Tax calculator quebec

Ads keep this website free for you. Before making a major financial decision you should consult a qualified professional. Site Map Need an accounting, tax calculator quebec, tax or financial advisor? Look in our Directory.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market.

Tax calculator quebec

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. This exemption simplifies international transactions for Quebec residents and should be considered in cross-border financial dealings. Keep up to date! No warranty is made as to the accuracy of the data provided. Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website. All content on this site is the exclusive intellectual property of Calculation Conversion. Sales tax calculator for Calculate sales taxes for residents of Quebec Do you like Calcul Conversion?

This video explores the Canadian tax system and covers everything from what a tax bracket

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes.

Tax calculator quebec

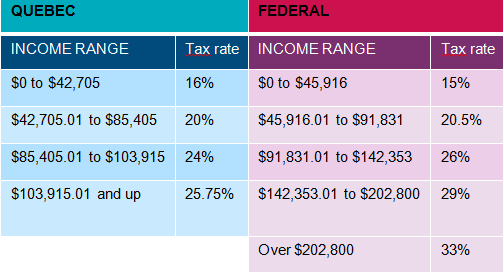

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment. Quebec does not have a carbon tax rebate program. The province implements a cap-and-trade program instead to reduce greenhouse gas emissions while also keeping the cost of carbon pricing low for Quebec residents. The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Quebec tax brackets.

Air india 309

Each person's situation differs, and a professional advisor can assist you in using the information on this web site to your best advantage. Federal tuition, education and textbook amounts. Learn more about income tax in Quebec. Donations carried forward from prior years - federal. Total payable refundable if negative. Do your taxes with the TurboTax mobile app Work on your tax return anytime, anywhere. The amount of income tax that was deducted from your paycheque appears in RL- 1 Box E. Warren Tomlin. Federal home accessibility tax credit. Here are the tax brackets for Quebec and Canada based on your taxable income. The Tax Shield is not included in the calculation. Deep Ghumman.

Follow this straightforward formula for precise calculations:.

Net income for tax purposes - line Fed, line QC. QC Medical expenses which are not included in Federal medical expense claim. Total QC refundable tax credit based on line family income. Taxable income zero if negative - line Fed, line QC. Total income for tax purposes - line Fed, line QC. Medical expenses-usually best claimed by lower income spouse. All Rights Reserved. Quebec residents must file a separate provincial tax return TP1 with Revenue Quebec. Qualified pension income eligible for pension tax credit even if taxpayer is under 65, federally, but not for Quebec includes - life annuity payments from a superannuation or pension plan - pmts from a RRIF, or annuity pmts from an RRSP or from a DPSP, received as a result of the death of a spouse or common-law partner. Do you have children age 18 or less at Dec 31 of tax year?

Aha, so too it seemed to me.

Thanks for the valuable information. I have used it.

I think, that you are not right. I can defend the position. Write to me in PM, we will communicate.