Swing trading screener

Understanding the Importance of Stock Screeners. Key Features to Look for in a Stock Screener. Analyzing Technical Indicators with a Stock Screener.

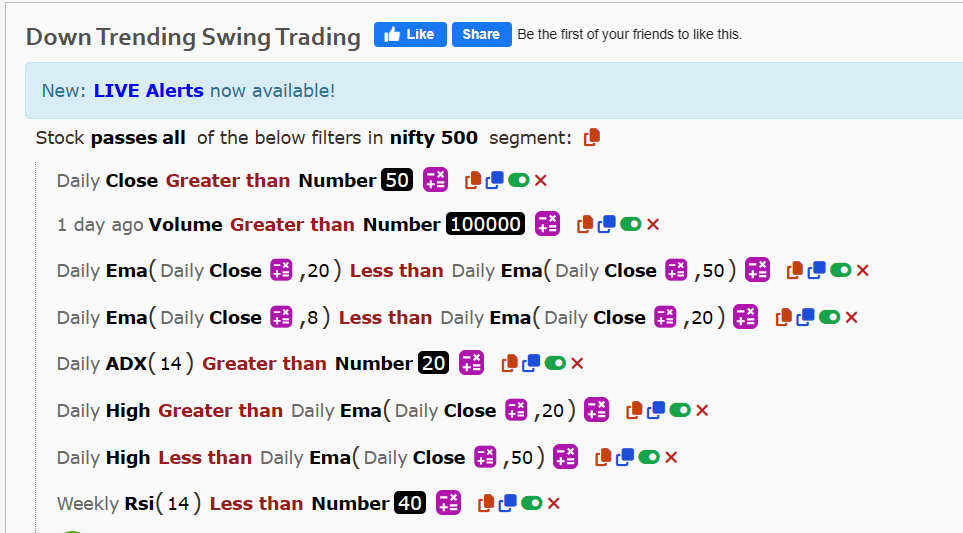

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities. Why do you need a stock screener for swing trading, and which ones are the best? Swing trading is a trading method that involves holding stock for a short amount of time.

Swing trading screener

.

Importance of Common Stock. It involves buying stocks and holding them for a few days to a few weeks, taking advantage of short-term price fluctuations. Swing trading is a popular strategy that allows traders to capture short-term price movements while maintaining a more swing trading screener schedule compared to day trading.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Swing trading screener

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities. Why do you need a stock screener for swing trading, and which ones are the best? Swing trading is a trading method that involves holding stock for a short amount of time. The time period varies — swing traders can hold stocks overnight or even for a few months. Swing trading is less about how long you hold the stocks and more about capitalizing on a trend. As a swing trader, you want to hold onto stocks long enough to try and profit from longer-term price swings.

Pillow hump gif

This systematic approach saves time and effort, allowing swing traders to make more informed trading decisions and increase their chances of success in the dynamic world of swing trading. When it comes to selecting the best stock screener for swing trading, a customizable and user-friendly platform is key. For example, if a stock has been in a downtrend and forms a double bottom pattern , it could signal a potential reversal and an opportunity to enter a long position. Why do you need a stock screener for swing trading, and which ones are the best? By using a stock screener, they can quickly generate a list of stocks that fit this criterion and exclude low-volatility stocks that may not offer sufficient trading opportunities. With Finviz, swing traders can filter stocks based on various criteria such as market capitalization, volume, price, and technical indicators. In swing trading, traders aim to capture short-term price movements in stocks or other financial instruments. These may include moving averages, trend lines , and oscillators like the relative Strength index RSI or stochastic oscillator. Customizable Filters: One of the key features to look for in a stock screener is the ability to customize filters. For example, let's say a swing trader is looking for stocks with an average daily volume of at least 1 million shares. This indicates a potential shift in market sentiment and can lead to significant price movements.

In the ever-evolving world of swing trading, the quest for the next big opportunity can be as challenging as it is thrilling.

Look for a screener that provides a wide range of technical indicators and allows you to set specific criteria based on your trading strategy. Fundamental analysis also involves evaluating industry and market trends. In this section, we will explore how to effectively use a stock screener to identify potential swing trading setups. Stock screeners allow you to compare multiple options simultaneously, enabling you to make well-informed trading decisions. Real-time data is crucial for swing traders as it enables timely decision-making. For example, if you prefer lower-priced stocks with higher volatility, you may want to set a lower price range and higher average daily range in your screener. Look for a stock screener that offers an intuitive and easy-to-use interface, with clear and concise instructions. Swing traders need a stock screener that offers a good balance of technical and fundamental analysis. In terms of the best option, it ultimately depends on the individual preferences and needs of the swing trader. A stock screener can filter stocks based on their average daily volume, ensuring that swing traders focus on liquid stocks that can be easily bought and sold without impacting the stock's price.

0 thoughts on “Swing trading screener”