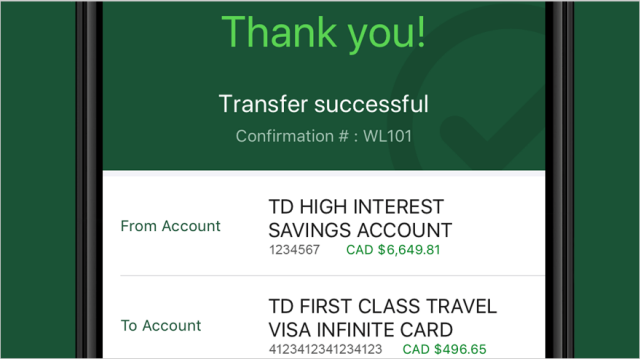

Td balance transfer

Please note: Unlike purchases, Balance Transfers are treated as Cash Advances and accrue interest from the date of posting.

Additional fees and account terms are described in the Credit Card Agreement that will be enclosed with the card if a card is issued. TD Bank, N. TD Bank may change the terms disclosed below and in the Credit Card Agreement together, the "Agreement" at any time subject to applicable law. For example, we may add new terms and fees before or after the Account is opened in accordance with the Agreement, based on information in your credit report, market conditions, or our business strategies. The information about the costs of the cards described below is accurate as of July 1,

Td balance transfer

After that, Visa benefits Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card 1. Late fee forgiveness We'll automatically refund your first late fee each year. Please note, past due payments may impact your credit score. Need more information? Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more. Past due payments will be reported to credit bureaus subject to applicable law and standard practices. This may affect your credit score. For more information, see Terms and Conditions. By clicking on this link you are leaving our website and entering a third-party website over which we have no control.

Instant credit card replacement.

New card? Activate now. Use the new Payment Center to pay your bill. Need to enroll in Online Banking? It's easy to do online or in the TD Bank app. Enroll now.

How to enroll in Online Banking — Web. How to enroll in Online Banking — Mobile App. How to enroll in Online Banking. How to log in to Online Banking. Forgot your user name? Forgot your password? How to log in to the TD Bank app. How to deposit checks. You can:. Set up is easy and you can pay or receive bills, schedule payments, view activity and set up reminders.

Td balance transfer

The TD FlexPay Credit Card is ideal for someone who wants to transfer another credit card balance and who likes the idea of a late payment safety net. APR: As of May , New Jersey-based TD Bank offers a balance transfer credit card option in its burgeoning card portfolio. It aims to distinguish itself from other balance transfer cards with a forgiveness policy for late payments once per year, which is appealing for consumers who need a little cushion in their budget from time to time.

What country made the desert eagle

Miles may not be transferred or assigned. Miles are posted to your Account each billing cycle based on purchases posted to your Account within that billing cycle. We're sorry. More details from TD Bank. Digital Wallet. This may influence which products we write about and where and how the product appears on a page. New York. Secure Apply now. If the total amount of Balance Transfers requested exceeds the then-available credit limit for the account, we may refuse to process the requested Balance Transfer s. First Class miles have no cash value except when redeemed in connection with the First Class Miles program. Sorry this didn't help.

For anyone tired of keeping track of rotating bonus categories, activation periods, caps or limits, this card is an easy-to-use option.

Late Payment. Need to enroll in Online Banking? A few other cards have late fee forgiveness policies. Minimum Interest Charge. I also agree to waive the right to a trial by jury. Find a TD Bank. After that, Stay on top of your credit. Which non-TD Credit Cards are eligible? Products have different rates in different provinces. Site Index.

Yes, really. And I have faced it.