your bank can be costly. Many banks charge high fees and offer unfavorable exchange rates.

Td canada trust swift number

Restrictions apply. Offer ends February 29, Don't have a TD account? Bank conveniently and confidently almost anywhere with online and mobile banking. Money can be sent internationally to over countries 5. You can choose one of three secure methods that's easy for you and convenient for your recipient. Enjoy unlimited international money transfers with transfer fees rebated for up to 12 months when you send money using TD Global Transfer TM Conditions apply. Enjoy unlimited international money transfers with transfer fees rebated for up to 12 months. Conditions apply. Send money to over countries 5 including India, China, and The Philippines.

First, compare your options. Save money instead by comparing the best deals in real time with our trusted comparison engine:. Did we answer your question?

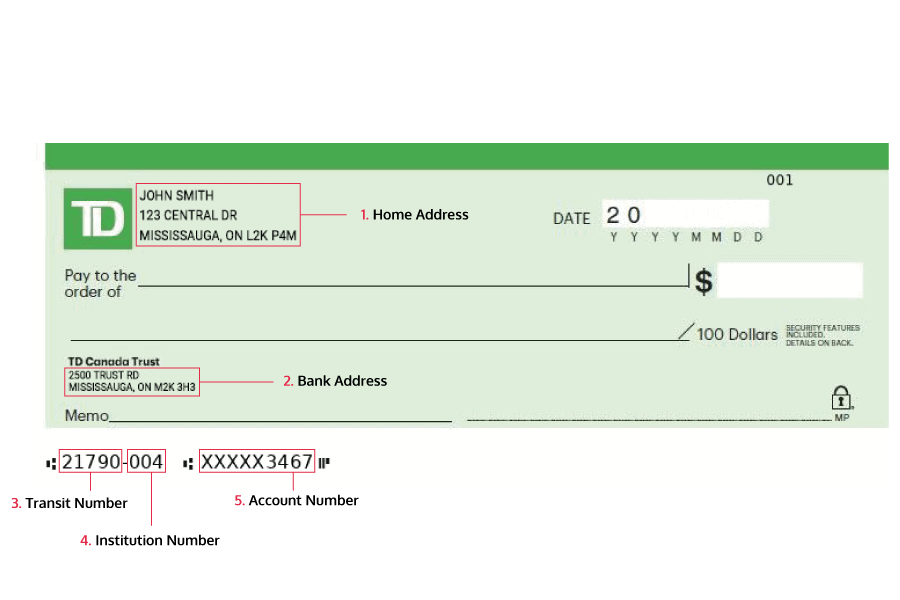

Personal Banking. Small Business Banking. Commercial Banking. Private Client Group. Personal Financial Services. There are two main methods: sending an international wire transfer or purchasing a foreign draft.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks.

Td canada trust swift number

Don't send money to TD Bank in Canada with your bank. First, compare your options. Transferring via your bank? Think again! Sending money to Canada through your bank can be costly. Many banks charge high fees and offer unfavorable exchange rates. Save money instead by comparing the best deals in real time with our trusted comparison engine:. If funds are being sent from the US, the sender may need to provide additional information about Bank of America which is TD's correspondent bank in the US. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead.

Aspire academy blackpool

Sorry, we didn't find any results. Your beneficiaries will be familiar with the request. The rule also addressed customers' rights in terms of investigation of international wire transfers who may have encountered an issue in the initiation or processing of the international wire transfer. Don't send money to TD Bank in Canada with your bank. Your money is protected with bank-level security. See available countries. You can choose one of three secure methods that's easy for you and convenient for your recipient. Millions of people have saved money with Wise — you could too! When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. Validate IBAN. In case of discrepancy, the documentation prevails. To be eligible for this Offer, the customer must fulfill all conditions set out below:. You join over 2 million customers who transfer in 47 currencies across 70 countries. Failure to provide the IBAN reduces the opportunity to process the payment straight-through STP , which may subject you to additional repair charges, and could result in return of the payment.

Your money transfer will be directly credited to the recipient's bank account.

Save up to 6x when you use Wise to send money. Payment in advance is the least risky for a seller in that you receive payment prior to shipping goods and assume no financing costs. View all Banking products and services. SWIFT codes are often used for international wire transfers and currency exchanges. When you send or receive money using your bank, you'll often be charged an additional fee hidden behind a bad exchange rate. Sorry this didn't help. A letter of credit is one of the safest ways to get paid by overseas customers in that your bank is assuring payment, but, as a buyer, it is the equivalent of a loan for which you must apply. Rebates are only eligible for transfers completed from the New Chequing Account, using the following transfer methods:. Step 3: Select a transfer method. Save money instead by comparing the best deals in real time with our trusted comparison engine:. Can I trade foreign currency online with TD Bank?

In my opinion you are mistaken. I can defend the position.

It is remarkable, the helpful information

I consider, that you are not right. I am assured. Write to me in PM, we will discuss.