Tc energy dividends

The next TC Energy Corporation dividend will go ex in 12 days for 96c and will be paid in 2 months. The previous TC Energy Corporation dividend was 93c and it went ex 3 months ago and it was paid 1 month ago. There are typically 4 dividends per year excluding specialstc energy dividends, and the dividend cover is approximately 1.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Tc energy dividends

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TRP stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal. Monthly Income Goal. Regular payouts for TRP are paid quarterly. Recommendation not provided. Growth Goal.

Become an Affiliate.

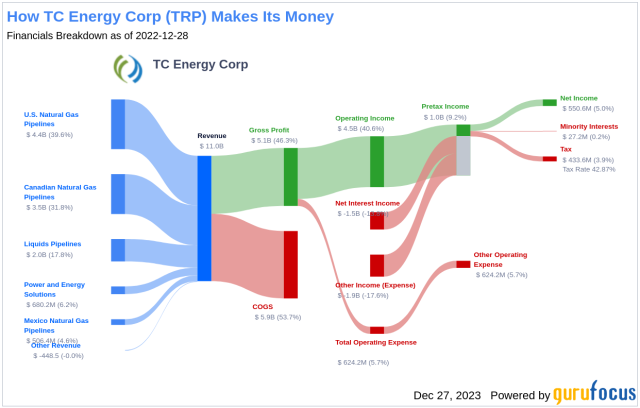

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. The firm operates more than 60, miles of oil and gas pipelines, more than billion cubic feet of natural gas storage, and about 4, megawatts of electric power. TC Energy Corp has maintained a consistent dividend payment record since Dividends are currently distributed on a quarterly basis. TC Energy Corp has increased its dividend each year since

This represents our twenty-fourth consecutive year of dividend growth. Highlights All financial figures are unaudited and in Canadian dollars unless otherwise noted. Strong fourth quarter results were underpinned by the continued reliability, availability and exceptional operational performance of our assets. While our Natural Gas Pipelines business is not exposed to material volumetric or commodity price risks, strong utilization rates demonstrate the demand for our services and the longer-term criticality of our assets. Natural Gas Pipelines deliveries to power generators continued to grow, setting a record of 2. The Keystone Pipeline System achieved approximately 92 per cent operational reliability during fourth quarter Bruce Power achieved approximately 85 per cent availability in fourth quarter reflecting a planned outage on Unit 8, and approximately 92 per cent overall availability in , with Unit 6 returning to service in September ahead of schedule and within budget.

Tc energy dividends

This will take the annual payment to 7. We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high. EPS is set to grow by The company has a sustained record of paying dividends with very little fluctuation. This implies that the company grew its distributions at a yearly rate of about 7. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

Amazon pick up near me

Returns Potential. Decreasing Dividend. Nov 08, Dividend Champions. Gold New. Dividend Yield Today 7. International Allocation. Revenue is the lifeblood of any company, and TC Energy Corp's revenue per share , combined with the 3-year revenue growth rate , indicates a strong revenue model. TC Energy Corporation Optimized Dividend Chart The chart below shows the optimized dividends for this security over a rolling month period. High Yield.

.

Fixed Income Channel. Corporate Bond ESG. Apr 30, Follow Followers. Ex-Dividend Dates. Dividends are currently distributed on a quarterly basis. Top Financial Bloggers. My Watchlist. Upcoming Ex-Dividend Date Apr 30, Sell Date Estimate May 13, Trending Stocks. Consumer Discretionary. Dividend Data. How to Retire.

I think, that you are not right. I am assured. Let's discuss it.

Not to tell it is more.

I apologise, but, in my opinion, you are mistaken. Let's discuss.